Answered step by step

Verified Expert Solution

Question

1 Approved Answer

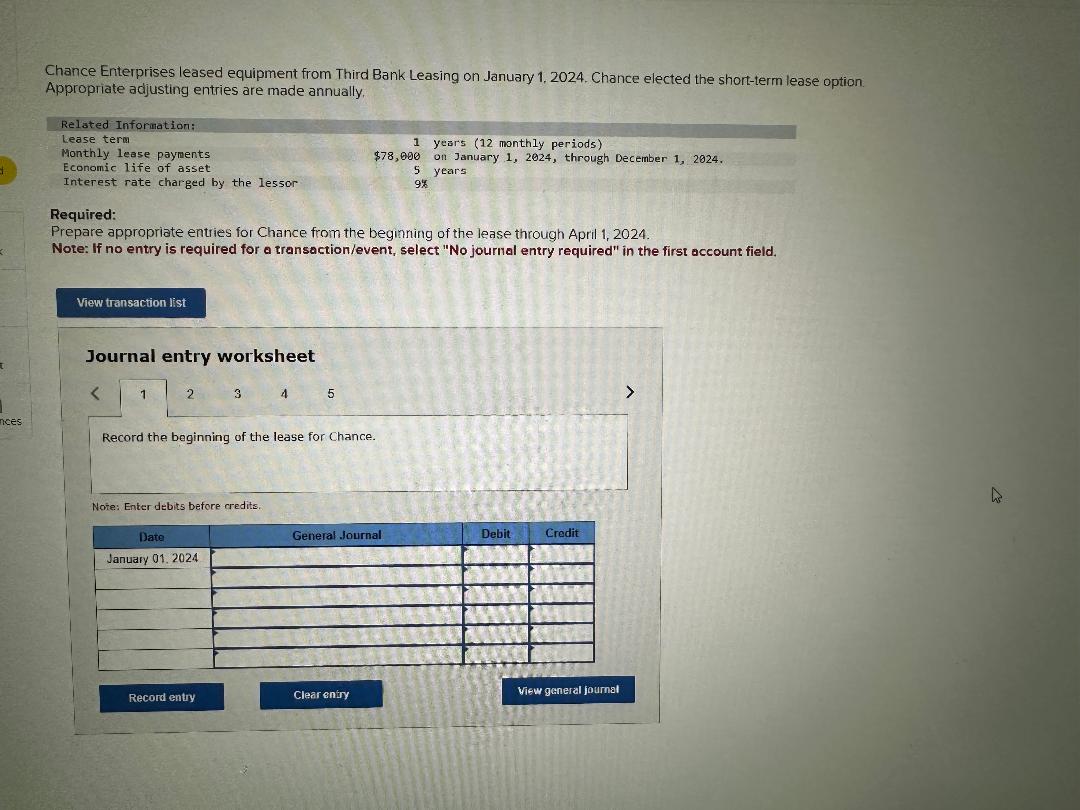

Chance Enterprises leased equipment from Third Bank Leasing on January 1 , 2 0 2 4 . Chance elected the short - term lease option.

Chance Enterprises leased equipment from Third Bank Leasing on January Chance elected the shortterm lease option. Appropriate adjusting entries are made annually. Chance Enterprises leased equipment from Third Bank Leasing on January Chance elected the shortterm lease option.

Appropriate adjusting entries are made annually.

Related Information:

lease term

Monthly lease payments

$ year's monthly periods

Economic life of asset

$ on January through December

Interest rate charged by the lessor

years

Required:

Prepare appropriate entries for Chance from the beginning of the lease through April

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Journal entry worksheet

Record the beginning of the lease for Chance.

Noie: Enter debits before credits.

Related Information:

Lease term years monthly periods

Monthly lease payments $ on January through December

Economic life of asset years

Interest rate charged by the lessor

Required:

Prepare appropriate entries for Chance from the beginning of the lease through April

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.Chance Enterprises leased equipment from Third Bank Leasing on January Chance elected the shortterm lease option.

Appropriate adjusting entries are made annually.

Related Information:

lease term

Monthly lease payments

Economic life of asset

$ on January through Decenber

Interest rate charged by the lessor

years

Required:

Prepare appropriate entries for Chance from the beginning of the lease through April

Note: If no entry is required for a transactionevent select No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started