CHAP 15 - 11

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

DROPDOWN OPTIONS ARE BELOW THIS MESSAGE

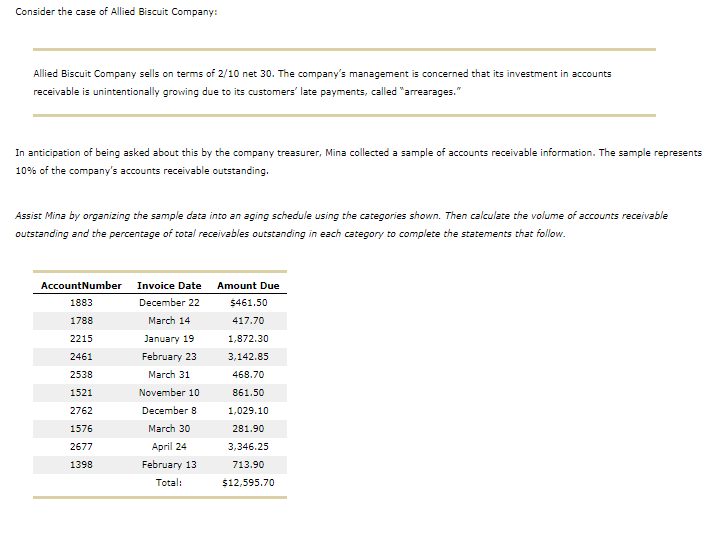

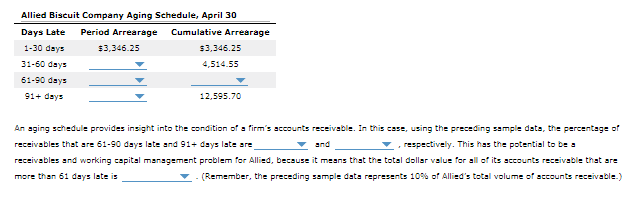

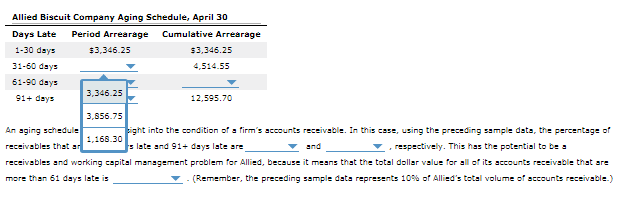

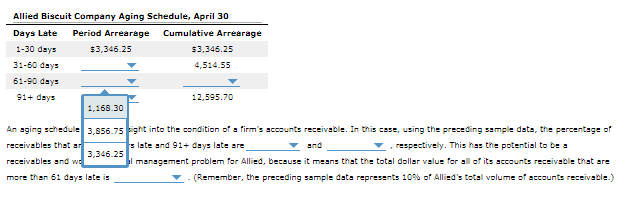

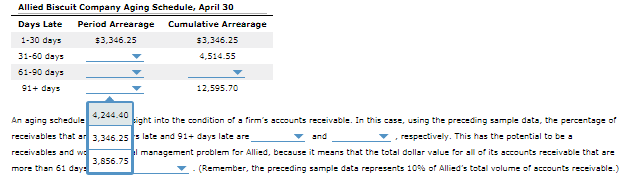

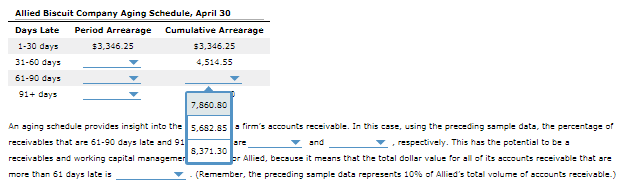

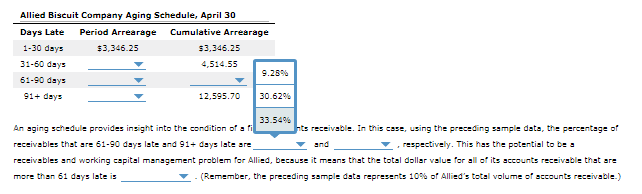

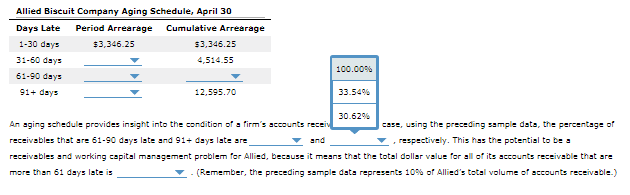

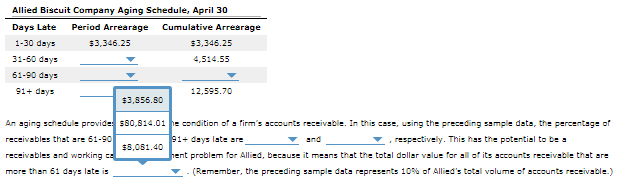

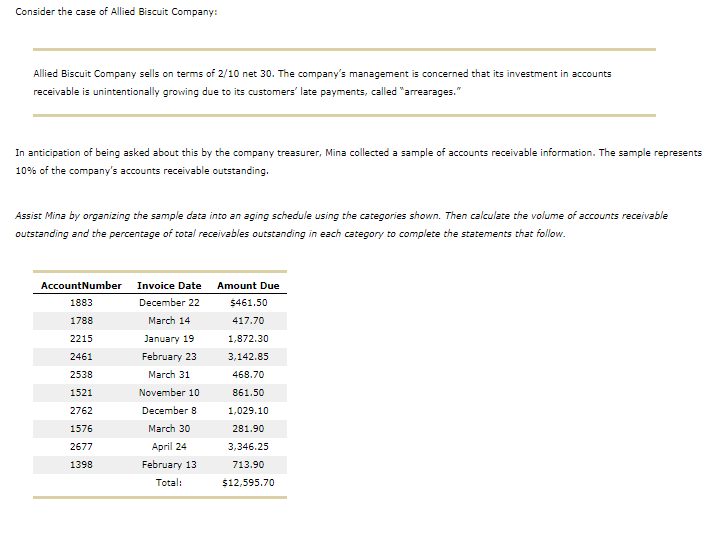

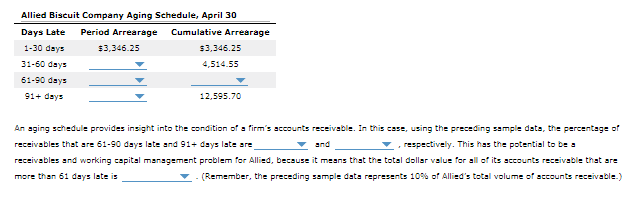

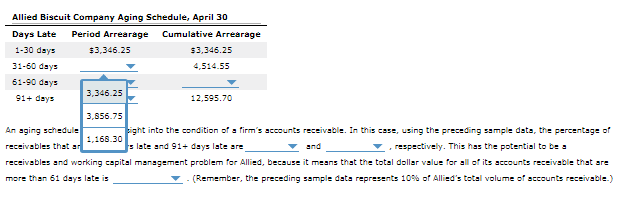

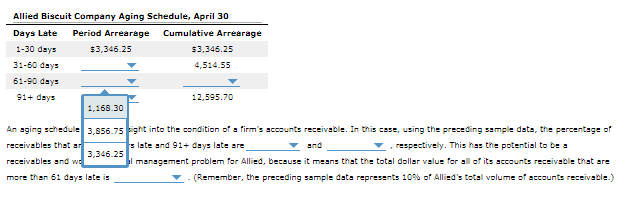

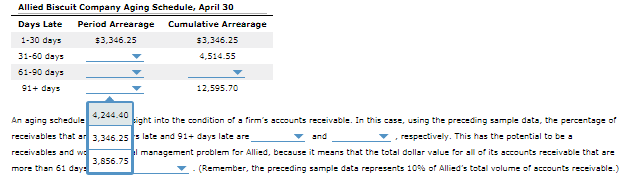

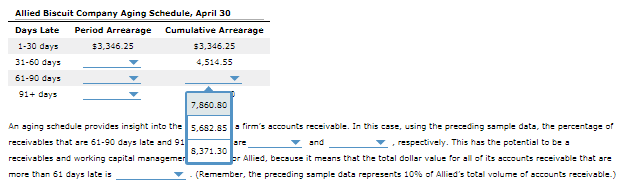

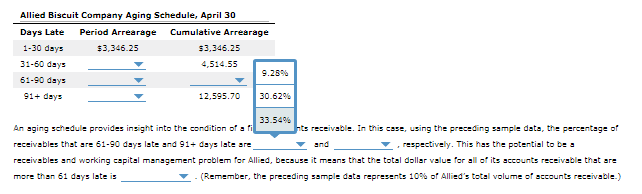

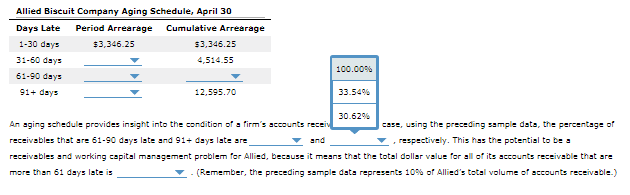

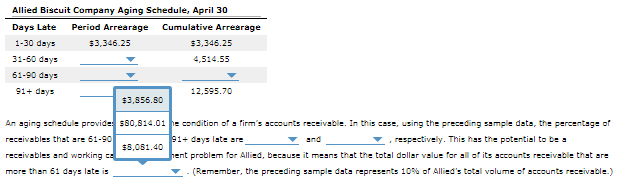

Consider the case of Allied Biscuit Company: Allied Biscuit Company sells on terms of 2/10 net 30. The company's management is concerned that its investment in accounts receivable is unintentionally growing due to its customers' late payments, called "arrearages In anticipation of being asked about this by the company treasurer, Mina collected a sam ple of accounts receivable information. The sample represents 10% of the company's accounts receivable outstanding. Assist Mina by organizing the sample data into an aging schedule using the categories shown. Then calculate the volume of accounts receivable outstanding and the percentage of total receivables outstanding in each category to complete the statements that follow. AccountNumber Invoice Date Amount Due December 22 1883 $461.50 March 14 1788 417.70 2215 January 19 1,872.30 February 23 2461 3,142.85 March 31 468.70 2538 November 10 1521 861.50 December 8 2762 1,029.10 March 30 1576 281.90 April 24 2677 3,346.25 February 13 1398 713.90 Total: $12,595.70 Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $3,346.25 31-60 days 4.514.55 61-90 days 91+ days 12,595.70 An aging schedule provides insight into the condition of a firm's accounts receivable. In this case, using the preceding sample dats, the percentage of receivables that are 61-90 days late and 91+ dsys late are respectively. This has the potential to be n receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are more than 61 days late is (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receivable.) Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $ 3,346.25 31-60 days 4,514.55 61-90 days 3,346.25 91+ days 12,595.70 3,856.75 ght into the condition of a firm's accounts receivable. In this case, using the preceding sample data, the percentage of An aging schedule 1,168.30 receivables that ar s late and 91+ days late are respectively. This has the potential to be and receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are more than 61 days late is (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receivable.) Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $3,346.25 31-60 days 4,514.55 61-90 days 91+ days 12.595.70 1,168.30 An aging schedule 856 75 ight into the condition of a firm's accounts receivable. In this case, using the preceding sample data, the percentage of s late and 91+ days late are receivables that an respectively. This has the potential to be a and 3.346.25 l manacement problem for Allied, because it mEans that the total dpllar value for all of its accounts receivable that are receivables and w (Remember, the preceding sample data represents 10 % of Allied's total volume of accounts receiva ble.) more than 61 days late is Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3.346.25 $3,346.25 31-60 days 4,514.55 61-90 days 91+ days 12,595.70 4244.40int into the condition ofa firm's accounta receivabie, In this case, using Ehhe preceding sample data. the parcentage of An aging schedule receivables that ar s late and 91+ days late re ,respectively. This has the potential to be a and 3,346.2 l management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are receivables and w 3,856.75 (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receivable.) more than 61 day Allied Biscuit Company Aging Schedule, April 30 Days Late Period Arrearage Cumulative Arrearage $ 3,346.25 1-30 days $3,346.25 31-60 days 4,514.55 61-90 days 91+ days 7,860.50 An aging schedule provides insight into the 5.682.85 a firm's accounts receivable. In this case, using the prece ding sample data, the percentage of receivables that are 61-90 days late and 91 ar respectively. This has the potential to be a d 8,371.30 receivables and working capital managemer r Allied, because it means that the total dpllar value for all of its accounts receivable that are (Remember, the preceding sample data represents 10 % of Allied's total volume of accounts receivable.) more than 61 days late is Allied Biscuit Company Aging Schedule, April 30 Days Late Period Arrearage Cumulative Arrearage 1-30 days $3,346.25 $3.346.25 31-60 days 4,514.55 9.28% 61-90 days 91+ days 30.62% 12.595.70 33.54% nts receivable. In this case, using the preceding sample data, the percentage of An aging schedule provides insight into the condition of a fi receivables that are 61-90 days late and 91+ dsys late are respectively. This has the potential to be a and receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are more than 61 days late is (Bemember, the preceding sample data rearesents 100% of Allied's tatal volume of acFOunts receivable.) Allied Biscuit Company Aging Schedule, April 30 Days Late Period Arrearage Cumulative Arrearage $3,346.25 1-30 days $3,346.25 31-60 days 4,514.55 100.00 % 61-90 days 91+ days 12,595.70 33.54% 30.62% An aging schedule provides insight into the condition of a firm's acco umts receiv case, using the preceding sample data, the percentage of receivables that are 61-90 days late and 91+ days late are respectively. This has the potential to be a and receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are (Remember, the preceding sample data represents 10%% of Allied's total volume of accounts receivable.) more than 61 days late is Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $3,346.25 31-60 days 4.514.55 61-90 days 91+ days 12,595.70 $3,856.80 An aging schedule provide S80,814.01 e condition of a firm's accounts receivable. Im this case, using the preceding sample data, the percentaqe of 91+ days late are receivables that are 61-90 respectively. This has the potential to be and $8.081.40 receivables and working cs ent prablem for Allied, because it means that the total dollar value for all of its accounts receivable that are (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receiva ble.) more than 61 days late is Consider the case of Allied Biscuit Company: Allied Biscuit Company sells on terms of 2/10 net 30. The company's management is concerned that its investment in accounts receivable is unintentionally growing due to its customers' late payments, called "arrearages In anticipation of being asked about this by the company treasurer, Mina collected a sam ple of accounts receivable information. The sample represents 10% of the company's accounts receivable outstanding. Assist Mina by organizing the sample data into an aging schedule using the categories shown. Then calculate the volume of accounts receivable outstanding and the percentage of total receivables outstanding in each category to complete the statements that follow. AccountNumber Invoice Date Amount Due December 22 1883 $461.50 March 14 1788 417.70 2215 January 19 1,872.30 February 23 2461 3,142.85 March 31 468.70 2538 November 10 1521 861.50 December 8 2762 1,029.10 March 30 1576 281.90 April 24 2677 3,346.25 February 13 1398 713.90 Total: $12,595.70 Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $3,346.25 31-60 days 4.514.55 61-90 days 91+ days 12,595.70 An aging schedule provides insight into the condition of a firm's accounts receivable. In this case, using the preceding sample dats, the percentage of receivables that are 61-90 days late and 91+ dsys late are respectively. This has the potential to be n receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are more than 61 days late is (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receivable.) Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $ 3,346.25 31-60 days 4,514.55 61-90 days 3,346.25 91+ days 12,595.70 3,856.75 ght into the condition of a firm's accounts receivable. In this case, using the preceding sample data, the percentage of An aging schedule 1,168.30 receivables that ar s late and 91+ days late are respectively. This has the potential to be and receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are more than 61 days late is (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receivable.) Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $3,346.25 31-60 days 4,514.55 61-90 days 91+ days 12.595.70 1,168.30 An aging schedule 856 75 ight into the condition of a firm's accounts receivable. In this case, using the preceding sample data, the percentage of s late and 91+ days late are receivables that an respectively. This has the potential to be a and 3.346.25 l manacement problem for Allied, because it mEans that the total dpllar value for all of its accounts receivable that are receivables and w (Remember, the preceding sample data represents 10 % of Allied's total volume of accounts receiva ble.) more than 61 days late is Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3.346.25 $3,346.25 31-60 days 4,514.55 61-90 days 91+ days 12,595.70 4244.40int into the condition ofa firm's accounta receivabie, In this case, using Ehhe preceding sample data. the parcentage of An aging schedule receivables that ar s late and 91+ days late re ,respectively. This has the potential to be a and 3,346.2 l management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are receivables and w 3,856.75 (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receivable.) more than 61 day Allied Biscuit Company Aging Schedule, April 30 Days Late Period Arrearage Cumulative Arrearage $ 3,346.25 1-30 days $3,346.25 31-60 days 4,514.55 61-90 days 91+ days 7,860.50 An aging schedule provides insight into the 5.682.85 a firm's accounts receivable. In this case, using the prece ding sample data, the percentage of receivables that are 61-90 days late and 91 ar respectively. This has the potential to be a d 8,371.30 receivables and working capital managemer r Allied, because it means that the total dpllar value for all of its accounts receivable that are (Remember, the preceding sample data represents 10 % of Allied's total volume of accounts receivable.) more than 61 days late is Allied Biscuit Company Aging Schedule, April 30 Days Late Period Arrearage Cumulative Arrearage 1-30 days $3,346.25 $3.346.25 31-60 days 4,514.55 9.28% 61-90 days 91+ days 30.62% 12.595.70 33.54% nts receivable. In this case, using the preceding sample data, the percentage of An aging schedule provides insight into the condition of a fi receivables that are 61-90 days late and 91+ dsys late are respectively. This has the potential to be a and receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are more than 61 days late is (Bemember, the preceding sample data rearesents 100% of Allied's tatal volume of acFOunts receivable.) Allied Biscuit Company Aging Schedule, April 30 Days Late Period Arrearage Cumulative Arrearage $3,346.25 1-30 days $3,346.25 31-60 days 4,514.55 100.00 % 61-90 days 91+ days 12,595.70 33.54% 30.62% An aging schedule provides insight into the condition of a firm's acco umts receiv case, using the preceding sample data, the percentage of receivables that are 61-90 days late and 91+ days late are respectively. This has the potential to be a and receivables and working capital management problem for Allied, because it means that the total dollar value for all of its accounts receivable that are (Remember, the preceding sample data represents 10%% of Allied's total volume of accounts receivable.) more than 61 days late is Allied Biscuit Company Aging Schedule, April 30 Period Arrearage Cumulative Arrearage Days Late 1-30 days $3,346.25 $3,346.25 31-60 days 4.514.55 61-90 days 91+ days 12,595.70 $3,856.80 An aging schedule provide S80,814.01 e condition of a firm's accounts receivable. Im this case, using the preceding sample data, the percentaqe of 91+ days late are receivables that are 61-90 respectively. This has the potential to be and $8.081.40 receivables and working cs ent prablem for Allied, because it means that the total dollar value for all of its accounts receivable that are (Remember, the preceding sample data represents 10% of Allied's total volume of accounts receiva ble.) more than 61 days late is