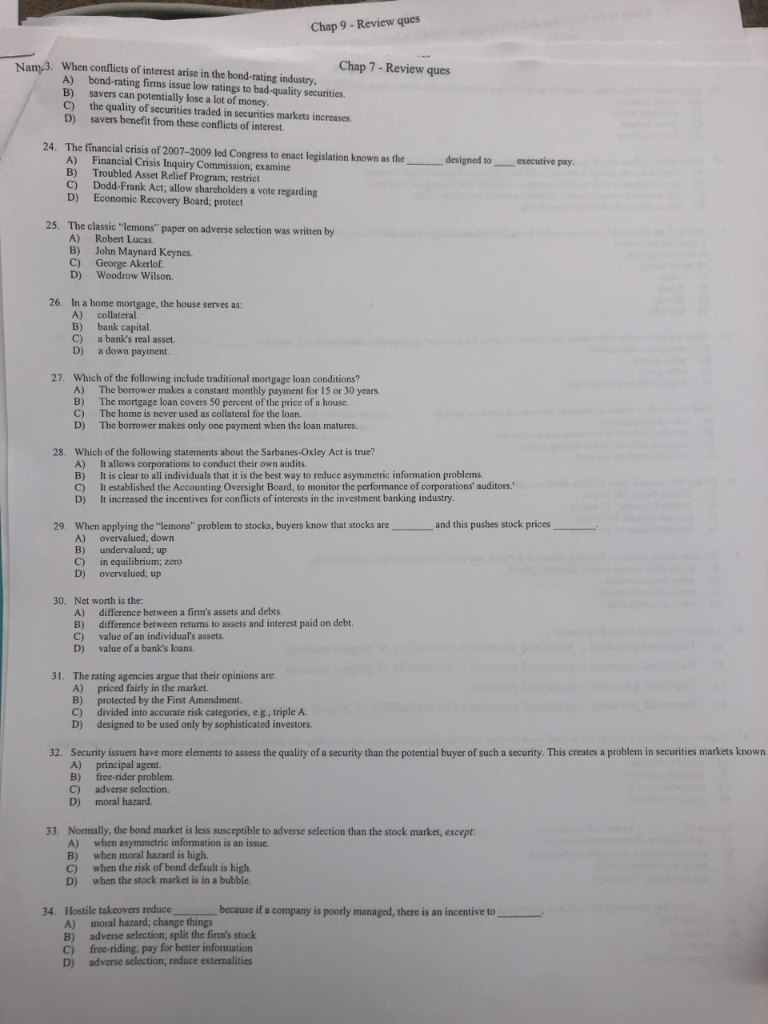

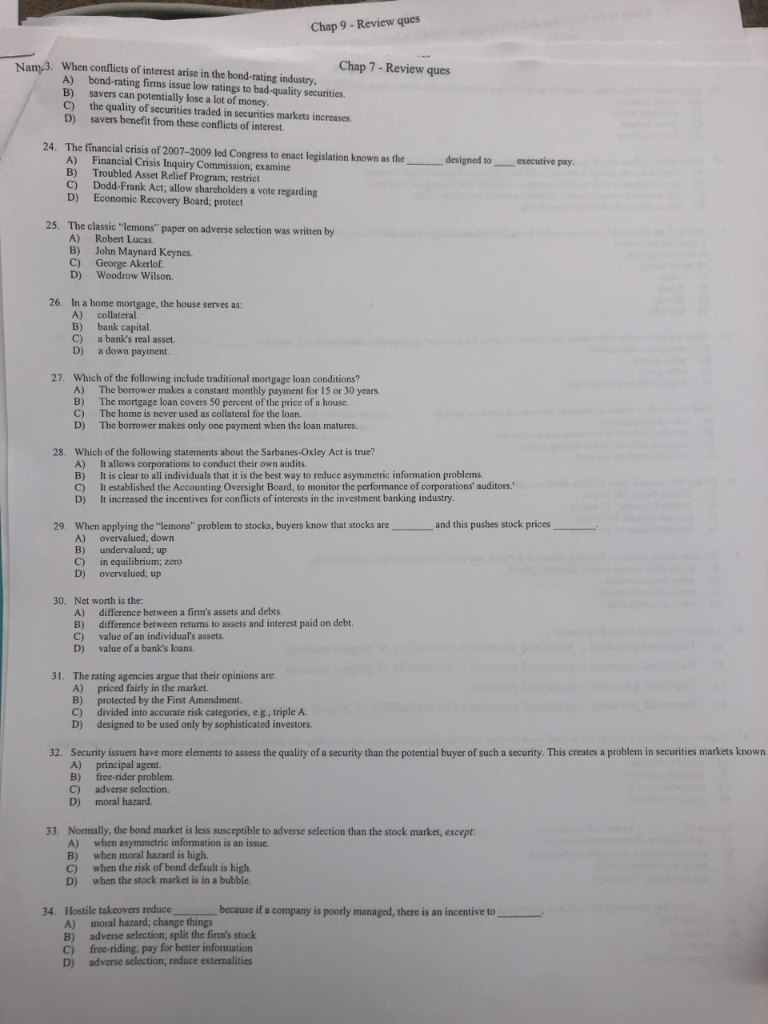

Chap 9- Review ques Chap 7- Review ques Nam-3. When conflicts of interest arise in the bond-rating industry. savers can ns issue low ratings to bad-quality securities. BY ot of moncy. C the quality of securiti arkets increases D savers benefit from these conflicts of interest. 24. The financial crisis of 2007-2009 led Congress to enact legislation known as the Troubled Asset Commission; examine BY C) Dodd-Frank Act; allow sharcholders a vote regarding D) Economic Recovery Board; protect designed to executive pay. 25. cla Beb paper on adverse selection was written by A) B) John Maynard Keynes. CY George Akerlof. Woodrow Wilson. DY 26. In a home mortgage, the house serves as A) collateral B) bank capital. eal asset ayment. d 27. Which of the following include traditional mortgage loan conditions? The borrower makes a constant monthly payment for 15 or 30 years A) of a house. The home is never used as collaterl for the loan C) D) The borrower makes only one payment when the loan matures. Which of the following statements about the Sarbanes-Oxley Act is true? It allowa indiriduale that is is ch b ts It established the Accounting Oversight Board, to monitor the performance of corporations' auditors. 28. o reduce asymmetric information problems. C) It increased the incentives for conflicts of interests in the investment banking industry. D) and this pushes stock prices mons" problem to stocks, buyers know that stocks are 29 When appued down undervalued; up B) in equilibrium; zero C) D overvalued; up 30. Net worth is the: difference between a firm's assets and debts. A) B) ditference between returns to assets and interest paid on debt. ass value of a bank's loans D The rating agencies argue that their opinions are: priced fairly in the market. 31. A) endment divided into accurate risk categories, e.g., triple A designed to be used only by sophisticated investors. C D 32. Security issuers have more elements assess the quality of a security than the potential buyer of such a security. This creates a problem in securities markets known free-rider problem C) adverse selection. moral hazard. D adverse selection than the stock market, except 33. Nomaly,e iformation is an issue. when moral hazard is high B) when the risk of bond default is high. C) when the stock market is in a bubble. DI 34. Hostile takeovers reduce because if a company is poorly managed, there is n incentive to moral a A) o split the firm's stock free-riding; pay for better information Ci adverse selection; reduce externalities DI SRa0 ca zaca 06 #zao 8