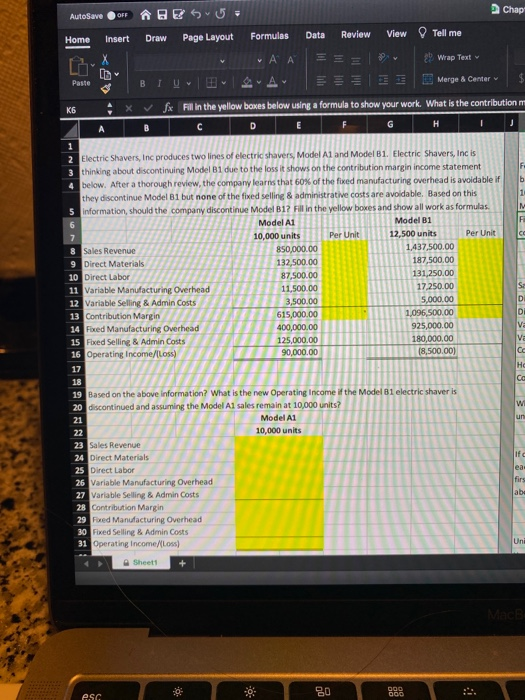

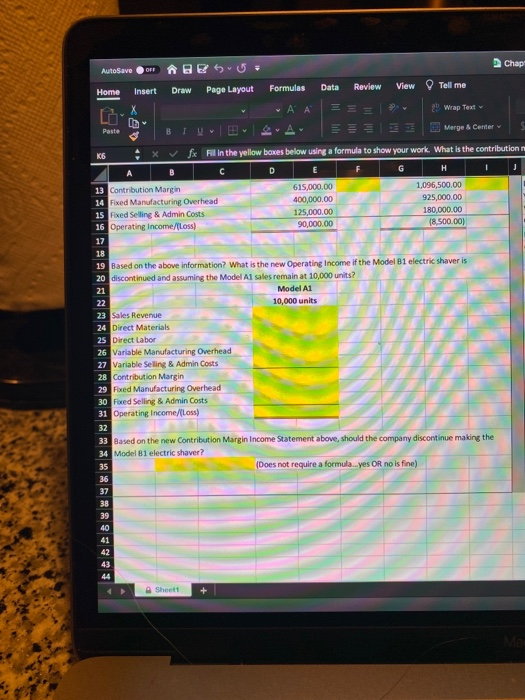

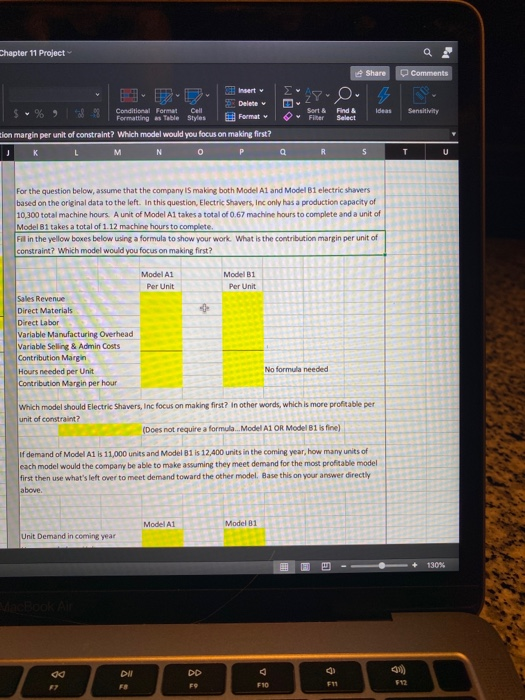

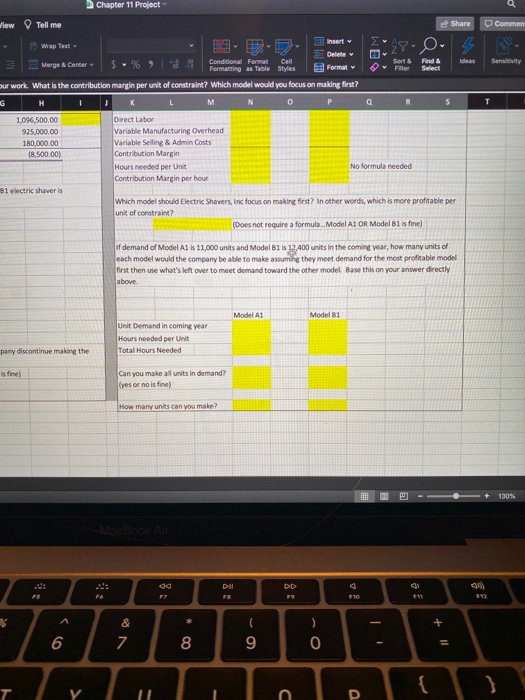

Chap AutoSave OFF EU Insert Draw Home Page Layout Formulas Data Review View Tell me E SE Wrap Text th ID ilil | Paste Merge & Center K6 fx Fill in the yellow boxes below using a formula to show your work. What is the contribution A B E H I D IF b M F CC S D D VE va 1 2 Electric Shavers, Inc produces two lines of electric shavers, Model A1 and Model B1. Electric Shavers, Inc is 3 thinking about discontinuing Model B1 due to the loss it shows on the contribution margin income statement 4 below. After a thorough review, the company learns that 60% of the fixed manufacturing overhead is avoidable if they discontinue Model B1 but none of the fixed selling & administrative costs are avoidable. Based on this 5 Information, should the company discontinue Model B12 Fill in the yellow boxes and show all work as formulas. 6 Model Ai Model B1 10,000 units Per Unit 12,500 units Per Unit 8 Sales Revenue 850,000.00 1.437,500.00 9 Direct Materials 132,500.00 187,500.00 10 Direct Labor 87,500.00 131,250.00 11 Variable Manufacturing Overhead 11,500.00 17.250.00 12 Variable Selling & Admin Costs 3,500.00 5,000.00 13 Contribution Margin 615,000.00 1,096,500.00 14 Fixed Manufacturing Overhead 400,000.00 925,000.00 15 Fixed Selling & Admin Costs 125,000.00 180,000.00 16 Operating Income/(Loss) 90,000.00 18,500.00) 17 18 19 Based on the above information? What is the new Operating Income if the Model B1 electric shaver is 20 discontinued and assuming the Model A1 sales remain at 10,000 units? 21 Model A1 22 10,000 units 23 Sales Revenue 24 Direct Materials 25 Direct Labor 26 Variable Manufacturing Overhead 27 Variable Selling & Admin Costs 28 Contribution Margin 29 Red Manufacturing Overhead 30 Fixed Selling & Admin Costs 31 Operating Income/(Loss) THO CE W un If ea: abe Une Sheet BO esc Chap AutoSave OR BEST Home Insert Draw Page Layout X Formulas Data Review View Tell me A A === 2 Wrap Text Paste Merge & Center K6 x fx Fil in the yellow boxes below using a formula to show your work. What is the contribution D G H 13 Contribution Margin 615,000.00 1,096,500.00 14 Fixed Manufacturing Overhead 400,000.00 925,000.00 15 Fixed Selling & Admin Costs 125,000.00 180,000.00 16 Operating Income/(Loss) 90,000.00 18.500.00) 17 18 19 Based on the above information? What is the new Operating Income if the Model B1 electric shaver is 20 discontinued and assuming the Model Al sales remain at 10,000 units? 21 Model A1 22 10,000 units 23 Sales Revenue 24 Direct Materials 25 Direct Labor 26 Variable Manufacturing Overhead 27 Variable Selling & Admin Costs 28 Contribution Margin 29 Fixed Manufacturing Overhead 30 Foed Selling & Admin Costs 31 Operating Income/(Loss) 32 33 Based on the new Contribution Margin Income Statement above, should the company discontinue making the 34 Model B1 electric shaver? 35 (Does not require a formula...yes OR no is fine) 36 37 38 39 40 41 42 43 44 Sheet1 Chapter 11 Project Share Comments 28-O. 4 Sort & Filter Find & Select Ideas Sensitivity 38Insert Delete Conditional Format Cell Formatting as Table Styles Format sion margin per unit of constraint? Which model would you focus on making first? M N 0 R 5 T U For the question below, assume that the company is making both Model A1 and Model B1 electric shavers based on the original data to the left. In this question, Electric Shavers, Inc only has a production capacity of 10,300 total machine hours. A unit of Model Al takes a total of 0.67 machine hours to complete and a unit of Model B1 takes a total of 1.12 machine hours to complete. Fil in the yellow boxes below using a formula to show your work. What is the contribution margin per unit of constraint? Which model would you focus on making first? Model A1 Per Unit Model B1 Per Unit Sales Revenue Direct Materials Direct Labor Variable Manufacturing Overhead Variable Selling & Admin Costs Contribution Margin Hours needed per Unit Contribution Margin per hour No formula needed Which model should Electric Shavers, Inc focus on making first? In other words, which is more profitable per unit of constraint? (Does not require a formula... Model A1 OR Model B1 is fine) of demand of Model A1 is 11,000 units and Model B1 is 12,400 units in the coming year, how many units of each model would the company be able to make assuming they meet demand for the most profitable model first then use what's left over to meet demand toward the other model. Base this on your answer directly above Model A1 Model B1 Unit Demand in coming year 130% DD 28 DI F8 F9 FIO F11 512 Chapter 11 Project View Tell me Share Commen 28.0 Sort & Ideas Sensitivity T Insert Wrap Teal Delete Merge Center Conditional Format Cell Find Formatting as Table Styles Format Filter Select our work. What is the contribution margin per unit of constraint? Which model would you focus on making first? G H M N 0 P R 1,096,500.00 Direct Labor 925,000.00 Variable Manufacturing Overhead 180,000.00 Variable Selling & Admin Costs 18,500.00) Contribution Margin Hours needed per Unit No formula needed Contribution Margin per hour B1 electric shaver is Which model should Electric Shavers, Inc focus on making first? In other words, which is more profitable per unit of constraint? (Does not require a formula...Model A1 OR Model B1 is fine) If demand of Model A1 is 11,000 units and Model B1 is 12,400 units in the coming year, how many units of each model would the company be able to make assuming they meet demand for the most profitable model first then use what's left over to meet demand toward the other model. Base this on your answer directly above Model A1 Model B1 Unit Demand in coming year Hours needed per Unit Total Hours Needed pany discontinue making the is fine) Can you make all units in demand? yes or no is fine) How many units can you make? 130% pu DD F 710 511 + & 7 ( 9 ) 0 6 8 {} T Y 1 C P