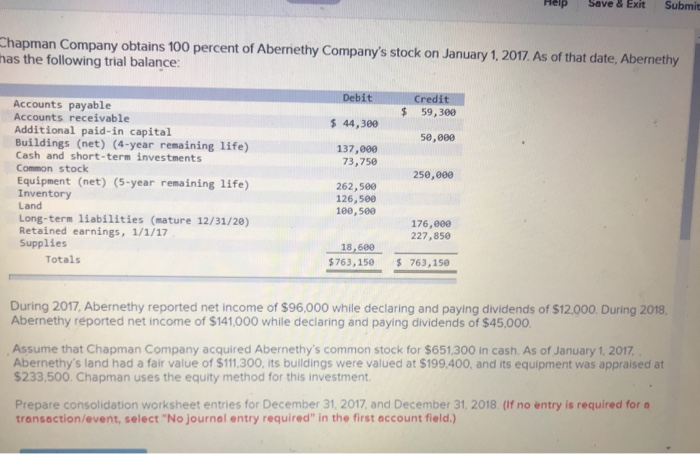

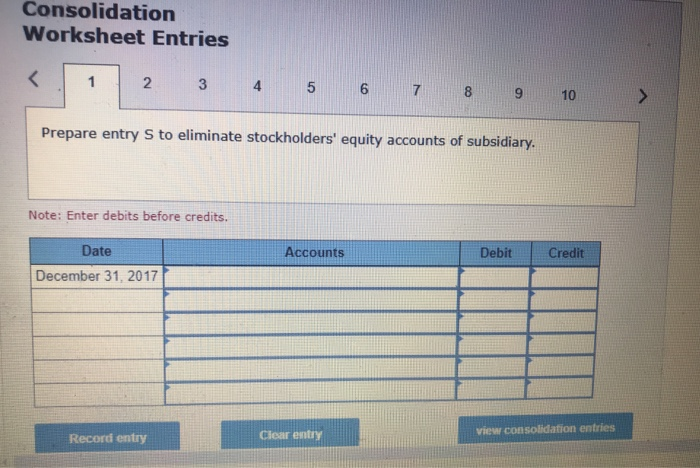

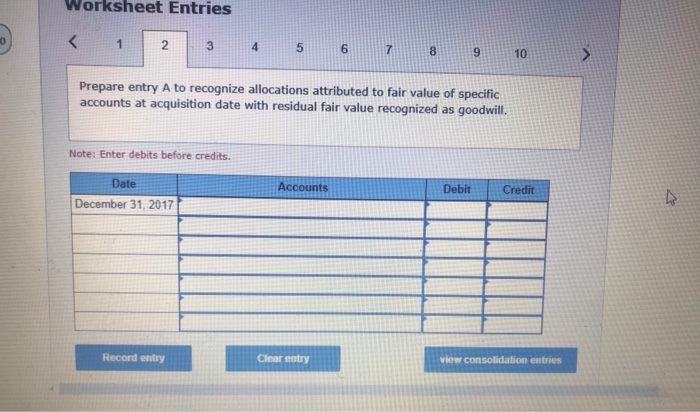

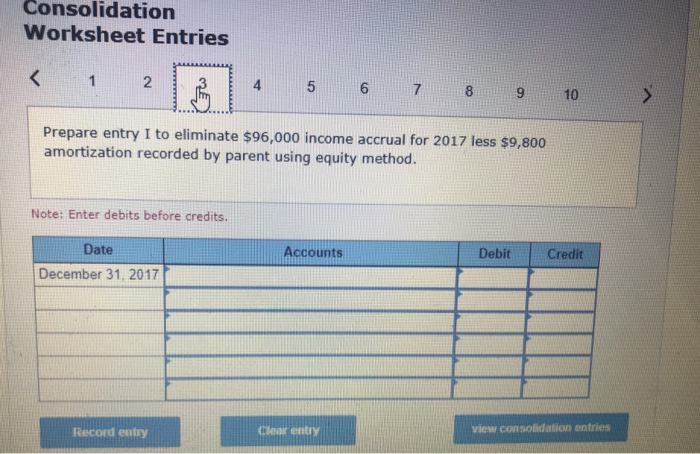

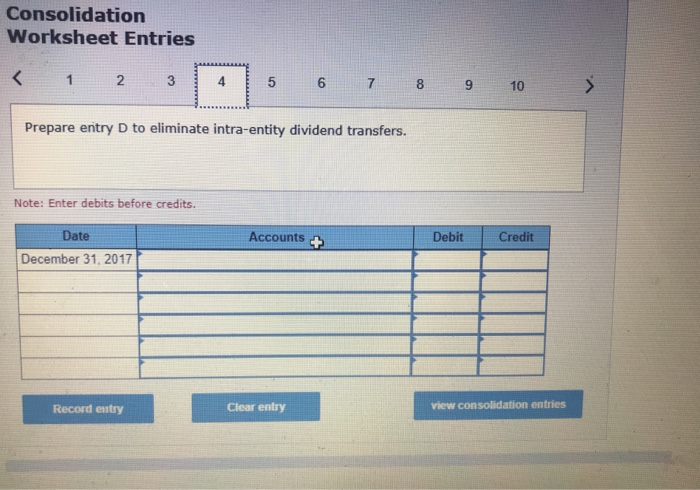

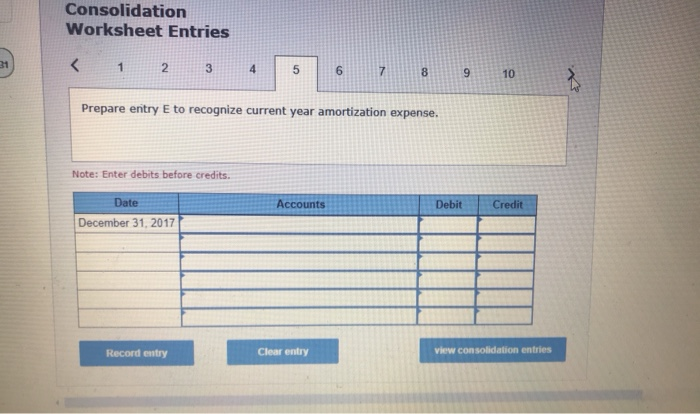

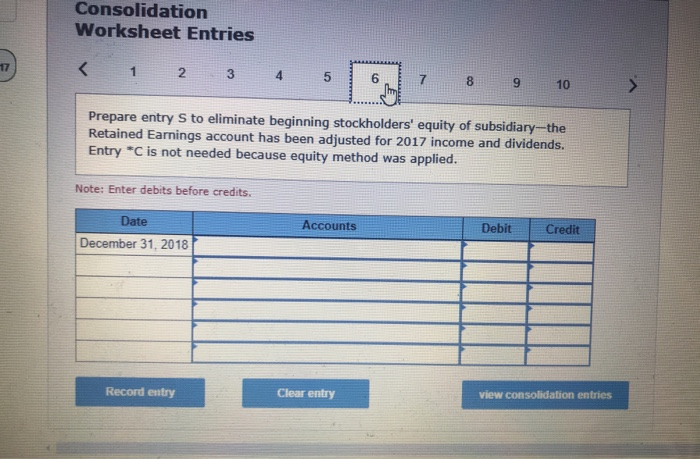

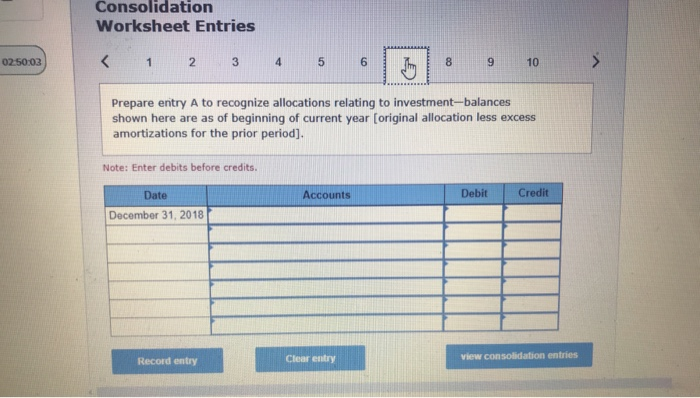

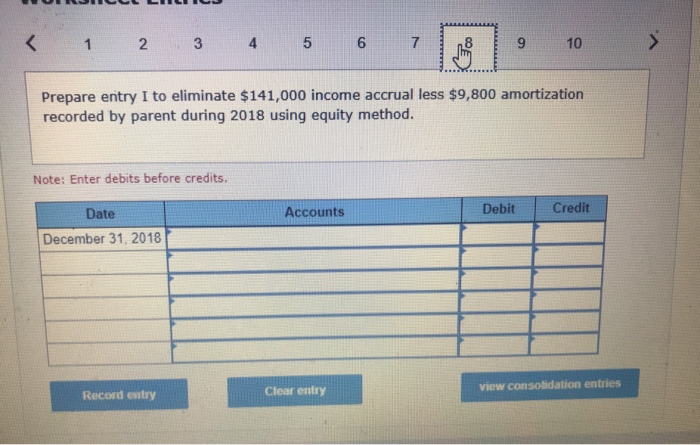

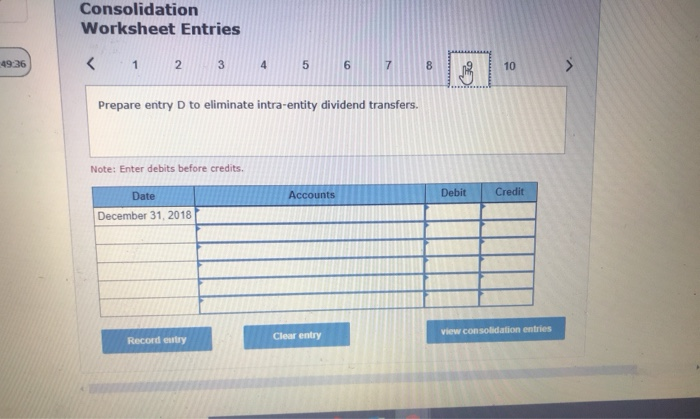

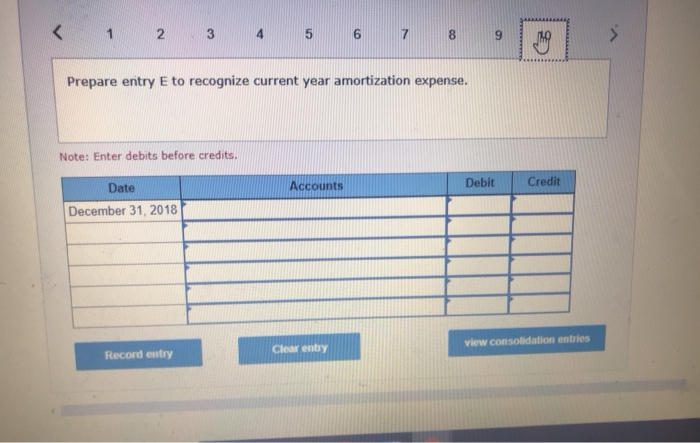

Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that date, Abernethy as the following trial balance: Debit Credit 59,300 $ $ 44,380 50,000 137,000 73,750 250,000 Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year remaining life) Cash and short-term investments Common stock Equipment (net) (5-year remaining life) Inventory Land Long-term liabilities (mature 12/31/20) Retained earnings, 1/1/17 Supplies Totals 262,500 126,500 100, 500 176,000 227,85e 18,600 $763,150 $763,150 During 2017. Abernethy reported net income of $96,000 while declaring and paying dividends of $12,000. During 2018, Abernethy reported net income of $141,000 while declaring and paying dividends of $45,000. Assume that Chapman Company acquired Abernethy's common stock for $651,300 in cash. As of January 1, 2017 Abernethy's land had a fair value of $111.300, its buildings were valued at $199.400, and its equipment was appraised at $233,500. Chapman uses the equity method for this investment. Prepare consolidation worksheet entries for December 31, 2017 and December 31, 2018. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) Consolidation Worksheet Entries Prepare entry S to eliminate stockholders' equity accounts of subsidiary. Note: Enter debits before credits. Accounts Debit Credit Date December 31, 2017 view consolidation entries Record entry Clear entry Worksheet Entries 2 3 4 5 5 6 7 8 9 10 > Prepare entry A to recognize allocations attributed to fair value of specific accounts at acquisition date with residual fair value recognized as goodwill. Note: Enter debits before credits. Accounts Debit Credit Date December 31, 2017 Record entry Clear entry view consolidation entries Consolidation Worksheet Entries Prepare entry I to eliminate $96,000 income accrual for 2017 less $9,800 amortization recorded by parent using equity method. Note: Enter debits before credits. Accounts Debit Credit Date December 31, 2017 Record entry Clear entry view consolidation entries Consolidation Worksheet Entries Prepare entry S to eliminate beginning stockholders' equity of subsidiary--the Retained Earnings account has been adjusted for 2017 income and dividends. Entry "C is not needed because equity method was applied. Note: Enter debits before credits. Accounts Debit Credit Date December 31, 2018 Record entry Clear entry View consolidation entries Consolidation Worksheet Entries 02:50:03