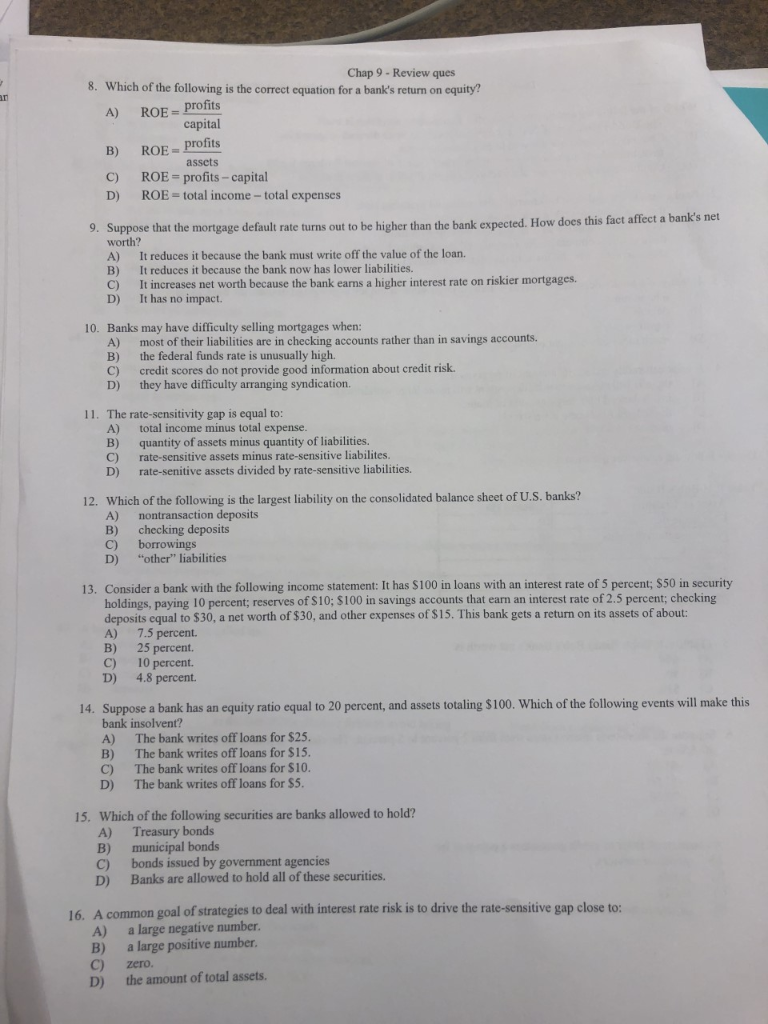

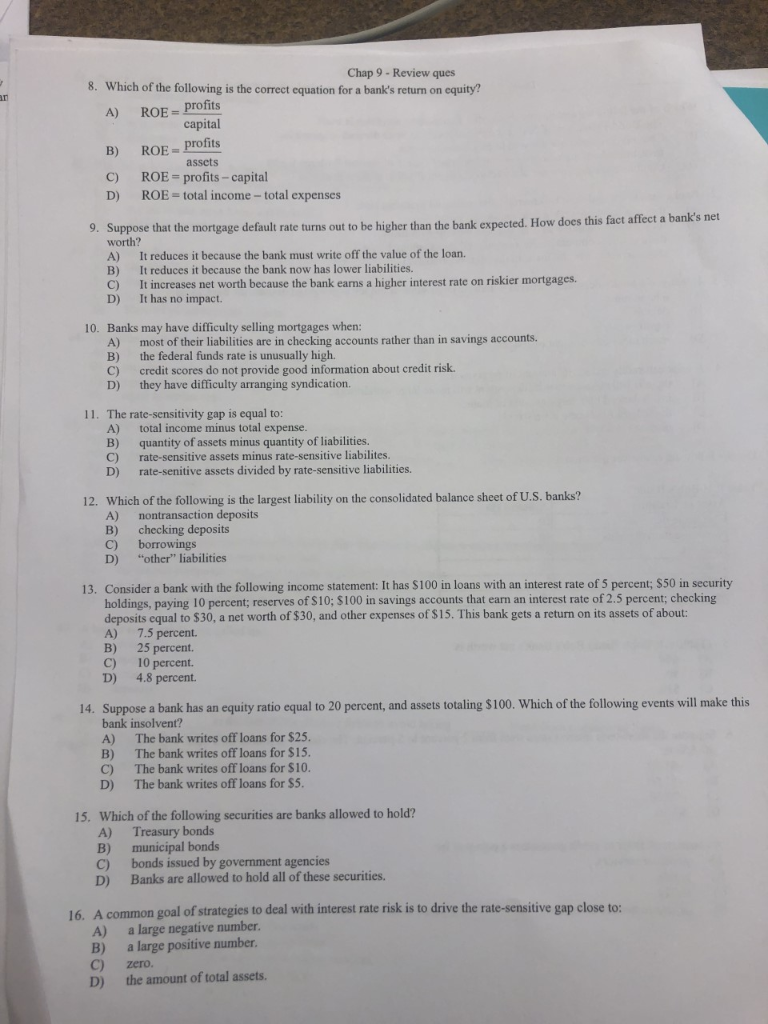

Chap 9- Review ques 8. Which of the following is the correct equation for a bank's return on cquity? ROE= Profits capital A) ROE profits assets B) ROE= profits- capital ROE= total income - total expenses C) D) 9. Suppose that the mortgage default rate turns out to be higher than the bank expected. How does this fact affect a bank's net worth? It reduces it because the bank must write off the value of the loan. It reduces it because the bank now has lower liabilities. It increases net worth because the bank eams a higher interest rate on riskier mortgages. It has no impact. B) C) D) 10. Banks may have difficulty selling mortgages when: most of their liabilities are in checking accounts rather than in savings accounts. the federal funds rate is unusually high. A) B) ation about credit risk. credit scores do not provide C) they have difficulty arranging syndication. D) 11. The rate-sensitivity gap is equal to: total income minus total expense. quantity of assets minus quantity of liabilities. rate-sensitive assets minus rate-sensitive liabilites. rate-senitive assets divided by rate-sensitive liabilities. A) B) C) D) 12. Which of the following is the largest liability on the consolidated balance sheet of U.S. banks? nontransaction deposits A) checking deposits borrowings "other" liabilities B) C) D) 13. Consider a bank with the following income statement: It has $100 in loans with an interest rate of 5 percent; $50 in security savings accounts that earn an interest rate of 2.5 percent; checking holdings, paying 10 percent; reserves of $10; $100 deposits equal to $30, a net worth of $30, and other expenses of $15. This bank gets a return on its assets of about: 7.5 percent. B) A) 25 percent. 10 percent. 4.8 percent. C) D 14. Suppose a bank has an equity ratio equal to 20 percent, and assets totaling $100. Which of the following events will make this bank insolvent? A) The bank writes off loans for $25. The bank writes off loans for $15. The bank writes off loans for $10. The bank writes off loans for $5. Bl C) D 15. Which of the following securities are banks allowed to hold? Treasury bonds A) municipal bonds B) bonds issued by government agencies C) Banks are allowed to hold all of these securities. D) 16. A common goal of strategies to deal with interest rate risk is to drive the rate-sensitive gap close to: large negative number A) large positive number. B) zero. the amount of to tal assets. C) D) aca