chap6 3

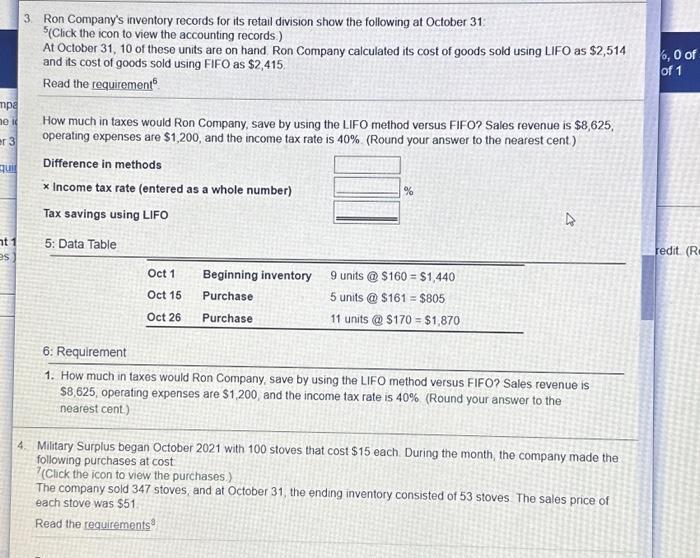

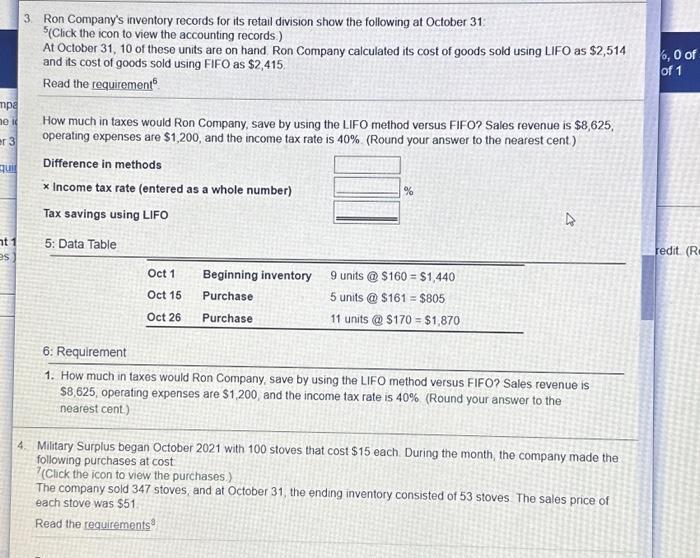

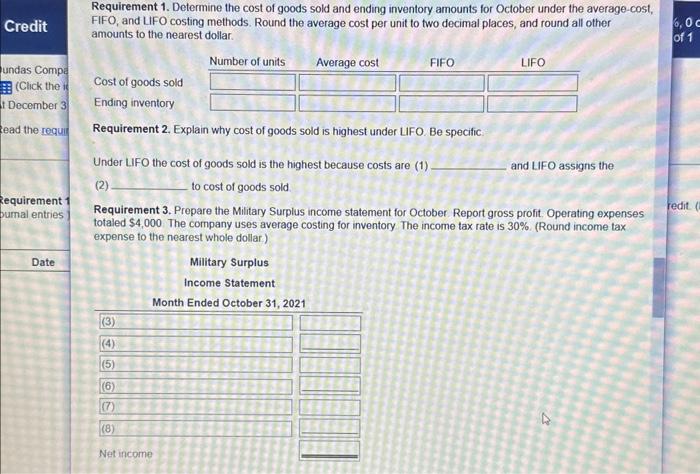

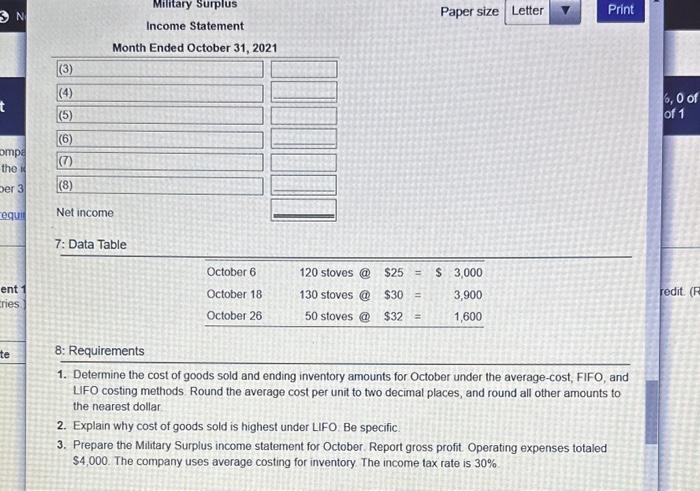

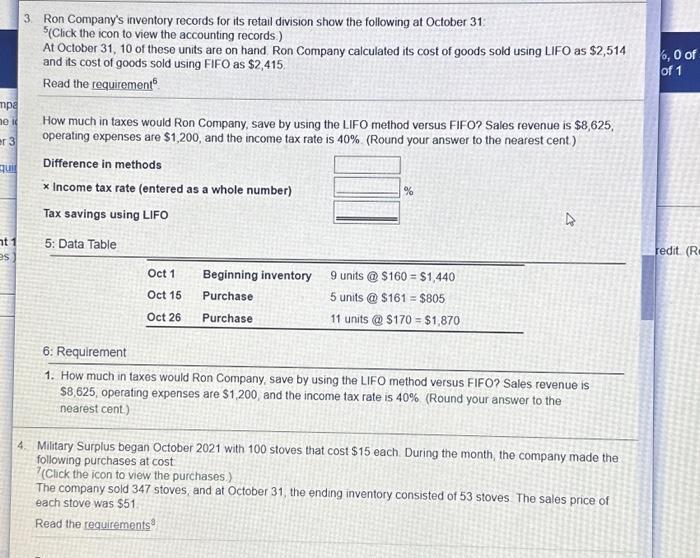

Requirement 1. Determine the cost of goods sold and ending inventory amounts for October under the average-cost, FIFO, and LIFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar. Requirement 2. Explain why cost of goods sold is highest under UFO. Be specific: Under LIFO the cost of goods sold is the highest because costs are (1) and LIFO assigns the (2) to cost of goods sold Requirement 3. Prepare the Military Surplus income statement for October. Report gross profit. Operating expenses totaled \\( \\$ 4,000 \\) The company uses average costing for inventory The income tax rate is \30. (Round income tax expense to the nearest whole dollar) 1. Determine the cost of goods sold and ending inventory amounts for October under the average-cost, FIFO, and LFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar 2. Explain why cost of goods sold is highest under LIFO Be specific. 3. Prepare the Military Surplus income statement for October. Report gross profit Operating expenses totaled \\( \\$ 4,000 \\). The company uses average costing for inventory. The income tax rate is \30 3. Ron Company's inventory records for its retail division show the following at October 31 : \\( { }^{5} \\) (Click the icon to view the accounting records) At October 31, 10 of these units are on hand. Ron Company calculated its cost of goods sold using LIFO as \\( \\$ 2,514 \\) and its cost of goods sold using FIFO as \\( \\$ 2,415 \\) Read the requirement \\( { }^{6} \\) How much in taxes would Ron Company, save by using the LIFO method versus FIFO? Sales revenue is \\( \\$ 8,625 \\). operating expenses are \\( \\$ 1,200 \\), and the income tax rate is \40. (Round your answer to the nearest cent) 6: Requirement 1. How much in taxes would Ron Company, save by using the LIFO method versus FIFO? Sales revenue is \\( \\$ 8,625 \\), operating expenses are \\( \\$ 1,200 \\), and the income tax rate is \40 (Round your answer to the nearest cent.) Military Surplus began October 2021 with 100 stoves that cost \\( \\$ 15 \\) each. During the month, the company made the following purchases at cost (Click the icon to view the purchases) The company sold 347 stoves, and at October 31 , the ending inventory consisted of 53 stoves. The sales price of each stove was \\( \\$ 51 \\) Read the requirements \\( { }^{3} \\) Requirement 1. Determine the cost of goods sold and ending inventory amounts for October under the average-cost, FIFO, and LIFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar. Requirement 2. Explain why cost of goods sold is highest under UFO. Be specific: Under LIFO the cost of goods sold is the highest because costs are (1) and LIFO assigns the (2) to cost of goods sold Requirement 3. Prepare the Military Surplus income statement for October. Report gross profit. Operating expenses totaled \\( \\$ 4,000 \\) The company uses average costing for inventory The income tax rate is \30. (Round income tax expense to the nearest whole dollar) 1. Determine the cost of goods sold and ending inventory amounts for October under the average-cost, FIFO, and LFO costing methods. Round the average cost per unit to two decimal places, and round all other amounts to the nearest dollar 2. Explain why cost of goods sold is highest under LIFO Be specific. 3. Prepare the Military Surplus income statement for October. Report gross profit Operating expenses totaled \\( \\$ 4,000 \\). The company uses average costing for inventory. The income tax rate is \30 3. Ron Company's inventory records for its retail division show the following at October 31 : \\( { }^{5} \\) (Click the icon to view the accounting records) At October 31, 10 of these units are on hand. Ron Company calculated its cost of goods sold using LIFO as \\( \\$ 2,514 \\) and its cost of goods sold using FIFO as \\( \\$ 2,415 \\) Read the requirement \\( { }^{6} \\) How much in taxes would Ron Company, save by using the LIFO method versus FIFO? Sales revenue is \\( \\$ 8,625 \\). operating expenses are \\( \\$ 1,200 \\), and the income tax rate is \40. (Round your answer to the nearest cent) 6: Requirement 1. How much in taxes would Ron Company, save by using the LIFO method versus FIFO? Sales revenue is \\( \\$ 8,625 \\), operating expenses are \\( \\$ 1,200 \\), and the income tax rate is \40 (Round your answer to the nearest cent.) Military Surplus began October 2021 with 100 stoves that cost \\( \\$ 15 \\) each. During the month, the company made the following purchases at cost (Click the icon to view the purchases) The company sold 347 stoves, and at October 31 , the ending inventory consisted of 53 stoves. The sales price of each stove was \\( \\$ 51 \\) Read the requirements \\( { }^{3} \\)