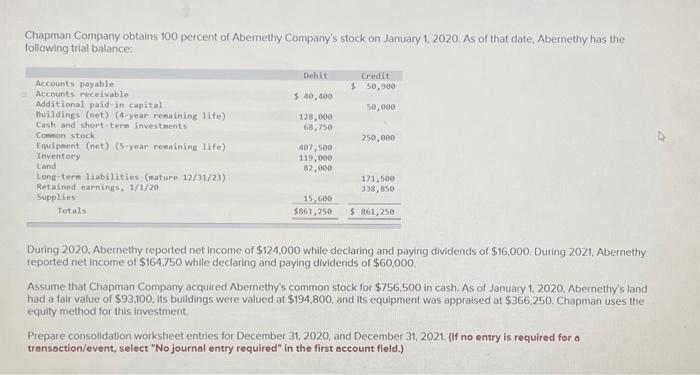

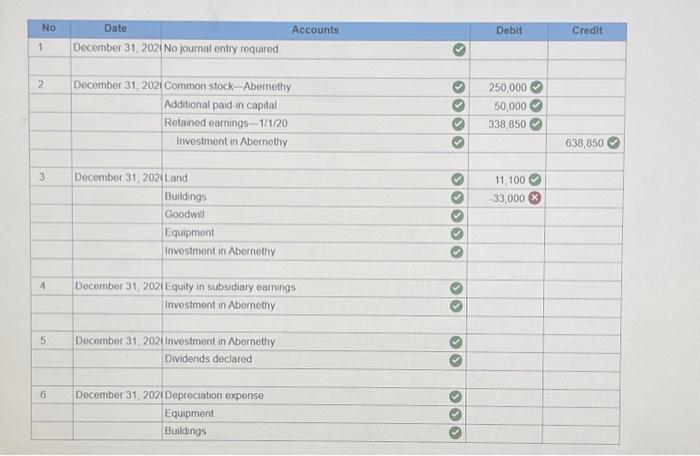

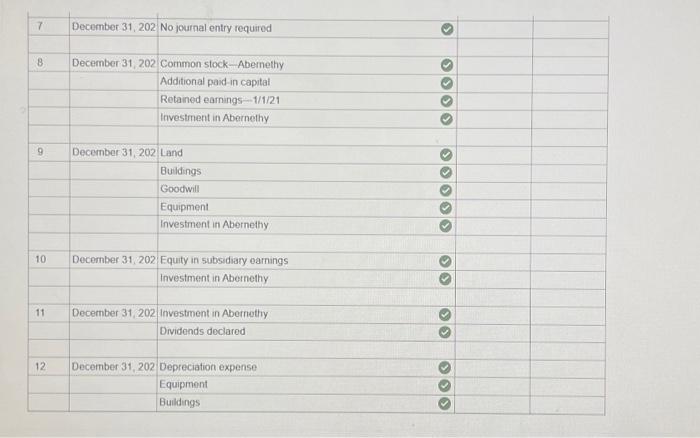

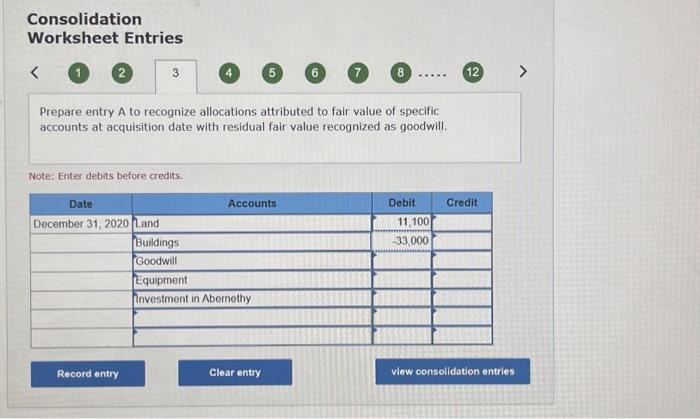

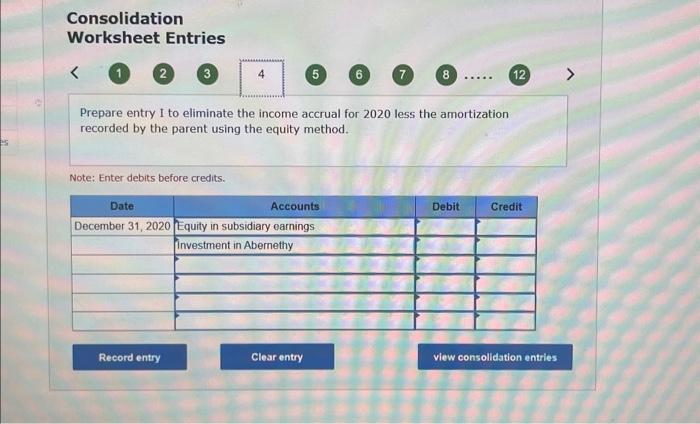

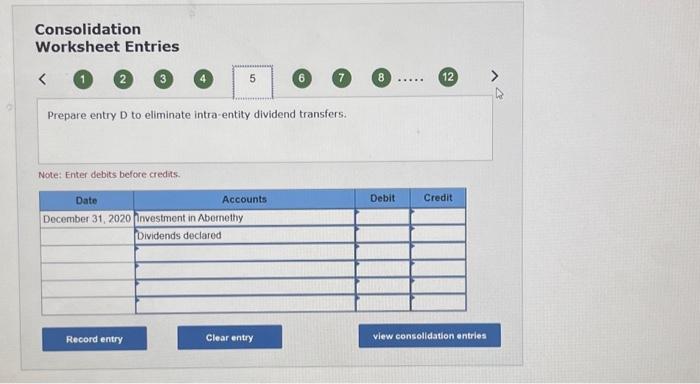

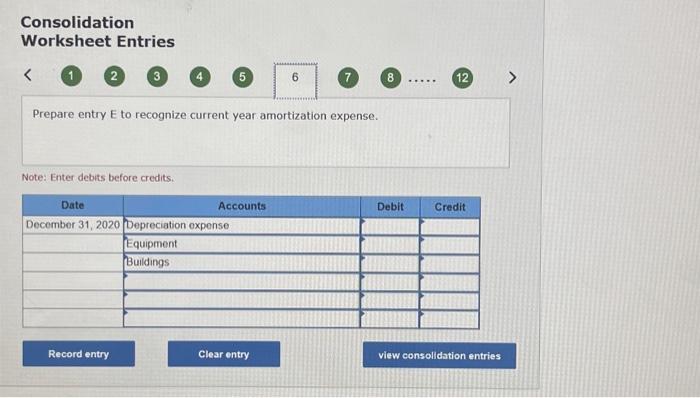

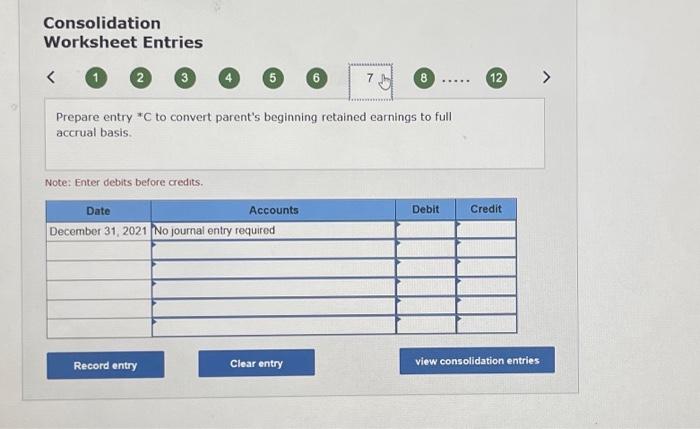

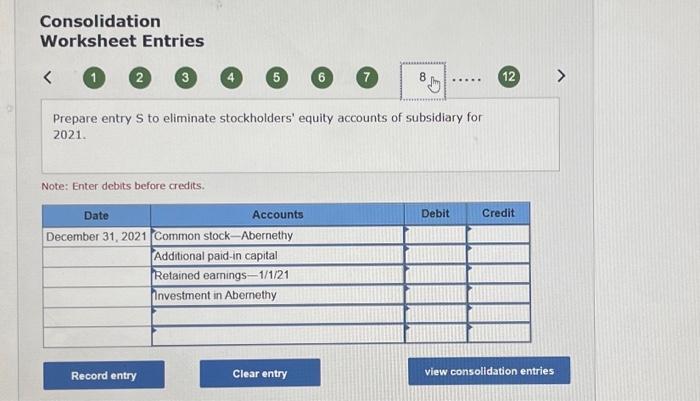

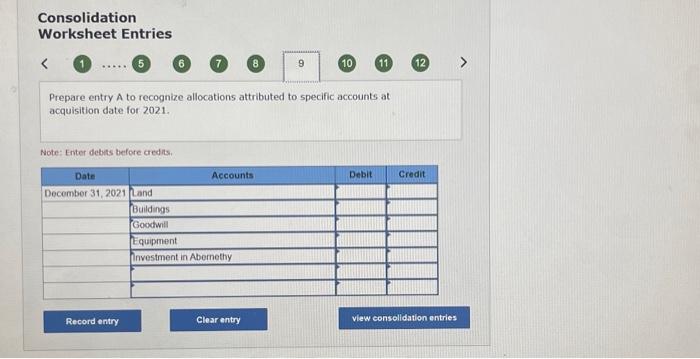

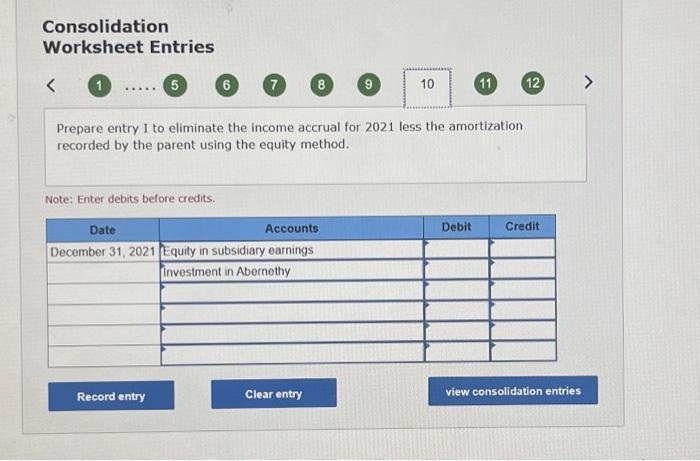

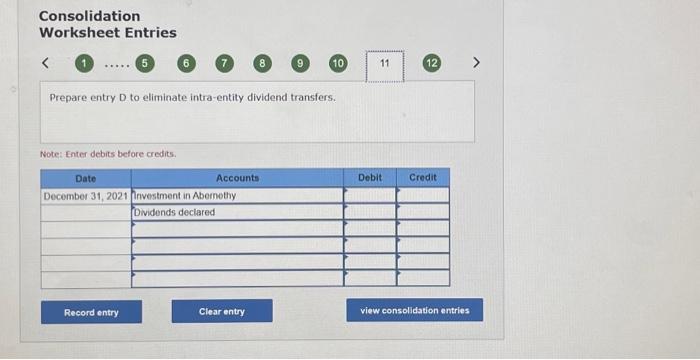

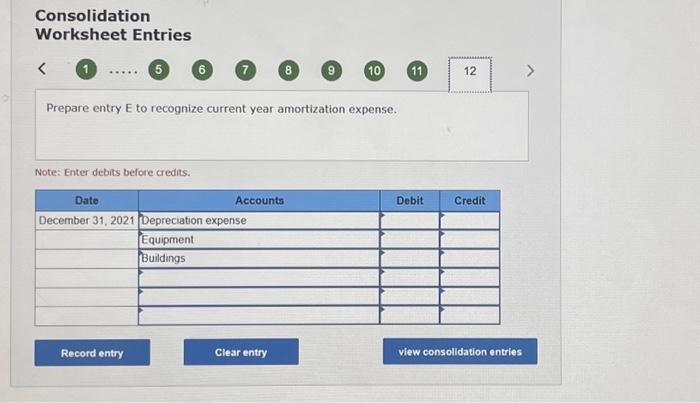

Chapman Company obtains 100 percent of Abemethy Company's stock on January 1, 2020. As of that date, Abernethy has the following trial balance: During 2020, Abemethy reported net income of $124,000 while declaring and paying dividends of $16,000. During 2021, Abernethy reported net income of $164,750 while declaring and paying dividends of $60,000. Assume that Chapman Company acquired Abemethy's common stock for $756,500 in cash. As of January 1, 2020, Abernethy's land had a fair value of $93,100, its buildings were valued at $194,800, and its equipment was appraised at $366,250. Chapman uses the equity method for this investment. Prepare consolldation worksheet entries for December 31, 2020, and December 31, 2021. (If no entry is required for a transection/event, select "No journal entry required" in the first account field.) Consolidation Worksheet Entries 1 2 3 (4. 5 8 Prepare entry C to convert parent's beginning retained earnings to full accrual basis. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry D to eliminate intra-entity dividend transfers. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry $ to eliminate stockholders' equity accounts of subsidiary for 2021. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry D to eliminate intra-entity dividend transfers. Note: Enter debits before credits. Consolidation Worksheet Entries 1. (6) 7 8 12 Prepare entry I to eliminate the income accrual for 2020 less the amortization recorded by the parent using the equity method. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry A to recognize allocations attributed to specific accounts at acquisition date for 2021 . Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry E to recognize current year amortization expense. Note: Enter debits before credits. Consolidation Worksheet Entries (1) 2 3 (4) 7 Prepare entry E to recognize current year amortization expense. Note: Enter debits before credits. Consolidation Worksheet Entries Prepare entry 1 to eliminate the income accrual for 2021 less the amortization recorded by the parent using the equity method. Note: Enter debits before credits