Answered step by step

Verified Expert Solution

Question

1 Approved Answer

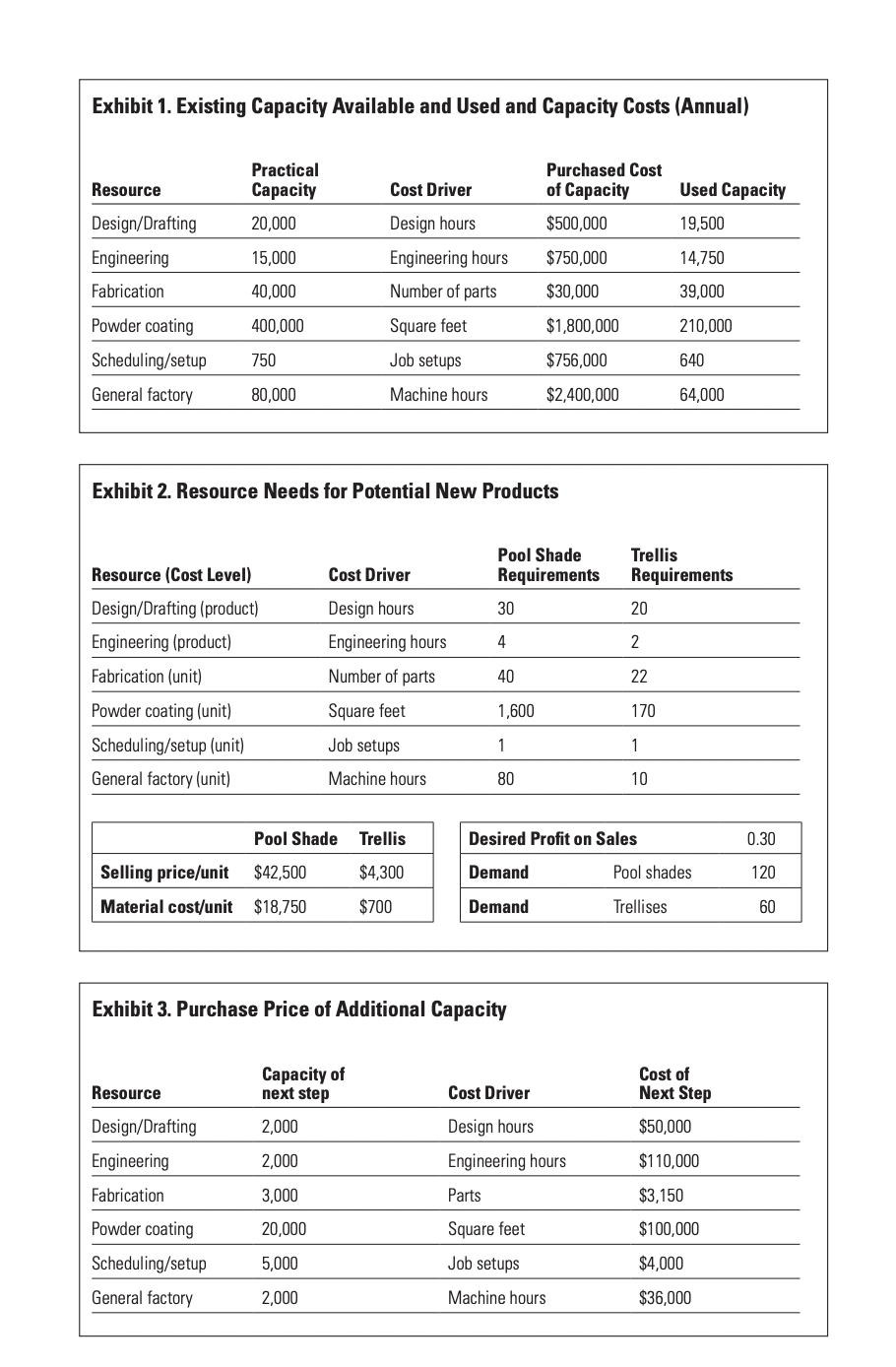

Chandler Corporation is currently producing several products, including both custom and standard designs. It has received requests for two new products: swimming pool shades and

Chandler Corporation is currently producing several

products, including both custom and standard designs. It

has received requests for two new products: swimming pool

shades and landscape trellises. It is considering whether

to produce either or both of these products. Based on the

projections in Exhibits to describing the current capacity

and required capacity needs for the new products, complete

the following requirements:Theory of Constraints:

a Assuming material is the only truly variable cost, find

the throughput margin per unit for:

i One pool shade

ii One trellis

b Assuming the powder coating process is the binding

constraint and additional capacity is difficult or too

costly to purchase, determine which product Chandler

should be making first. Explain how and why you came

to this conclusion. Also, show your computations to

support your conclusion.

c Assuming the powder coating process is the binding

constraint and additional capacity is difficult or too

costly to purchase, determine what mix of products

should be made with the existing excess capacity.

d Determine the incremental throughput margin Chandler

would earn if it sold the mix you determined in cExhibit Existing Capacity Available and Used and Capacity Costs Annual

Exhibit Resource Needs for Potential New Products

Exhibit Purchase Price of Additional Capacity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started