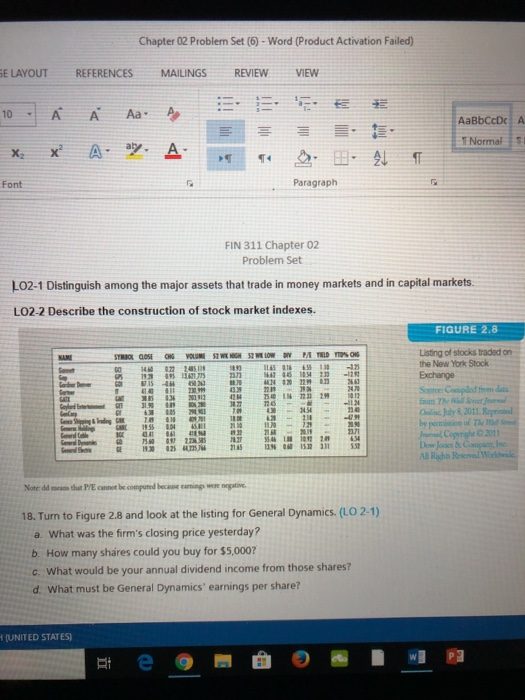

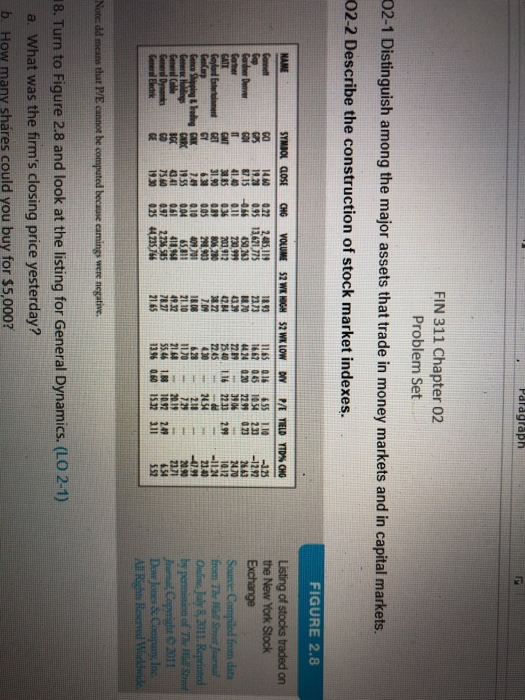

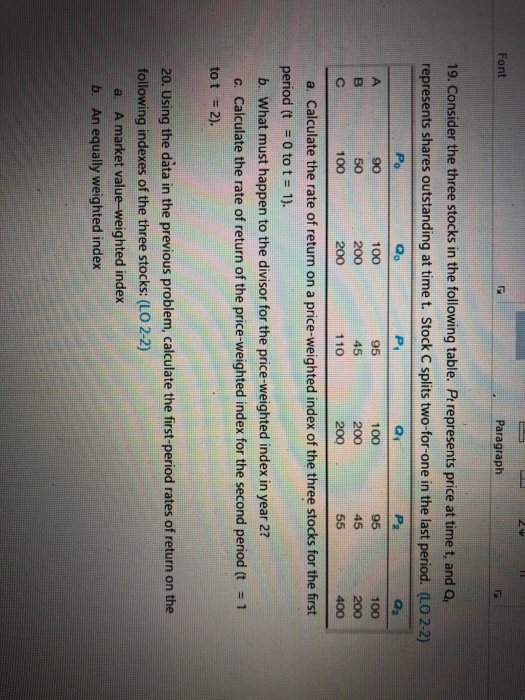

Chapter 02 Problem Set (6) - Word (Product Activation Failed) SE LAYOUT REFERENCES MAILINGS REVIEW VIEW SEE 10 A Aa A AaBbCcDc A T Normal x x A. ay. A n am - 1 Font Paragraph FIN 311 Chapter 02 Problem Set LO2-1 Distinguish among the major assets that trade in money markets and in capital markets. LO2-2 Describe the construction of stock market indexes. FIGURE 2.8 STIG COSE CHO VOLUMIWEMON ME LOW PATED IN ONG Listing of stocks traded on the New York Stock Exchange Sesto Comped from data from me O n July 8, 2011. Reprint Dende 1300 025 273825 W 1 Copyright 2011 Dow Jones & Comaine AR Reserved W e Note:dd meum that PE cannot be computed because aming 18. Turn to Figure 2.8 and look at the listing for General Dynamics. (LO 2-1) a. What was the firm's closing price yesterday? b. How many shares could you buy for $5,000? c. What would be your annual dividend income from those shares? d. What must be General Dynamics' earnings per share? 4(UNITED STATES) et e Font Paragraph 19. Consider the three stocks in the following table. Prrepresents price at time t, and a represents shares outstanding at time t. Stock C splits two-for-one in the last period. (LO 2-2) Qo 100 95 45 400 90 100 100 5020045 200 200 100 200 110 200 a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). b. What must happen to the divisor for the price-weighted index in year 2? c. Calculate the rate of return of the price-weighted index for the second period (t = 1 to t = 2). 20. Using the data in the previous problem, calculate the first-period rates of return on the following indexes of the three stocks: (LO 2-2) a. A market value-weighted index b. An equally weighted index Chapter 02 Problem Set (6) - Word (Product Activation Failed) SE LAYOUT REFERENCES MAILINGS REVIEW VIEW SEE 10 A Aa A AaBbCcDc A T Normal x x A. ay. A n am - 1 Font Paragraph FIN 311 Chapter 02 Problem Set LO2-1 Distinguish among the major assets that trade in money markets and in capital markets. LO2-2 Describe the construction of stock market indexes. FIGURE 2.8 STIG COSE CHO VOLUMIWEMON ME LOW PATED IN ONG Listing of stocks traded on the New York Stock Exchange Sesto Comped from data from me O n July 8, 2011. Reprint Dende 1300 025 273825 W 1 Copyright 2011 Dow Jones & Comaine AR Reserved W e Note:dd meum that PE cannot be computed because aming 18. Turn to Figure 2.8 and look at the listing for General Dynamics. (LO 2-1) a. What was the firm's closing price yesterday? b. How many shares could you buy for $5,000? c. What would be your annual dividend income from those shares? d. What must be General Dynamics' earnings per share? 4(UNITED STATES) et e Font Paragraph 19. Consider the three stocks in the following table. Prrepresents price at time t, and a represents shares outstanding at time t. Stock C splits two-for-one in the last period. (LO 2-2) Qo 100 95 45 400 90 100 100 5020045 200 200 100 200 110 200 a. Calculate the rate of return on a price-weighted index of the three stocks for the first period (t = 0 to t = 1). b. What must happen to the divisor for the price-weighted index in year 2? c. Calculate the rate of return of the price-weighted index for the second period (t = 1 to t = 2). 20. Using the data in the previous problem, calculate the first-period rates of return on the following indexes of the three stocks: (LO 2-2) a. A market value-weighted index b. An equally weighted index