Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 07 Group work - STU.xlsx Problem 4a Page 10 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $40,000. During the year, Beerbo's sales

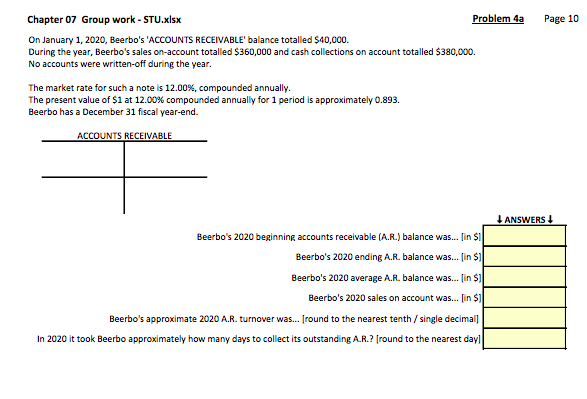

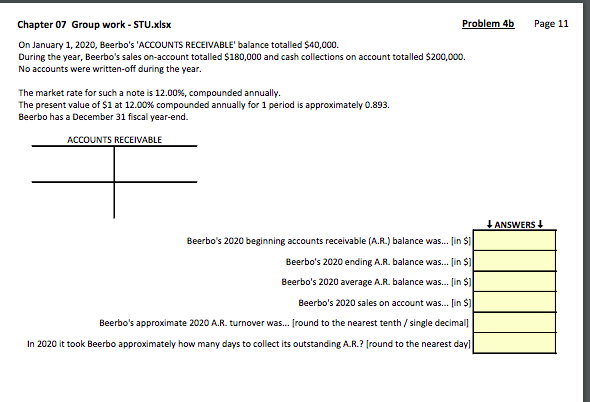

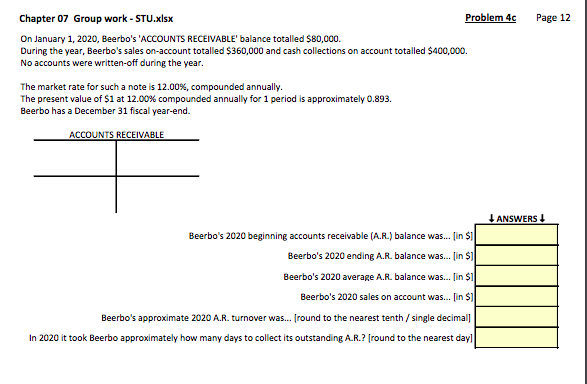

Chapter 07 Group work - STU.xlsx Problem 4a Page 10 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $40,000. During the year, Beerbo's sales on-account totalled $360,000 and cash collections on account totalled $380,000. No accounts were written-off during the year. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE ANSWERS Beerbo's 2020 beginning accounts receivable (A.R.) balance was... [in $1 Beerbo's 2020 ending A.R. balance was... [in $1 Beerbo's 2020 average A.R. balance was... [in $] Beerbo's 2020 sales on account was... [in $] Beerbo's approximate 2020 A.R. turnover was... (round to the nearest tenth / single decimall In 2020 it took Beerbo approximately how many days to collect its outstanding A.R.?(round to the nearest dayil Chapter 07 Group work - STU.xlsx Problem 4b Page 11 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $40,000. During the year, Beerbo's sales on-account totalled $180,000 and cash collections on account totalled $200,000. No accounts were written-off during the year. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE ANSWERS! Beerbo's 2020 beginning accounts receivable (A.R.) balance was... [in $1 Beerbo's 2020 ending A.R. balance was... [in $] Beerbo's 2020 average A.R. balance was... [in $1 Beerbo's 2020 sales on account was... [in $] Beerbo's approximate 2020 A.R. turnover was... (round to the nearest tenth / single decimall In 2020 it took Beerbo approximately how many days to collect its outstanding A.R.? fround to the nearest dayl Page 12 Chapter 07 Group work - STU.xlsx Problem 4c On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $80,000. During the year, Beerbo's sales on-account totalled $360,000 and cash collections on account totalled $400,000. No accounts were written-off during the year. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE ANSWERS Beerbo's 2020 beginning accounts receivable (A.R.) balance was... [in $1 Beerbo's 2020 ending A.R. balance was... [in $] Beerbo's 2020 average A.R. balance was... [in $1 Beerbo's 2020 sales on account was... [in $1 Beerbo's approximate 2020 A.R. turnover was... (round to the nearest tenth / single decimall In 2020 it took Beerbo approximately how many days to collect its outstanding A.R.?round to the nearest dayil Chapter 07 Group work - STU.xlsx Problem 4a Page 10 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $40,000. During the year, Beerbo's sales on-account totalled $360,000 and cash collections on account totalled $380,000. No accounts were written-off during the year. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE ANSWERS Beerbo's 2020 beginning accounts receivable (A.R.) balance was... [in $1 Beerbo's 2020 ending A.R. balance was... [in $1 Beerbo's 2020 average A.R. balance was... [in $] Beerbo's 2020 sales on account was... [in $] Beerbo's approximate 2020 A.R. turnover was... (round to the nearest tenth / single decimall In 2020 it took Beerbo approximately how many days to collect its outstanding A.R.?(round to the nearest dayil Chapter 07 Group work - STU.xlsx Problem 4b Page 11 On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $40,000. During the year, Beerbo's sales on-account totalled $180,000 and cash collections on account totalled $200,000. No accounts were written-off during the year. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE ANSWERS! Beerbo's 2020 beginning accounts receivable (A.R.) balance was... [in $1 Beerbo's 2020 ending A.R. balance was... [in $] Beerbo's 2020 average A.R. balance was... [in $1 Beerbo's 2020 sales on account was... [in $] Beerbo's approximate 2020 A.R. turnover was... (round to the nearest tenth / single decimall In 2020 it took Beerbo approximately how many days to collect its outstanding A.R.? fround to the nearest dayl Page 12 Chapter 07 Group work - STU.xlsx Problem 4c On January 1, 2020, Beerbo's 'ACCOUNTS RECEIVABLE' balance totalled $80,000. During the year, Beerbo's sales on-account totalled $360,000 and cash collections on account totalled $400,000. No accounts were written-off during the year. The market rate for such a note is 12.00%, compounded annually. The present value of $1 at 12.00% compounded annually for 1 period is approximately 0.893. Beerbo has a December 31 fiscal year-end. ACCOUNTS RECEIVABLE ANSWERS Beerbo's 2020 beginning accounts receivable (A.R.) balance was... [in $1 Beerbo's 2020 ending A.R. balance was... [in $] Beerbo's 2020 average A.R. balance was... [in $1 Beerbo's 2020 sales on account was... [in $1 Beerbo's approximate 2020 A.R. turnover was... (round to the nearest tenth / single decimall In 2020 it took Beerbo approximately how many days to collect its outstanding A.R.?round to the nearest dayil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started