CHAP 4 - Q10

CHAP 6 - Q2

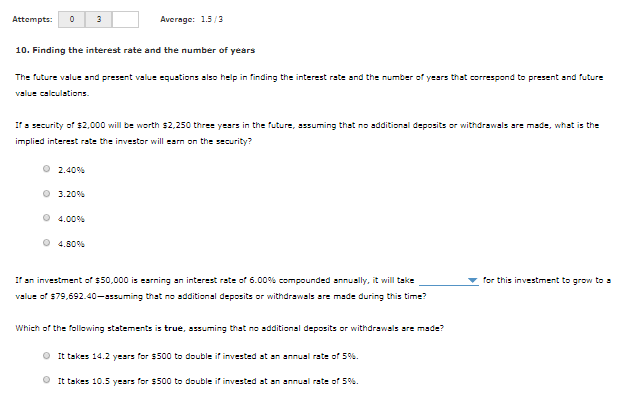

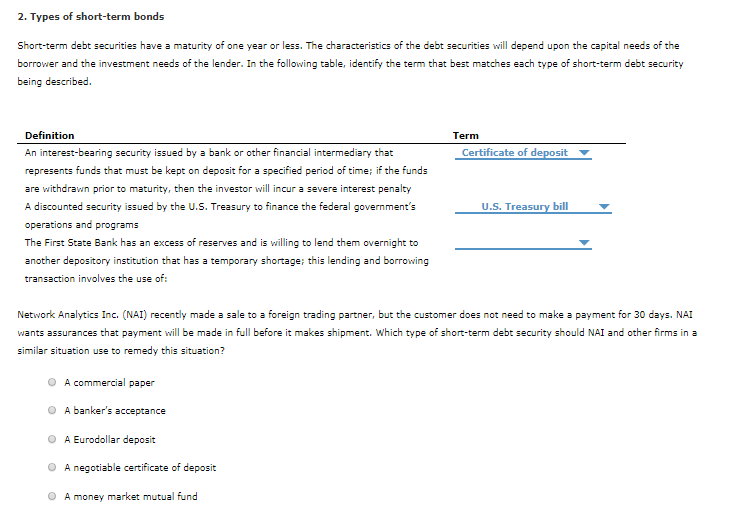

Attempts: 0 3 Average: 1.5/3 10. Finding the interest rate and the number of years The future value and present value equations also help in finding the interest rate and the number of years that correspond to present and future value calculations. If a security of $2,000 will be worth $2,250 three years in the future, assuming that no additional deposits or withdrawals are made, what is the implied interest rate the investor will earn on the security? 2.40% O 3.209 4.00% 4.80% for this investment to grow to : If an investment of $50,000 is earning an interest rate of 6.00% compounded annually, it will take value of 579,692.40-935uming that no additional deposits or withdrawals are made during this time? Which of the following statements is true, assuming that no additional deposits or withdrawals are made? It takes 14.2 years for 5500 to double it invested at an annual rate of 5%. It takes 10.5 years for $500 to double it invested at an annual rate of 5%. 2. Types of short-term bonds Short-term debt securities have a maturity of one year or less. The characteristics of the debt securities will depend upon the capital needs of the borrower and the investment needs of the lender. In the following table, identify the term that best matches each type of short-term debt security being described. Term Certificate of deposit Definition An interest-bearing security issued by a bank or other financial intermediary that represents funds that must be kept on deposit for a specified period of time; if the funds are withdrawn prior to maturity, then the investor will incur a severe interest penalty A discounted security issued by the U.S. Treasury to finance the federal government's operations and programs The First State Bank has an excess of reserves and is willing to lend them overnight to another depository institution that has a temporary shortage; this lending and borrowing transaction involves the use of: U.S. Treasury bill Network Analytics Inc. (NAI) recently made a sale to a foreign trading partner, but the customer does not need to make a payment for 30 days. NAI wants assurances that payment will be made in full before it makes shipment. Which type of short-term debt security should NAI and other firms in a similar situation use to remedy this situation? O A commercial paper O A banker's acceptance O A Eurodollar deposit O A negotiable certificate of deposit A money market mutual fund