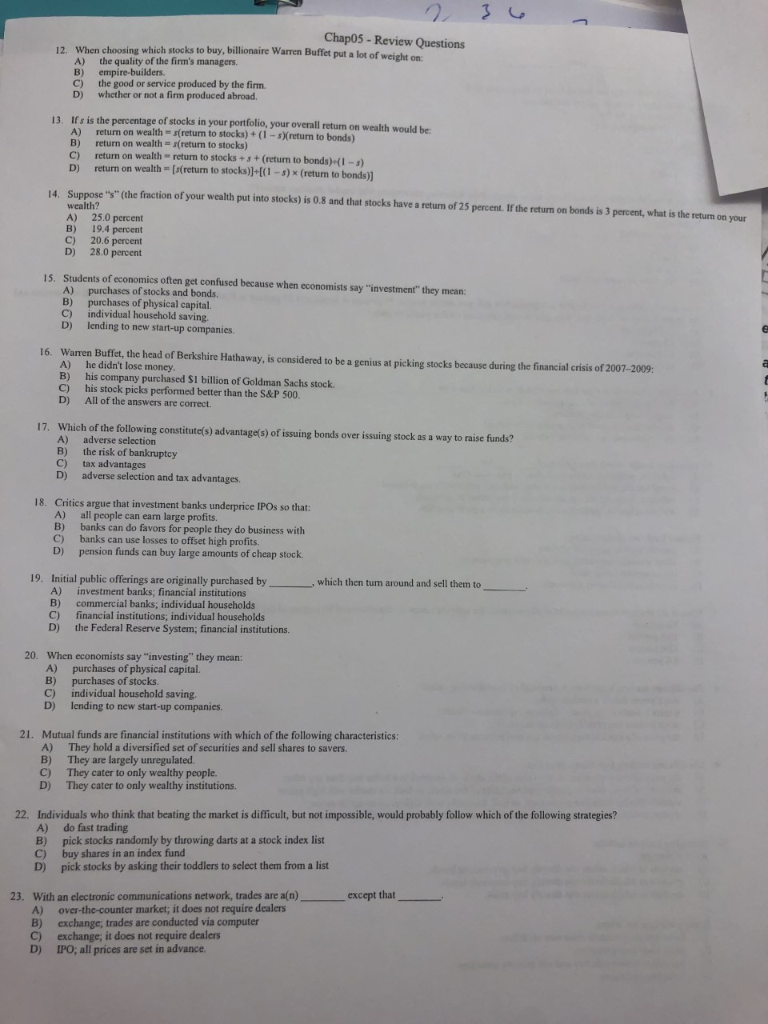

Chap05- Review Questions Ilionaire Warren Buffet put a lot of weight on 12. When the quality of the firm's managers B) empire-builders. duced by the firm. road whether D) Ifs is the percentage 13. stocks in your portfolio, your overall return wealth would be stocks) + (1-s)(return to bonds) relurn on wealth s(return return on wealth return to stocks +s+(retun to bonds)e C return on wealth [s(return to stocks)]+[(1-s) x (return to bonds)l D (the fraction of your wealth put into stocks) is 0.8 and that stocks have a return of 25 percent. If the retun on bonds is 3 percent, what is the return on your 14. se wealth? A) 25.0 percent 19.4 percent B) 28.0 percent D 1S. Students of economics often get confused because when economists say "investment" they mean tocks and bonds. uch B) individual household saving, C) lending to new start-up companies. D) 16. Warren Buffet A) he didn't lose of Berkshire Hathaway, is considered to be a genius at picking stocks because during the financial crisis of 2007-2009: B) his company purchased SI billion of Goldman Sachs stock his stock picks performed better than the S&P 500. All of the answers are correct 17. Which of the following constitute(s) advantage(s) of issuing bonds over issuing stock as a way to raise funds? A) adverse selection the risk of bankruptcy tax advantages election and tax advantages. 18. Critics argue that investment banks underprice IPOS so that: A all people can earn large profits banks can do favors for people they do business with pension funds can buy large amounts of chean stock DI Initial public offerings are originally purchased by nvestment banks; financial institutions 19. which then tum around and sell them to C D financial institutions; individual households the Federal Reserve System; financial institutions. When economists say "investing" they mean: 20. l capital. purchases of stocks B) individual household saving. C) lending to new start-up companies. D) on with which of the following characteristics: f securities 21 Mutu They boldd to savers They are largely unregulated They cater to only wealthy people. They cater to only wealthy institutions. B) C D 22. Individ that beating the market is difficult, but not impossible, would probably follow which of the following strategies? pick stocks randomly by throwing darts BI t a stock index list C) buy shares an index fund pick stocks by asking their toddlers to select them from a list DI With an electronic communications network, trades are a(n) over-the-counter market; it does not require dealers exchange, trades are conducis except that 23. A computer IPO; all prices are set in advance. D) 00 WRoa Chap05- Review Questions Ilionaire Warren Buffet put a lot of weight on 12. When the quality of the firm's managers B) empire-builders. duced by the firm. road whether D) Ifs is the percentage 13. stocks in your portfolio, your overall return wealth would be stocks) + (1-s)(return to bonds) relurn on wealth s(return return on wealth return to stocks +s+(retun to bonds)e C return on wealth [s(return to stocks)]+[(1-s) x (return to bonds)l D (the fraction of your wealth put into stocks) is 0.8 and that stocks have a return of 25 percent. If the retun on bonds is 3 percent, what is the return on your 14. se wealth? A) 25.0 percent 19.4 percent B) 28.0 percent D 1S. Students of economics often get confused because when economists say "investment" they mean tocks and bonds. uch B) individual household saving, C) lending to new start-up companies. D) 16. Warren Buffet A) he didn't lose of Berkshire Hathaway, is considered to be a genius at picking stocks because during the financial crisis of 2007-2009: B) his company purchased SI billion of Goldman Sachs stock his stock picks performed better than the S&P 500. All of the answers are correct 17. Which of the following constitute(s) advantage(s) of issuing bonds over issuing stock as a way to raise funds? A) adverse selection the risk of bankruptcy tax advantages election and tax advantages. 18. Critics argue that investment banks underprice IPOS so that: A all people can earn large profits banks can do favors for people they do business with pension funds can buy large amounts of chean stock DI Initial public offerings are originally purchased by nvestment banks; financial institutions 19. which then tum around and sell them to C D financial institutions; individual households the Federal Reserve System; financial institutions. When economists say "investing" they mean: 20. l capital. purchases of stocks B) individual household saving. C) lending to new start-up companies. D) on with which of the following characteristics: f securities 21 Mutu They boldd to savers They are largely unregulated They cater to only wealthy people. They cater to only wealthy institutions. B) C D 22. Individ that beating the market is difficult, but not impossible, would probably follow which of the following strategies? pick stocks randomly by throwing darts BI t a stock index list C) buy shares an index fund pick stocks by asking their toddlers to select them from a list DI With an electronic communications network, trades are a(n) over-the-counter market; it does not require dealers exchange, trades are conducis except that 23. A computer IPO; all prices are set in advance. D) 00 WRoa