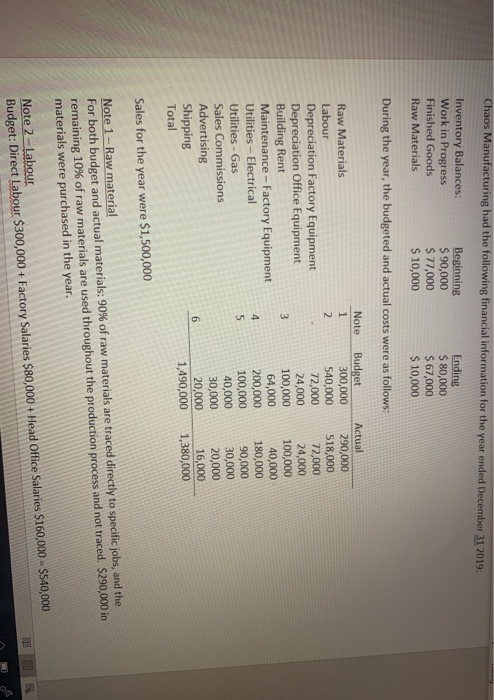

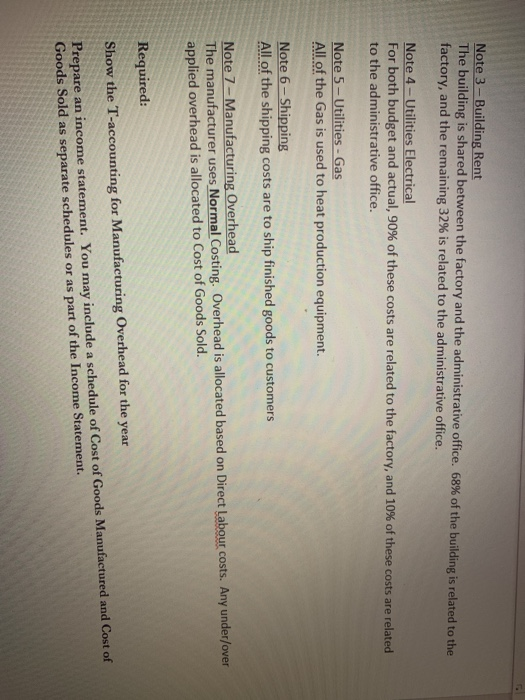

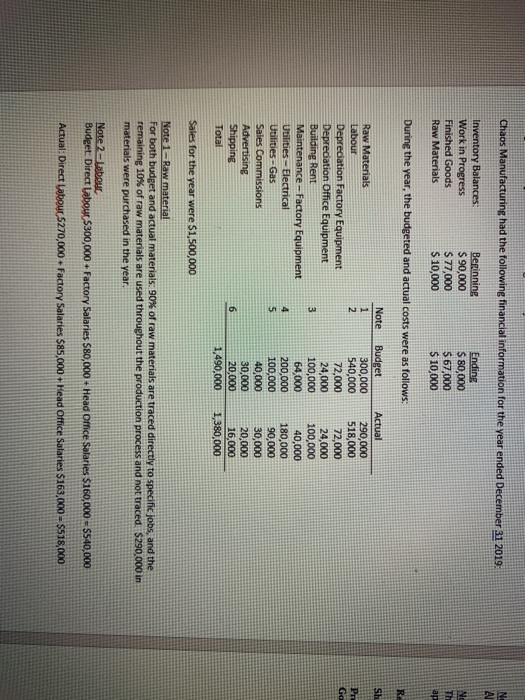

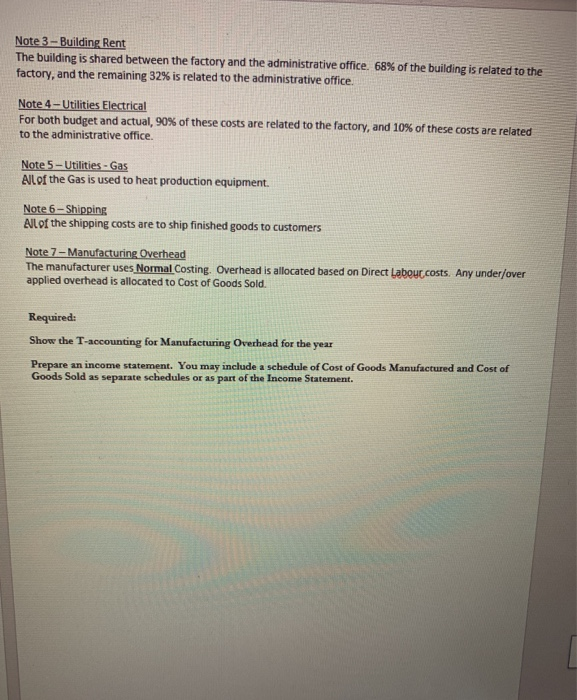

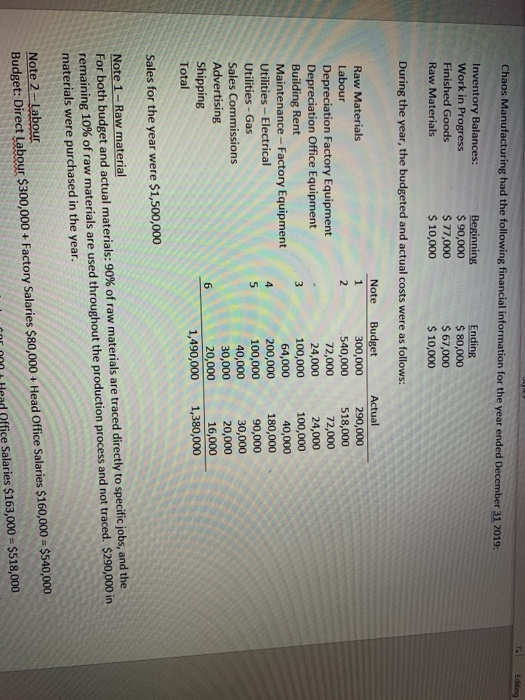

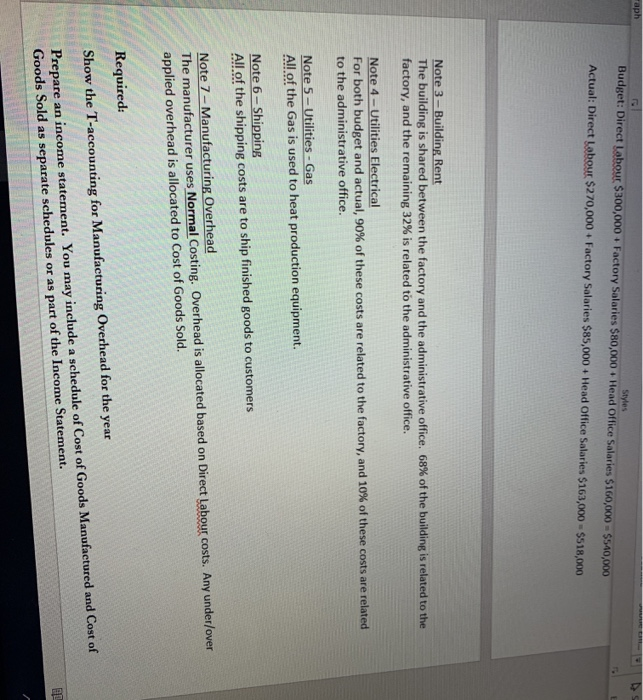

Chaos Manufacturing had the following financial information for the year ended December 31 2019: Inventory Balances: Work in Progress Finished Goods Raw Materials Beginning $ 90,000 $ 77,000 $ 10,000 Ending $ 80,000 $ 67,000 $ 10,000 During the year, the budgeted and actual costs were as follows: Note 1 2 3 Raw Materials Labour Depreciation Factory Equipment Depreciation Office Equipment Building Rent Maintenance - Factory Equipment Utilities - Electrical Utilities - Gas Sales Commissions Advertising Shipping Total Budget 300,000 540,000 72,000 24,000 100,000 64,000 200,000 100,000 40,000 30,000 20,000 1,490,000 Actual 290,000 518,000 72,000 24,000 100,000 40,000 180,000 90,000 30,000 20,000 16,000 1,380,000 4 5 6 Sales for the year were $1,500,000 Note 1 - Raw material For both budget and actual materials: 90% of raw materials are traced directly to specific jobs, and the remaining 10% of raw materials are used throughout the production process and not traced. $290,000 in materials were purchased in the year. Note 2 - Labour Budget: Direct Labour $300,000 + Factory Salaries $80,000 + Head Office Salaries $160,000 - $540,000 Note 3 - Building Rent The building is shared between the factory and the administrative office. 68% of the building is related to the factory, and the remaining 32% is related to the administrative office. Note 4 - Utilities Electrical For both budget and actual, 90% of these costs are related to the factory, and 10% of these costs are related to the administrative office. Note 5 - Utilities - Gas All of the Gas is used to heat production equipment. Note 6 - Shipping All of the shipping costs are to ship finished goods to customers Note 7 - Manufacturing Overhead The manufacturer uses Normal Costing. Overhead is allocated based on Direct Labour costs. Any under/over applied overhead is allocated to Cost of Goods Sold. Required: Show the T-accounting for Manufacturing Overhead for the year Prepare an income statement. You may include a schedule of Cost of Goods Manufactured and Cost of Goods Sold as separate schedules or as part of the Income Statement. Chaos Manufacturing had the following financial information for the year ended December 31 2019: Inventory Balances Work in Progress Finished Goods Raw Materials Berinning $ 90,000 $ 77,000 $ 10,000 Ending $ 80,000 $ 67,000 $ 10,000 an During the year, the budgeted and actual costs were as follows: R SH Note 1 2 Pri Go 3 Raw Materials Labour Depreciation Factory Equipment Depreciation Office Equipment Building Rent Maintenance - Factory Equipment Utilities - Electrical Utilities - Gas Sales Commissions Advertising Shipping Total Budget 300,000 540,000 72,000 24,000 100,000 64,000 200,000 100,000 40,000 30,000 20,000 1,490,000 Actual 290,000 518,000 72,000 24,000 100,000 40,000 180,000 90,000 30,000 20,000 16,000 1,380,000 6 Sales for the year were $1,500,000 Note 1 - Raw material For both budget and actual materials: 90% of raw materials are traced directly to specific jobs, and the remaining 10% of raw materials are used throughout the production process and not traced. $290,000 in materials were purchased in the year. Note 2 - Labour Budget: Direct Labout $300,000 + Factory Salaries 580,000+ Head Office Salaries $160,000 - $540,000 Actual: Direct Labour S270,000 - Factory Salaries $85,000 . Head Office Salaries 5163,000 - $518,000 Note 3 - Building Rent The building is shared between the factory and the administrative office. 68% of the building is related to the factory, and the remaining 32% is related to the administrative office. Note 4 - Utilities Electrical For both budget and actual, 90% of these costs are related to the factory, and 10% of these costs are related to the administrative office. Note 5 - Utilities - Gas All of the Gas is used to heat production equipment. Note 6 - Shipping All of the shipping costs are to ship finished goods to customers Note 7 - Manufacturing Overhead The manufacturer uses Normal Costing. Overhead is allocated based on Direct Labour costs. Any under/over applied overhead is allocated to Cost of Goods Sold. Required: Show the T-accounting for Manufacturing Overhead for the year Prepare an income statement. You may include a schedule of Cost of Goods Manufactured and Cost of Goods Sold as separate schedules or as part of the Income Statement. Editing Chaos Manufacturing had the following financial information for the year ended December 31 2019: Inventory Balances: Beginning Ending Work in Progress $ 90,000 $ 80,000 Finished Goods $ 77,000 $ 67,000 Raw Materials $ 10,000 $ 10,000 During the year, the budgeted and actual costs were as follows: Note 1 2 3 Raw Materials Labour Depreciation Factory Equipment Depreciation Office Equipment Building Rent Maintenance - Factory Equipment Utilities - Electrical Utilities - Gas Sales Commissions Advertising Shipping Total Budget 300,000 540,000 72,000 24,000 100,000 64,000 200,000 100,000 40,000 30,000 20,000 1,490,000 Actual 290,000 518,000 72,000 24,000 100,000 40,000 180,000 90,000 30,000 20,000 16,000 1,380,000 4 5 6 Sales for the year were $1,500,000 Note 1 - Raw material For both budget and actual materials: 90% of raw materials are traced directly to specific jobs, and the remaining 10% of raw materials are used throughout the production process and not traced. $290,000 in materials were purchased in the year. Note 2 - Labour Budget: Direct Labour $300,000 + Factory Salaries $80,000 + Head Office Salaries $160,000 = $540,000 Office Salaries $163,000 = $518,000 raph Styles Budget: Direct Labour $300,000 . Factory Salaries $80,000+ Head Office Salaries $160,000 - $540,000 Actual: Direct Labour $270,000 Factory Salaries $85,000 + Head Office Salaries $163,000 - $518,000 Note 3 - Building Rent The building is shared between the factory and the administrative office. 68% of the building is related to the factory, and the remaining 32% is related to the administrative office. Note 4 - Utilities Electrical For both budget and actual, 90% of these costs are related to the factory, and 10% of these costs are related to the administrative office. Note 5 - Utilities - Gas All of the Gas is used to heat production equipment. Note 6 - Shipping All of the shipping costs are to ship finished goods to customers Note 7 - Manufacturing Overhead The manufacturer uses Normal Costing. Overhead is allocated based on Direct Labour costs. Any under/over applied overhead is allocated to Cost of Goods Sold. Required: Show the T-accounting for Manufacturing Overhead for the year Prepare an income statement. You may include a schedule of Cost of Goods Manufactured and Cost of Goods Sold as separate schedules or as part of the Income Statement. EL