Answered step by step

Verified Expert Solution

Question

1 Approved Answer

chap 4 analysis #9 turnover ratio, and the ectiveness in using the company y asets, and Hydre Cosmetics Inc, Dupont Analysis CHLOE: I see what

chap 4 analysis #9

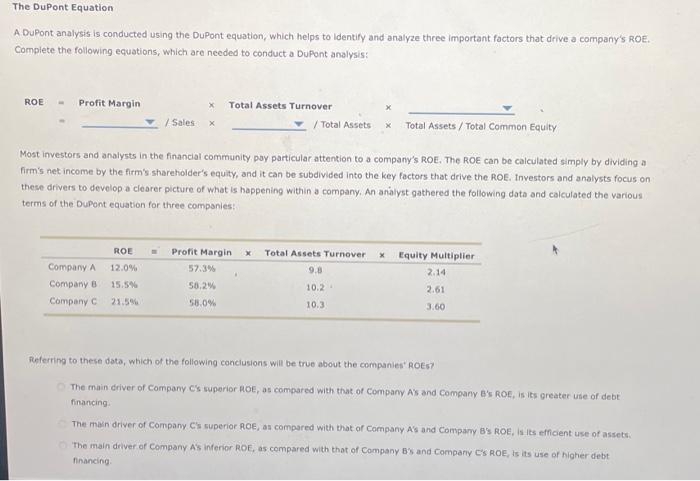

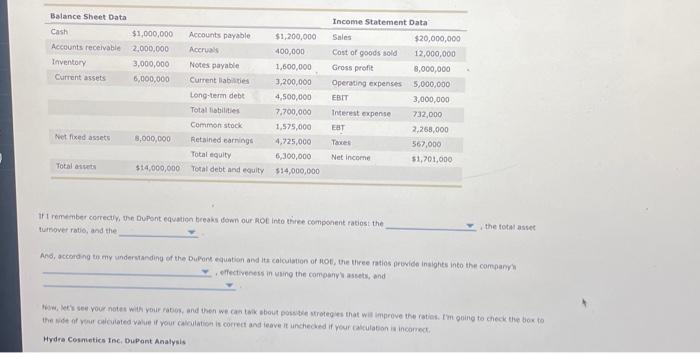

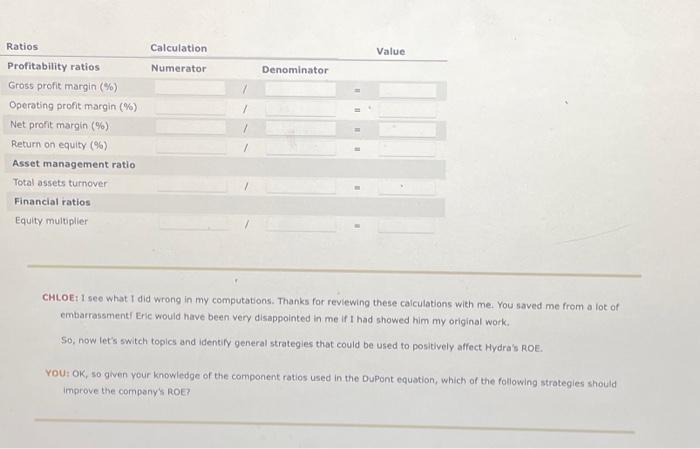

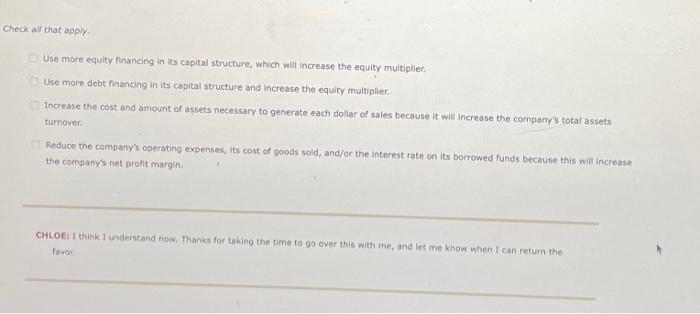

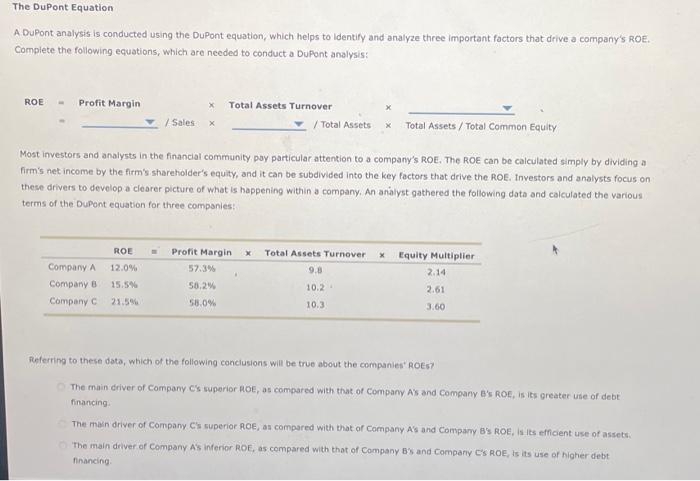

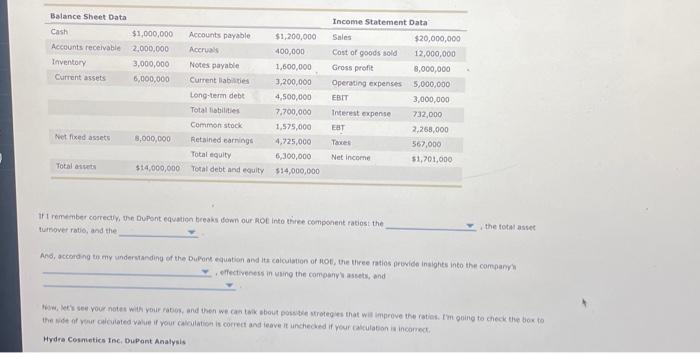

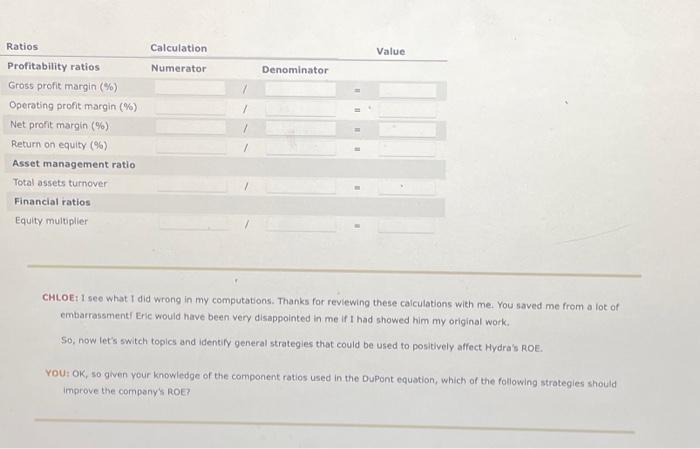

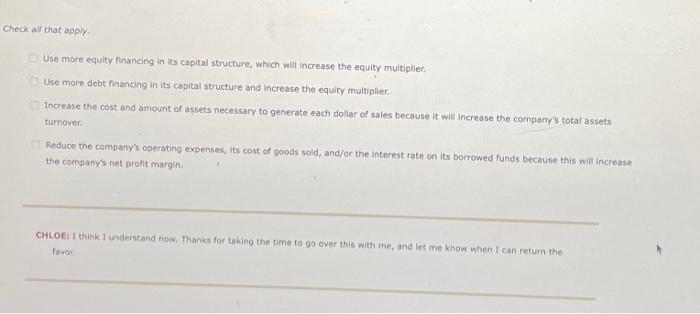

turnover ratio, and the ectiveness in using the company y asets, and Hydre Cosmetics Inc, Dupont Analysis CHLOE: I see what 1 did wrong in my computations. Thanks for reviewing these calculations with me. You saved me from a lot of embarrassmenti Eric would have been very disappointed in me if t had showed him my original work. So; now let's switch topics and identiry general strategies that could be used to positively affect Hydra's ROE. YoU: OK, so given your knowledge of the component ratios used in the Dupont equation, which of the following strategies should improve the compeny's ROE? A Dupont analysis is conducted using the DuPont equation, which helps to identify and analyze three important factors that drive a company's ROE. Complete the following equations, which are needed to conduct a DuPont analysis: Most investors and analysts in the financial community pay particular attention to a company's ROE. The ROE can be calculated simply by dividing a firm's net income by the firm's shareholder's equity, and it can be subdivided into the key factors that drive the ROE. Investors and analysts focus on these drivers to develop a clearer picture of what is happening within a company. An analyst gathered the following data and calculated the various terms of the Dupont equation for three companies: Referring to these dato, which of the following conclusions will be true about the companies' RoEs? The main driver of Company C's superior HOE, as compared with that of Company A's and Company B's ROE, is its greater use of debt financing. The main driver of Company C's superior ROE, as compared with that of Company A's and Compamy B's ROE, is Its efficient use of assets. The main driver of Company As inferior. ROE, as compared with that of Company B's and Company C's ROE, is its use of higher debt financing. Check all that apply. Use more equity financing in its capital structure, which will increase the equity multipller. Use more debt financing in its capital structure and increase the equity multiplier: Increase the cost and amount of assets necessary to generate each dollar of sales because it will increase the company's total assets turnover Reduce the company's operating expenses, its cost of goods sold, and/or the interest rate on its borrowed funds because this will increase. the company's net profit margin. CHLOEi t think I undertand now. Thanks for taking the time to go over this with me, and let me know when f can retum the favor

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started