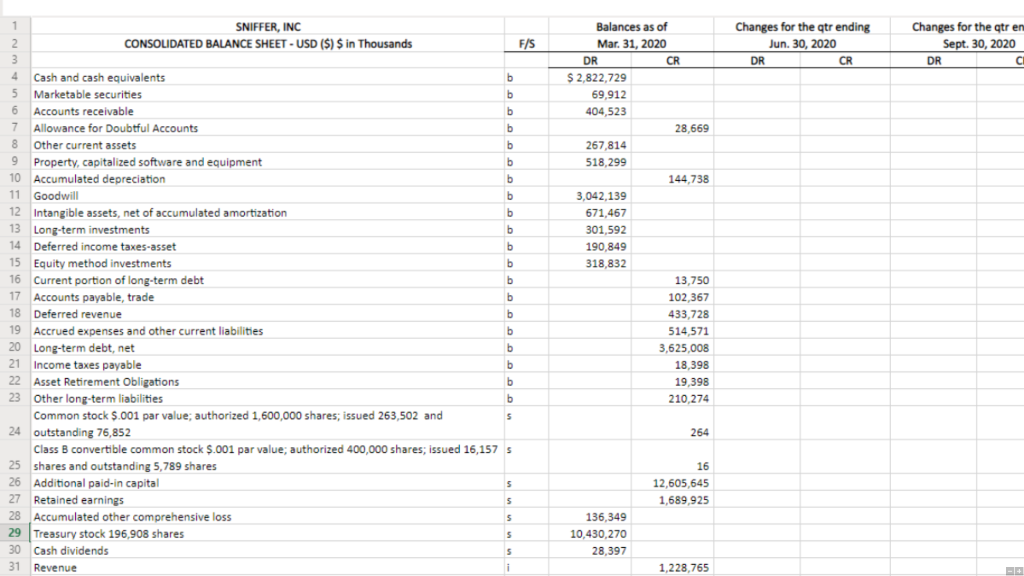

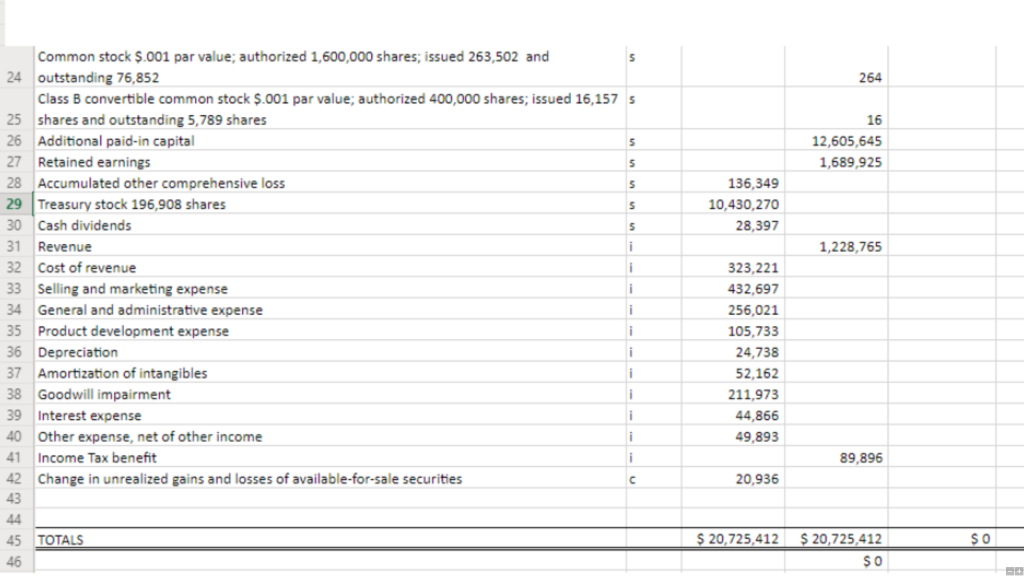

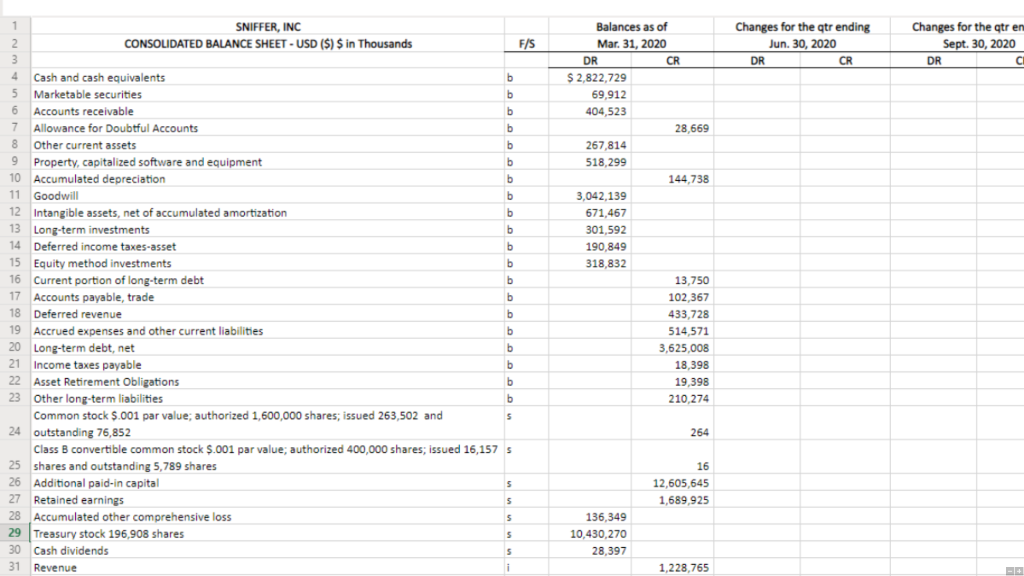

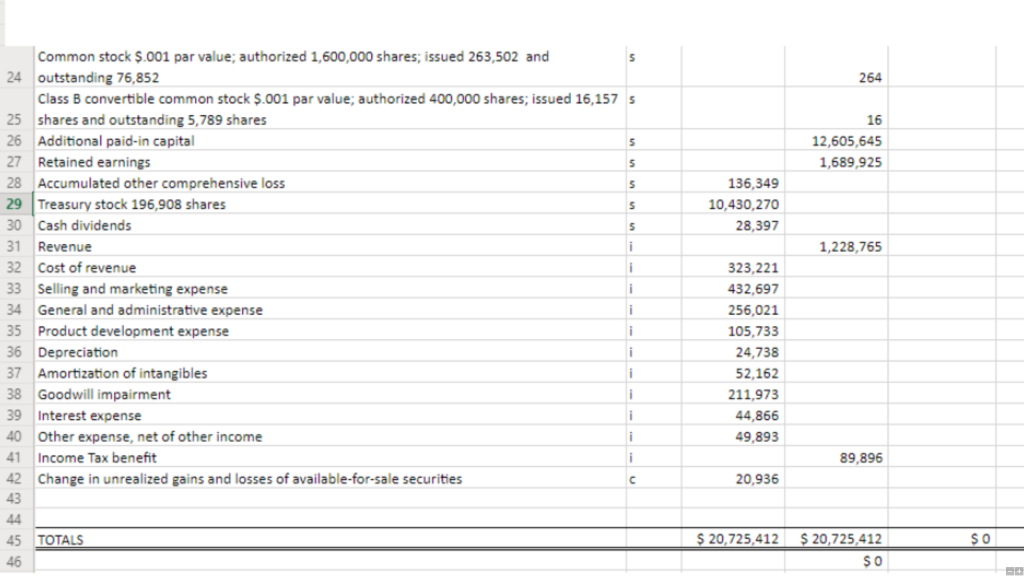

Changes for the trending Jun 30, 2020 DR CR Changes for the qtr en Sept. 30, 2020 , DR CI b b Balances as of Mar. 31, 2020 DR CR $ 2,822,729 69,912 404,523 28,669 267,814 518,299 144,738 3,042,139 671,467 301,592 190,849 318,832 13,750 102,367 433,728 514,571 3,625,008 18,398 19,398 210.274 b 1 SNIFFER, INC 2 CONSOLIDATED BALANCE SHEET - USD ($) $ in Thousands F/S 3 4 Cash and cash equivalents b 5 Marketable securities 6 Accounts receivable b 7 Allowance for Doubtful Accounts b 8 Other current assets b 9 Property, capitalized software and equipment b 10 Accumulated depreciation b 11 Goodwill 12 Intangible assets, net of accumulated amortization b 13 Long-term investments 14 Deferred income taxes-asset 15 Equity method investments b 16 Current portion of long-term debt 17 Accounts payable, trade b 18 Deferred revenue b 19 Accrued expenses and other current liabilities b 20 Long-term debt, net 21 Income taxes payable b 22 Asset Retirement Obligations b 23 Other long-term liabilities b Common stock $.001 par value; authorized 1,600,000 shares; issued 263,502 and 24 outstanding 76,852 Class B convertible common stock $.001 par value; authorized 400,000 shares; issued 16,157 s 25 shares and outstanding 5,789 shares 26 Additional paid-in capital 5 27 Retained earnings 28 Accumulated other comprehensive loss 29 Treasury stock 196,908 shares 5 30 Cash dividends 31 Revenue b b 5 264 16 12,605,645 1,689,925 5 5 136,349 10,430,270 28,397 5 i 1,228,765 -+ 264 5 16 12,605,645 1,689,925 5 5 136,349 10,430,270 28,397 5 1,228,765 Common stock $.001 par value; authorized 1,600,000 shares; issued 263,502 and 24 outstanding 76,852 Class B convertible common stock $.001 par value; authorized 400,000 shares; issued 16,157 5 25 shares and outstanding 5,789 shares 26 Additional paid-in capital 27 Retained earnings 28 Accumulated other comprehensive loss 5 29 Treasury stock 196,908 shares 30 Cash dividends 31 Revenue i 32 Cost of revenue i 33 Selling and marketing expense i 34 General and administrative expense i 35 Product development expense i 36 Depreciation i 37 Amortization of intangibles i 38 Goodwill impairment i 39 Interest expense i 40 Other expense, net of other income i 41 Income Tax benefit i 42 Change in unrealized gains and losses of available-for-sale securities 43 323,221 432,697 256,021 105,733 24,738 52,162 211,973 44,866 49,893 89,896 20,936 44 45 TOTALS $ 20,725,412 $0 $ 20,725,412 $0 46 1) Create a multi-step income statement using the numbers given. -+ Changes for the trending Jun 30, 2020 DR CR Changes for the qtr en Sept. 30, 2020 , DR CI b b Balances as of Mar. 31, 2020 DR CR $ 2,822,729 69,912 404,523 28,669 267,814 518,299 144,738 3,042,139 671,467 301,592 190,849 318,832 13,750 102,367 433,728 514,571 3,625,008 18,398 19,398 210.274 b 1 SNIFFER, INC 2 CONSOLIDATED BALANCE SHEET - USD ($) $ in Thousands F/S 3 4 Cash and cash equivalents b 5 Marketable securities 6 Accounts receivable b 7 Allowance for Doubtful Accounts b 8 Other current assets b 9 Property, capitalized software and equipment b 10 Accumulated depreciation b 11 Goodwill 12 Intangible assets, net of accumulated amortization b 13 Long-term investments 14 Deferred income taxes-asset 15 Equity method investments b 16 Current portion of long-term debt 17 Accounts payable, trade b 18 Deferred revenue b 19 Accrued expenses and other current liabilities b 20 Long-term debt, net 21 Income taxes payable b 22 Asset Retirement Obligations b 23 Other long-term liabilities b Common stock $.001 par value; authorized 1,600,000 shares; issued 263,502 and 24 outstanding 76,852 Class B convertible common stock $.001 par value; authorized 400,000 shares; issued 16,157 s 25 shares and outstanding 5,789 shares 26 Additional paid-in capital 5 27 Retained earnings 28 Accumulated other comprehensive loss 29 Treasury stock 196,908 shares 5 30 Cash dividends 31 Revenue b b 5 264 16 12,605,645 1,689,925 5 5 136,349 10,430,270 28,397 5 i 1,228,765 -+ 264 5 16 12,605,645 1,689,925 5 5 136,349 10,430,270 28,397 5 1,228,765 Common stock $.001 par value; authorized 1,600,000 shares; issued 263,502 and 24 outstanding 76,852 Class B convertible common stock $.001 par value; authorized 400,000 shares; issued 16,157 5 25 shares and outstanding 5,789 shares 26 Additional paid-in capital 27 Retained earnings 28 Accumulated other comprehensive loss 5 29 Treasury stock 196,908 shares 30 Cash dividends 31 Revenue i 32 Cost of revenue i 33 Selling and marketing expense i 34 General and administrative expense i 35 Product development expense i 36 Depreciation i 37 Amortization of intangibles i 38 Goodwill impairment i 39 Interest expense i 40 Other expense, net of other income i 41 Income Tax benefit i 42 Change in unrealized gains and losses of available-for-sale securities 43 323,221 432,697 256,021 105,733 24,738 52,162 211,973 44,866 49,893 89,896 20,936 44 45 TOTALS $ 20,725,412 $0 $ 20,725,412 $0 46 1) Create a multi-step income statement using the numbers given. -+