CHAP 8 - Q11

Please answer it completely, with the graph and everything I will really appreciate it.

HERE ARE THE DROPDOWN OPTIONS

PLEASE ALSO SHOW WHERE EXACTLY THE LINE SHOULD BE ON THE MAP THANK YOU

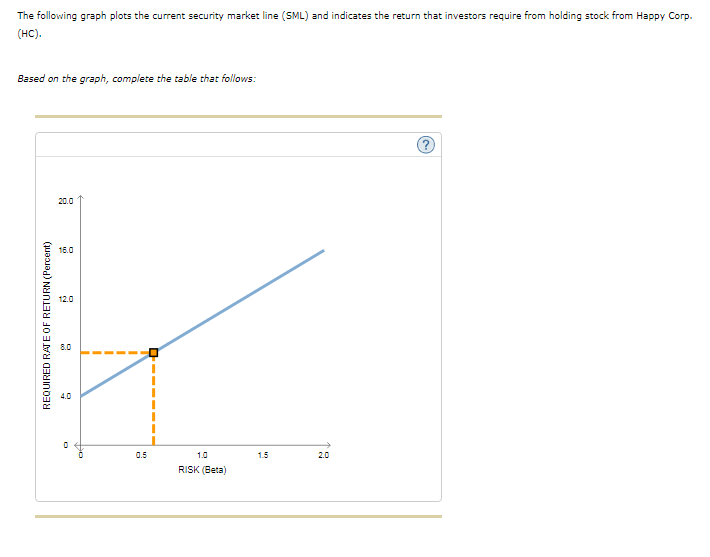

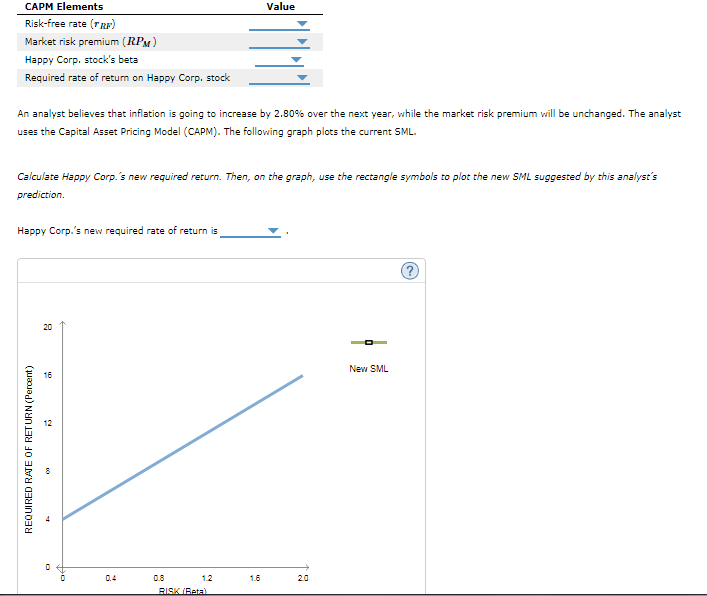

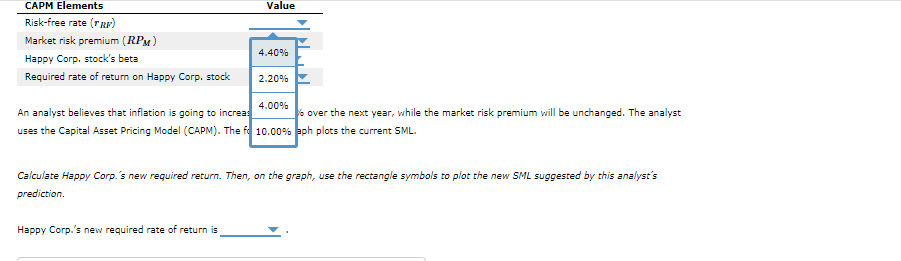

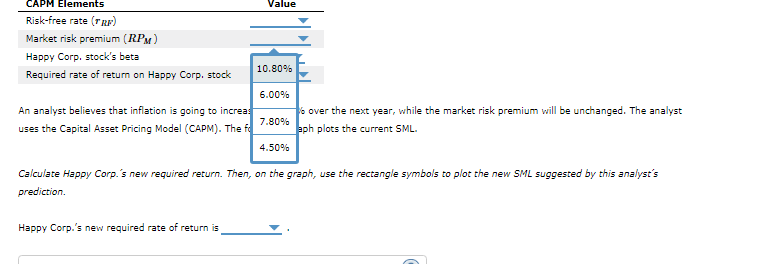

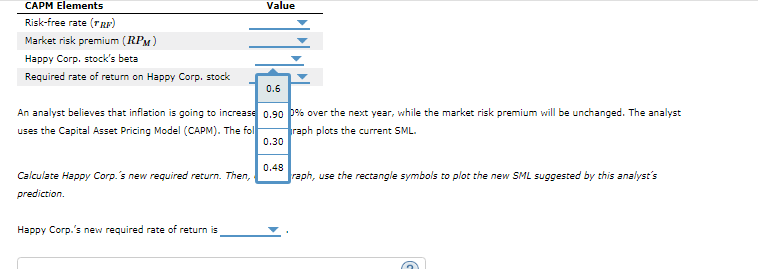

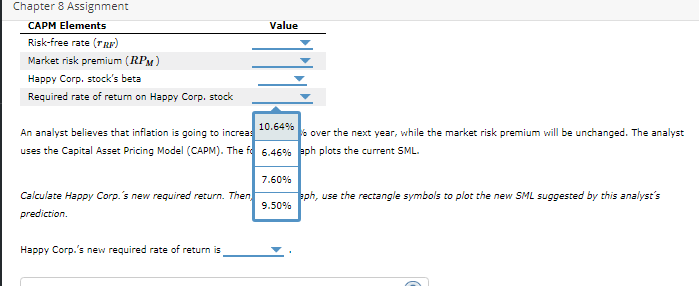

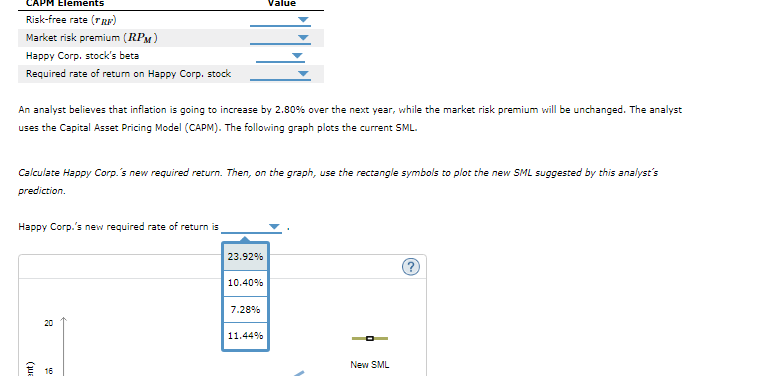

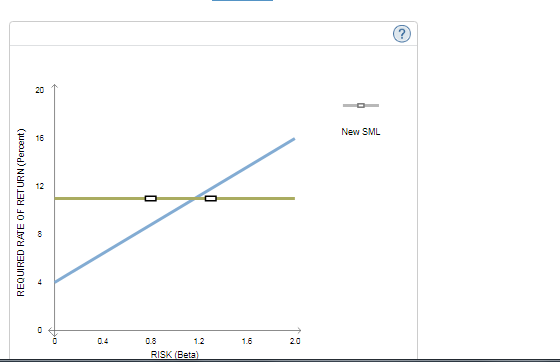

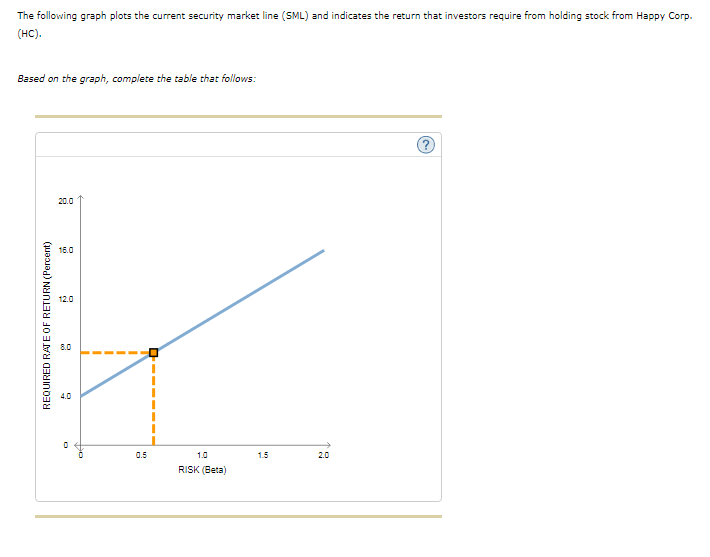

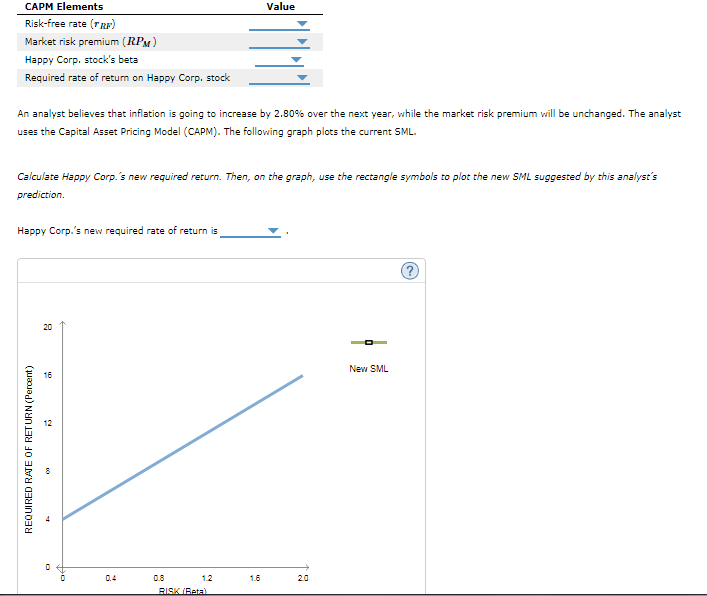

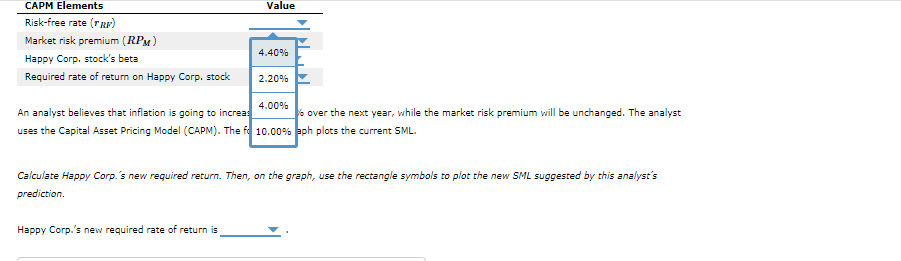

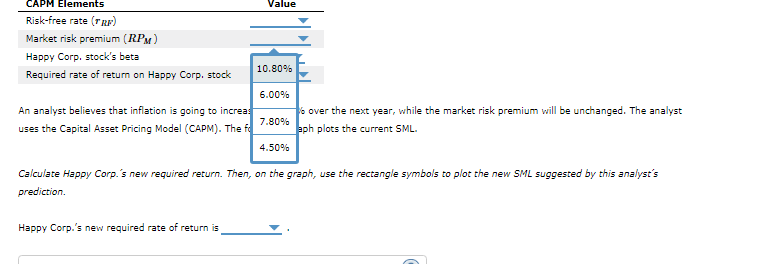

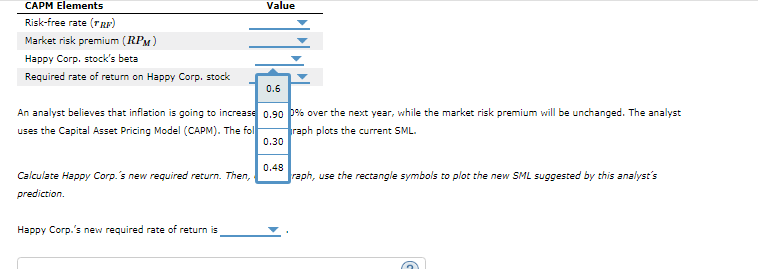

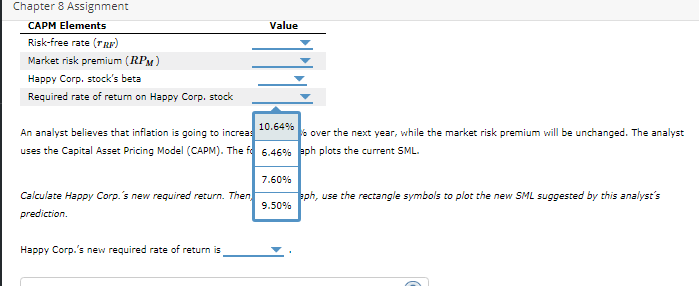

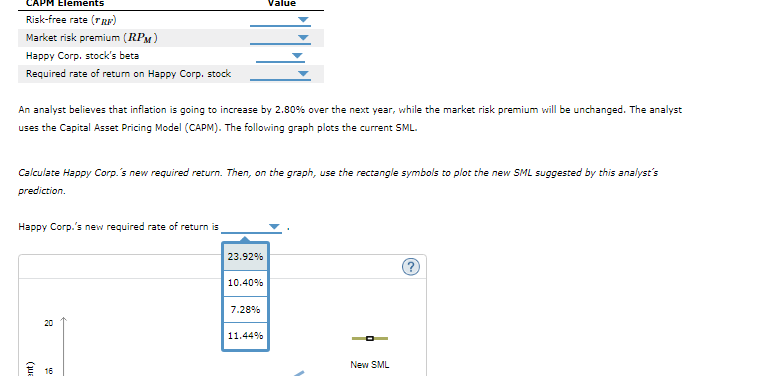

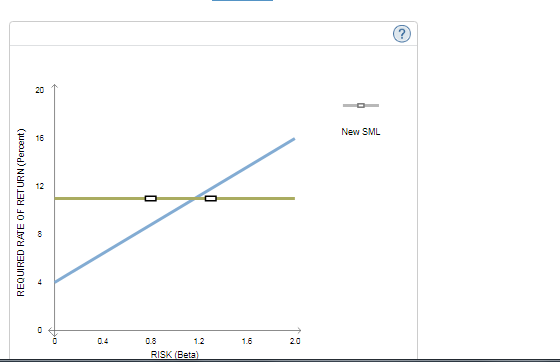

The following graph plots the current security market line (SML) and indicates the return that investors require from holding stock from Happy Corp. (HC) Based on the graph, complete the table that follows: 20.0 16.0 12.0 8.0 4.0 2.0 0.5 1.0 1.5 RISK (Beta) REQUIRED RATE OF RETURN (Percent) CAPM Elements Value Risk-free rate (rR) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock An analyst believes that inflation is going to increase by 2.80% over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML Calculate Happy Corp. 's new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by this analyst's prediction. Happy Corp.'s new required rate of return is 20 New SML 20 0.4 0.8 12 1.6 RISK (Beta) (uaoua Nan ino3 CAPM Elements Value Risk-free rate (rRE) Market risk premium (RPM) 4.40% Happy Corp, stock's beta Required rate of return on Happy Corp. stock 2.20% 4.00% An analyst believes that inflation is going to increas % over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The fo 10.00 % aph plots the current SML Calculate Happy Corp. 's new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by thiss analyst's prediction Happy Corp.'s new required rate of return is Value CAPM Elements Risk-free rate rRF) Market risk premium (RPM) Happy Corp. stock's beta 10.80% Required rate of return on Happy Corp. stock 6.00% An analyst believes that inflation is going to increas % over the next year, while the market risk premium will be unchanged. The analyst 7.80% uses the Capital Asset Pricing Model (CAPM). The f aph plots the current SML 4.50% Calculate Happy Corp.'s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by this analyst's prediction. Happy Corp.'s new required rate of return is CAPM Elements Value Risk-free rate (rR) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock 0.6 An analyst believes that inflation is going to increase .90 % over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The fol raph plots the current SML 0.30 0.48 raph, use the rectangle symbols to plot the new SML suggested by this analyst's Calculate Happy Corp. 's new required return. Then, prediction. Happy Corp.'s new required rate of return is Chapter 8 Assignment CAPM Elements Value Risk-free rate (RE) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock 10.64% % over the next year, while the market risk premium will be unchanged. The analyst An analyst believes that inflation is going to increas uses the Capital Asset Pricing Model (CAPM). The f 6.46%aph plots the current SML. 7,60% ph, use the rectangle symbols to plot the new SML suggested by this analyst's Calculate Happy Corp. 's new required return. Then, 9.50% prediction Happy Corp.'s new required rate of return is CAPM Elements Value Risk-free rate (RE) Market risk premium (RPM) Happy Corp. stock's beta Required rate of return on Happy Corp. stock An analyst believes that inflation is going to increase by 2.80 % over the next year, while the market risk premium will be unchanged. The analyst uses the Capital Asset Pricing Model (CAPM). The following graph plots the current SML Calculate Happy Corp.'s new required return. Then, on the graph, use the rectangle symbols to plot the new SML suggested by this analyst's prediction. Happy Corp.'s new required rate of return is 23.92% 10.40% 7.28% 20 11.44% New SML 16 (ue 20 New SML 14 18 12 18 20 RISK (Beta)