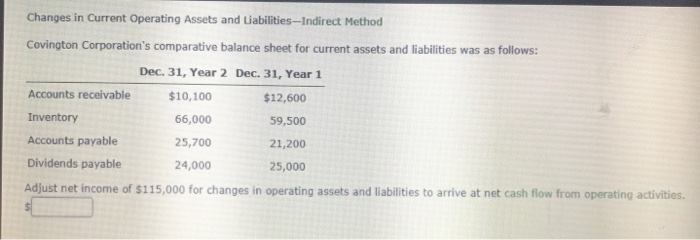

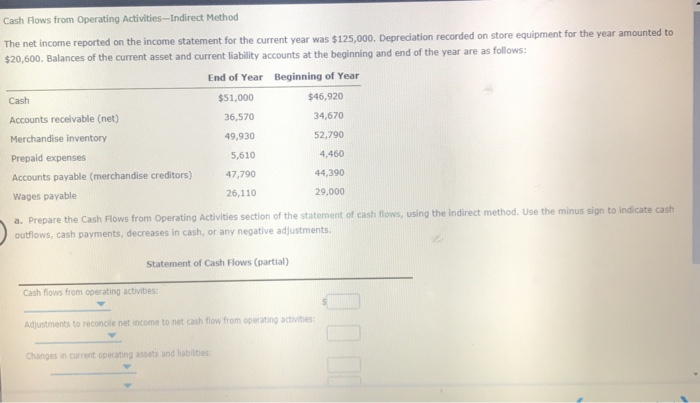

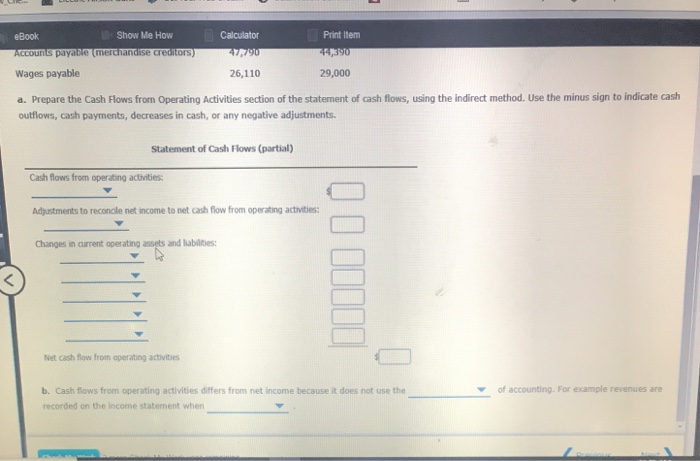

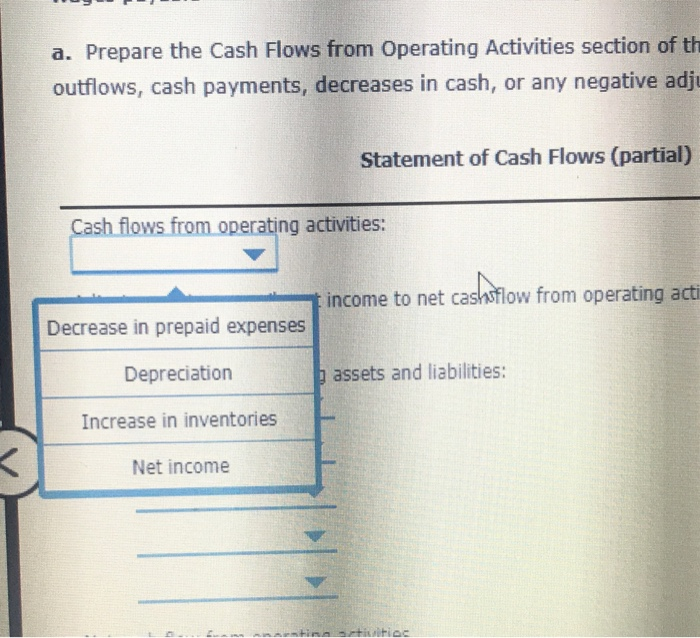

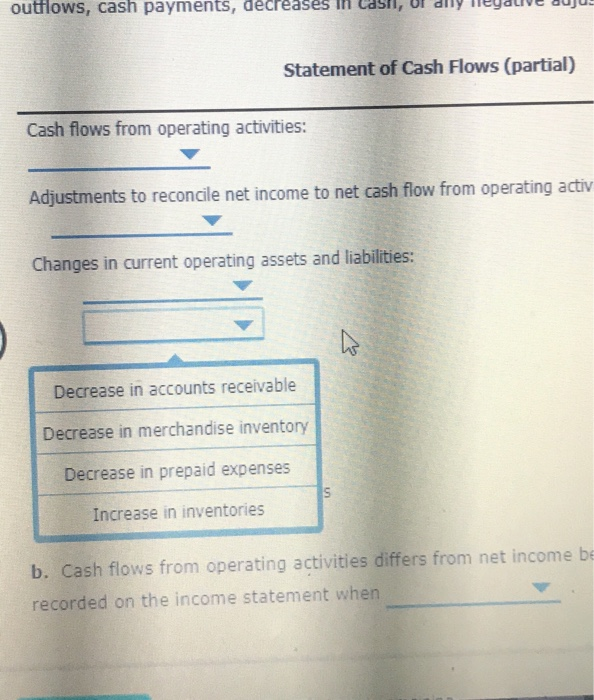

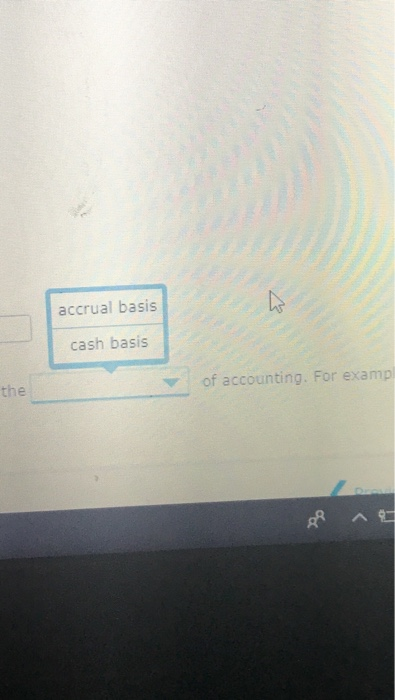

Changes in Current Operating Assets and Liabilities-Indirect Method Covington Corporation's comparative balance sheet for current assets and liabilities was as follows: Dec. 31, Year 2 Dec. 31, Year 1 Accounts receivable $10,100 $12,600 Inventory 66,000 59,500 Accounts payable 25,700 21,200 Dividends payable 24,000 25,000 Adjust net income of $115,000 for changes in operating assets and liabilities to arrive at net cash flow from operating activities. Cash Flows from Operating Activities-Indirect Method The net income reported on the income statement for the current vear was $125.000, Depreciation recorded on store equipment for the year amounted to $20,600. Balances of the current asset and current liability accounts at the beginning and end of the year are as follows: Beginning of Year End of Year $46,920 $51,000 Cash 34,670 36,570 Accounts receivable (net) 52,790 49,930 Merchandise inventory 4.460 5,610 Prepaid expenses 44,390 47,790 Accounts payable (merchandise creditors) 29,000 26,110 Wages payable a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash gative adjustments outflows, cash payments, decreases in cash, or any Statement of Cash Flows (partial) Cash flows from operating activities Adjustments to reconcile net income to net cash flow from operating activities Changes in current operating assets and liabilbes Show Me How Calculator Print Item eBook 47,790 44,390 Accounts payabie (merchandise creditors) 29,000 Wages payable 26,110 a. Prepare the Cash Flows from Operating Activities section of the statement of cash flows, using the indirect method. Use the minus sign to indicate cash outflows, cash payments, decreases in cash, or any negative adjustments. Statement of Cash Flows (partial) Cash flows from operating activities Adjustments to reconcle net income to net cash flow from operating activities Changes in current operating assets and liabilities Net cash flow from operating activities of accounting. For example revenues are b. Cash flows from operating activities differs from net income because it does not use the recorded on the income statement when a. Prepare the Cash Flows from Operating Activities section of th outflows, cash payments, decreases in cash, or any negative adju Statement of Cash Flows (partial) Cash flows from operating activities: income to net cashsflow from operating acti Decrease in prepaid expenses assets and liabilities: Depreciation Increase in inventories Net income sctivitioc ntin outflows, cash payments, decreases Statement of Cash Flows (partial) Cash flows from operating activities: Adjustments to reconcile net income to net cash flow from operating activ Changes in current operating assets and liabilities: Decrease in accounts receivable Decrease in merchandise inventory Decrease in prepaid expenses Increase in inventories b. Cash flows from operating activities differs from net income be recorded on the income statement when accrual basis cash basis of accounting. For examp the Drou