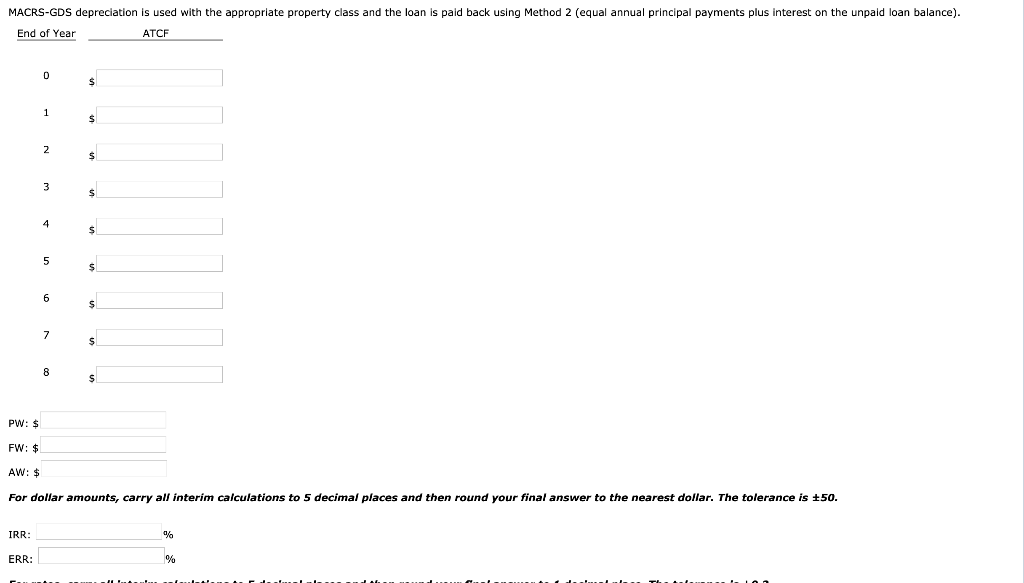

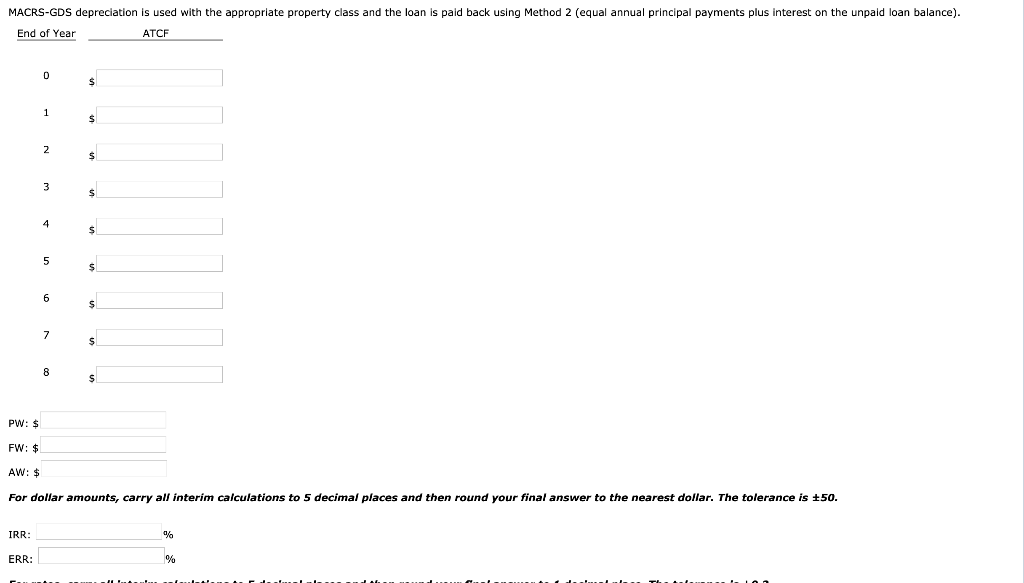

Chapter 09, Problem 053 (Video Solution) Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1,300,000, $500,000 of which is borrowed at 11% for 5 years, and will have a salvage value of $250,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. Corporate income taxes are 40%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR, if the chamber is kept for 8 years. After-tax MARR is 10%. Determine for each year the ATCF and the PW, FW, AW, IRR, and ERR for the investment if: Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. MACRS-GDS depreciation is used with the appropriate property class and the loan is paid back using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). End of Year ATCF PW: $ FW: $ AW: $ For dollar amounts, carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +50. IRR: ERR: Chapter 09, Problem 053 (Video Solution) Raytheon wishes to use an automated environmental chamber in the manufacture of electronic components. The chamber is to be used for rigorous reliability testing and burn-in. It is installed for $1,300,000, $500,000 of which is borrowed at 11% for 5 years, and will have a salvage value of $250,000 after 8 years. Its use will create an opportunity to increase sales by $650,000 per year and will have operating expenses of $250,000 per year. Corporate income taxes are 40%. Develop tables using a spreadsheet to determine the ATCF for each year and the after-tax PW, AW, IRR, and ERR, if the chamber is kept for 8 years. After-tax MARR is 10%. Determine for each year the ATCF and the PW, FW, AW, IRR, and ERR for the investment if: Click here to access the TVM Factor Table Calculator Click here to access the MACRS-GDS table. MACRS-GDS depreciation is used with the appropriate property class and the loan is paid back using Method 2 (equal annual principal payments plus interest on the unpaid loan balance). End of Year ATCF PW: $ FW: $ AW: $ For dollar amounts, carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is +50. IRR: ERR