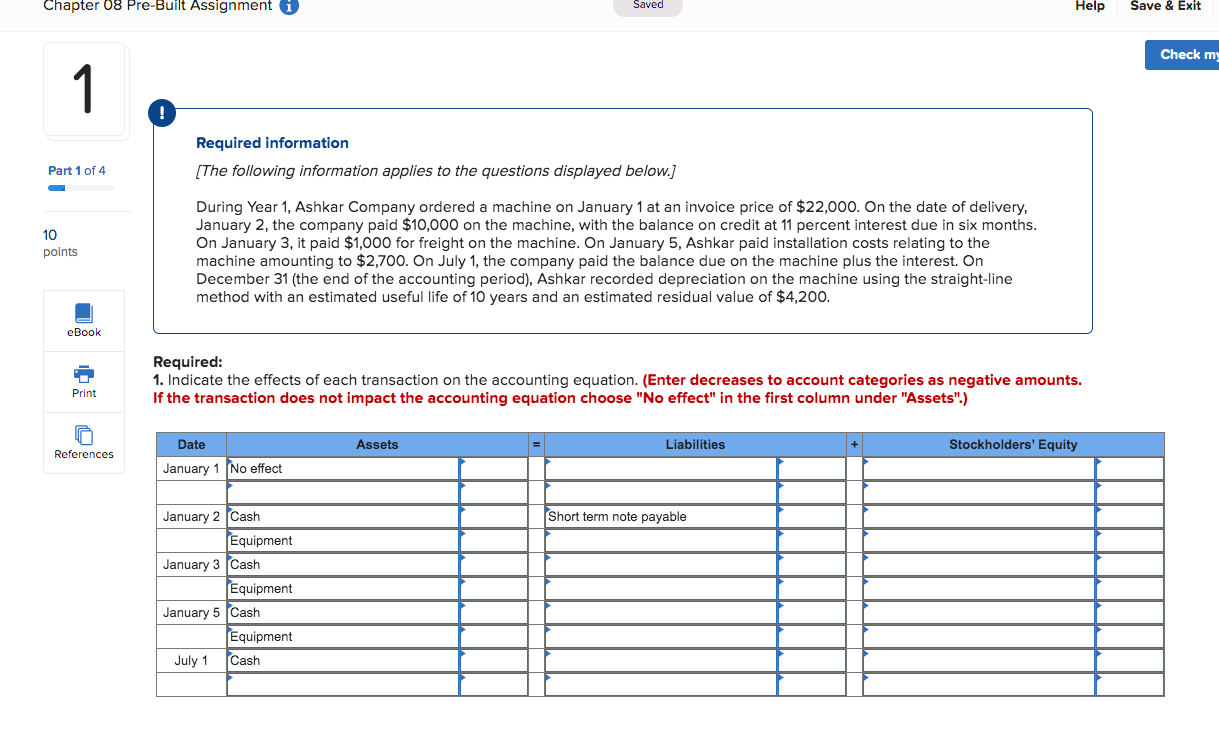

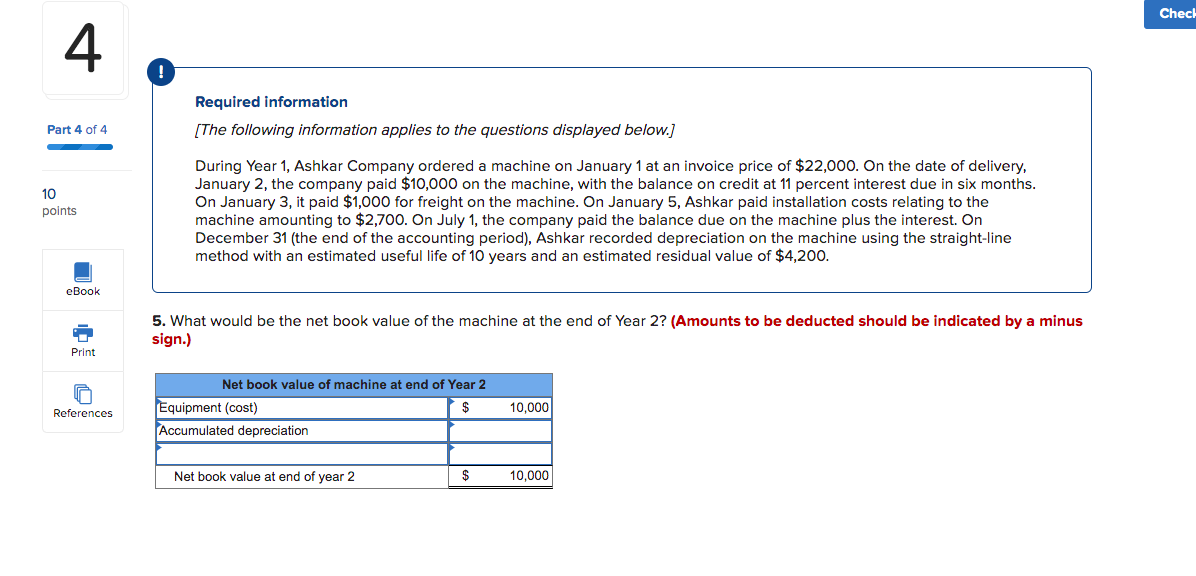

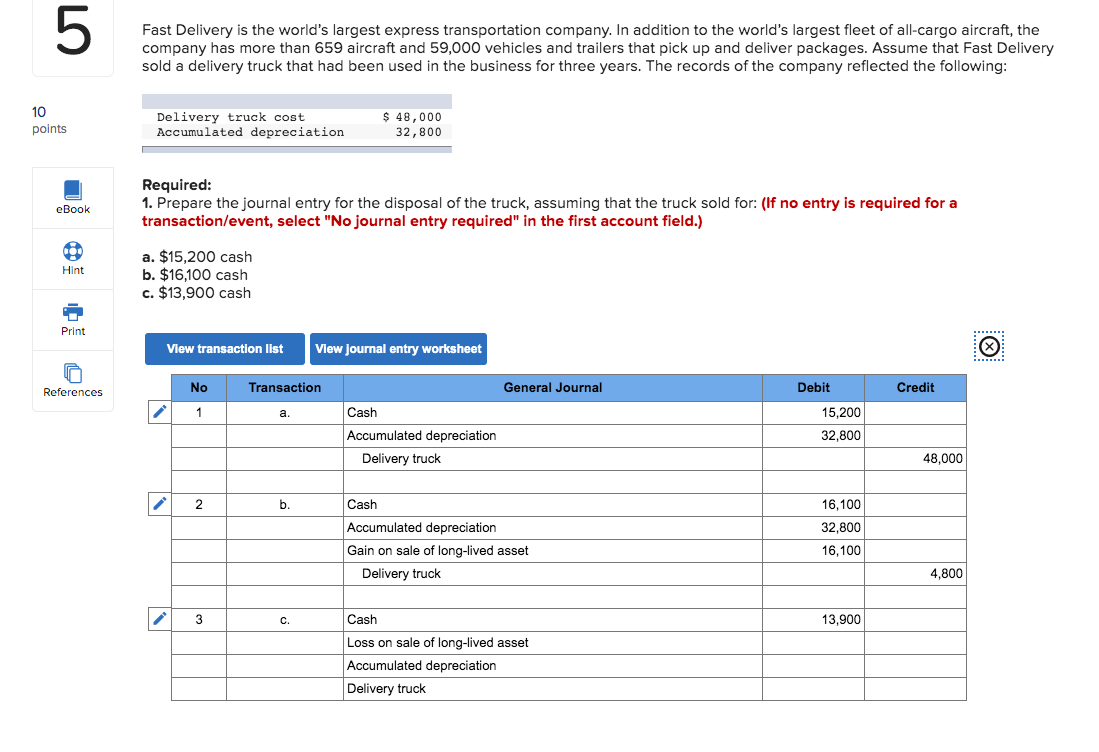

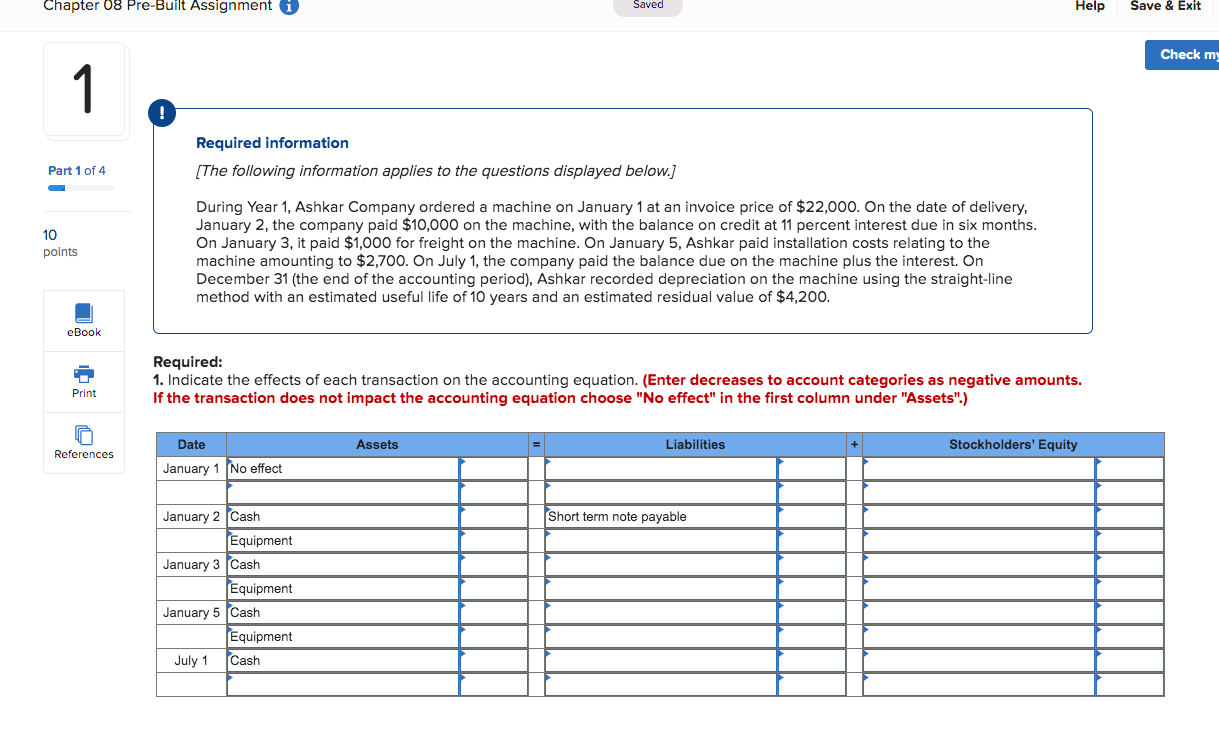

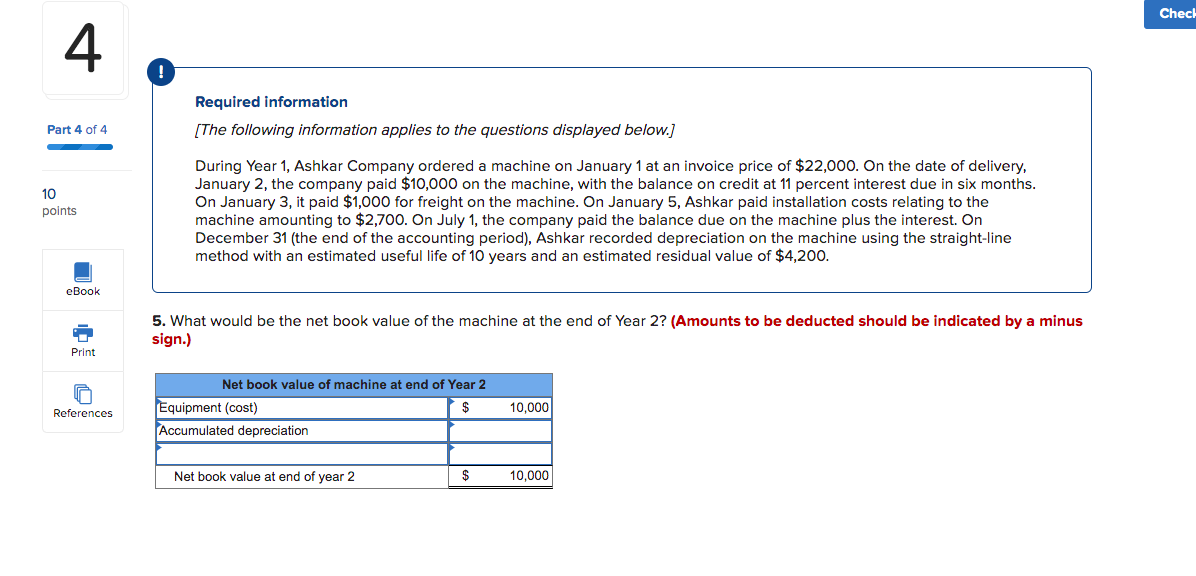

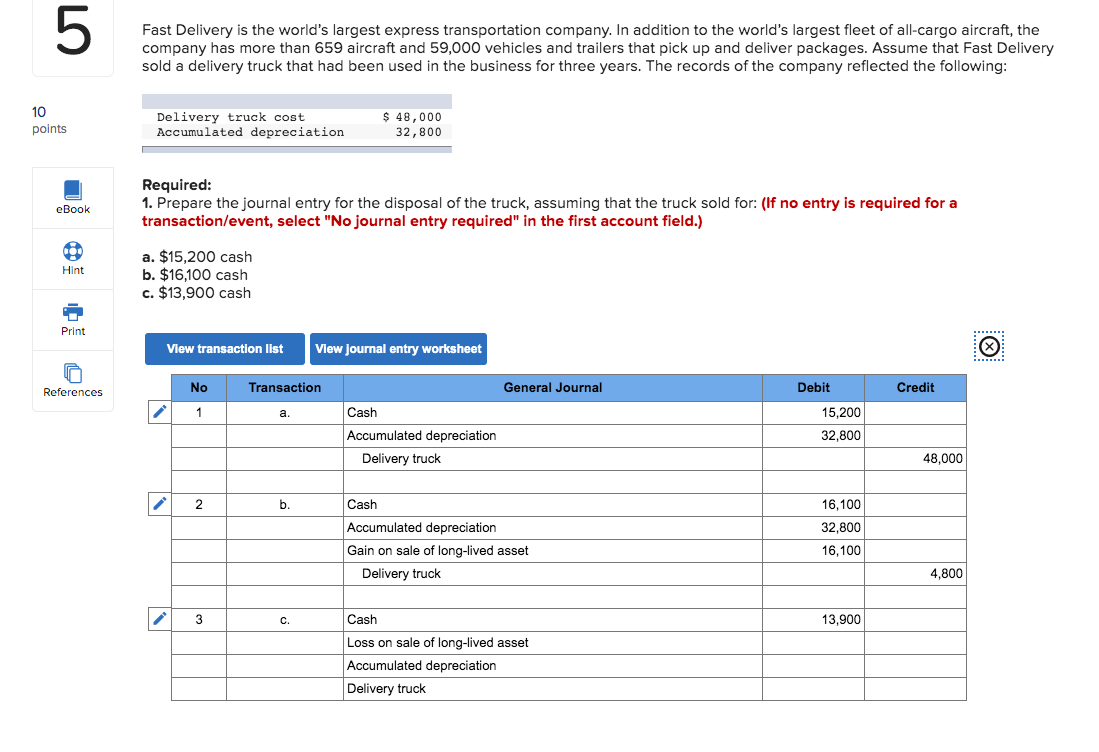

Chapter 08 Pre-Built Assignment i Saved Help Save & Exit Check my 1 Required information [The following information applies to the questions displayed below.) Part 1 of 4 10 points During Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $22,000. On the date of delivery, January 2, the company paid $10,000 on the machine, with the balance on credit at 11 percent interest due in six months. On January 3, it paid $1,000 for freight on the machine. On January 5, Ashkar paid installation costs relating to the machine amounting to $2,700. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $4,200. eBook . Print Required: 1. Indicate the effects of each transaction on the accounting equation. (Enter decreases to account categories as negative amounts. If the transaction does not impact the accounting equation choose "No effect" in the first column under "Assets") Date Assets Liabilities Stockholders' Equity References January 1 No effect Short term note payable January 2 Cash Equipment January 3 Cash Equipment January 5 Cash Equipment July 1 Cash Chech Required information [The following information applies to the questions displayed below.) Part 4 of 4 10 points During Year 1, Ashkar Company ordered a machine on January 1 at an invoice price of $22,000. On the date of delivery, January 2, the company paid $10,000 on the machine, with the balance on credit at 11 percent interest due in six months. On January 3, it paid $1,000 for freight on the machine. On January 5, Ashkar paid installation costs relating to the machine amounting to $2,700. On July 1, the company paid the balance due on the machine plus the interest. On December 31 (the end of the accounting period), Ashkar recorded depreciation on the machine using the straight-line method with an estimated useful life of 10 years and an estimated residual value of $4,200. eBook 5. What would be the net book value of the machine at the end of Year 2? (Amounts to be deducted should be indicated by a minus sign.) Print References Net book value of machine at end of Year 2 Equipment (cost) $ Accumulated depreciation 10,000 Net book value at end of year 2 $ 10,000 5 Fast Delivery is the world's largest express transportation company. In addition to the world's largest fleet of all-cargo aircraft, the company has more than 659 aircraft and 59,000 vehicles and trailers that pick up and deliver packages. Assume that Fast Delivery sold a delivery truck that had been used in the business for three years. The records of the company reflected the following: 10 points Delivery truck cost Accumulated depreciation $ 48,000 32,800 eBook Required: 1. Prepare the journal entry for the disposal of the truck, assuming that the truck sold for: (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Hint a. $15,200 cash b. $16,100 cash c. $13,900 cash Print View transaction list View Journal entry worksheet References No Transaction General Journal Debit Credit 1 a. 15,200 Cash Accumulated depreciation Delivery truck 32,800 48,000 2 b. 16,100 32,800 Cash Accumulated depreciation Gain on sale of long-lived asset Delivery truck 16,100 4,800 3 c. Cash 13,900 Loss on sale of long-lived asset Accumulated depreciation Delivery truck