Answered step by step

Verified Expert Solution

Question

1 Approved Answer

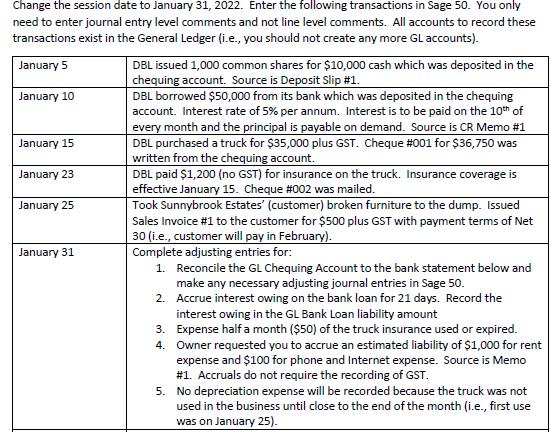

Change the session date to January 31, 2022. Enter the following transactions in Sage 50. You only need to enter journal entry level comments

Change the session date to January 31, 2022. Enter the following transactions in Sage 50. You only need to enter journal entry level comments and not line level comments. All accounts to record these transactions exist in the General Ledger (i.e., you should not create any more GL accounts). January 5 January 10 January 15 January 23 January 25 January 31 DBL issued 1,000 common shares for $10,000 cash which was deposited in the chequing account. Source is Deposit Slip #1. DBL borrowed $50,000 from its bank which was deposited in the chequing account. Interest rate of 5% per annum. Interest is to be paid on the 10th of every month and the principal is payable on demand. Source is CR Memo #1 DBL purchased a truck for $35,000 plus GST. Cheque #001 for $36,750 was written from the chequing account. DBL paid $1,200 (no GST) for insurance on the truck. Insurance coverage is effective January 15. Cheque # 002 was mailed. Took Sunnybrook Estates' (customer) broken furniture to the dump. Issued Sales Invoice # 1 to the customer for $500 plus GST with payment terms of Net 30 (i.e., customer will pay in February). Complete adjusting entries for: 1. 2. 3. 4. Reconcile the GL Chequing Account to the bank statement below and make any necessary adjusting journal entries in Sage 50. Accrue interest owing on the bank loan for 21 days. Record the interest owing in the GL Bank Loan liability amount Expense half a month ($50) of the truck insurance used or expired. Owner requested you to accrue an estimated liability of $1,000 for rent expense and $100 for phone and Internet expense. Source is Memo #1. Accruals do not require the recording of GST. 5. No depreciation expense will be recorded because the truck was not used in the business until close to the end of the month (i.e., first use was on January 25). January 31 Date January 3 January 5 January 10 January 17 January 31 Review the DBL's trial balance and make sure that the balance sheet accounts represent "reality" in terms of assets owned, liabilities owed, and common shares issued. Edmonton Credit Union Chequing Account Statement For month-ended January 31, 2022 Deposits Transaction Description Account Opened Deposit Slip #1 Bank Loan Credit Memo #1 Cheque 001 Service Charge $10,000.00 $50,000.00 Withdrawals $36,750.00 $5.00 Balance $0.00 $10,000.00 $60,000.00 $23,250.00 $23,245.00 Submission for Marking: 1. Save the following under the "c_submission files" folder to show your work: Create a backup file (.cab) with the file name "CABYourLastName". a) b) 2. 3. Export DBL's Chart of Accounts in PDF format with the file name "COAYourLastName. Note: Sage 50's default export file format is Excel so make sure you change it to PDF. c) Export DBL's Journal entries (without corrections) for the Month of January in PDF format with the file name "JEYourLastName". d) Export DBL's Trial Balance, excluding zero balance accounts, at January 31 in PDF format with the file name "TBYourLastName. Zip the "c_submission files" folder to create a "c_submission files.zip" file. You must zip the folder into a file because the Moodle Dropbox only allows one file to be uploaded. In Citrix, open Moodle for Sage, find the Assignment #1 Drop box and submit your "c_submission files.zip" file.

Step by Step Solution

★★★★★

3.31 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Answer is as follow As per policy I am answering as follow Answer Date Jan 5 Jan 10 Ja...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started