Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( CHAPTER 1 0 ) A large wine maker would like to buy new stainless steel containers for aging its wine. It is planning to

CHAPTER

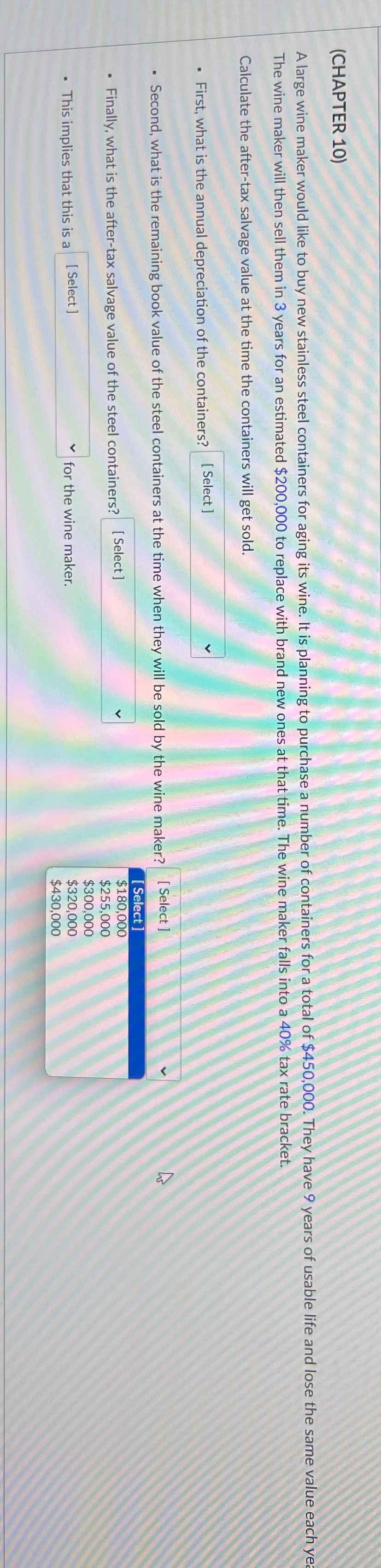

A large wine maker would like to buy new stainless steel containers for aging its wine. It is planning to purchase a number of containers for a total of $ They have years of usable life and lose the same value each ye The wine maker will then sell them in years for an estimated $ to replace with brand new ones at that time. The wine maker falls into a tax rate bracket.

Calculate the aftertax salvage value at the time the containers will get sold.

First, what is the annual depreciation of the containers?

Second, what is the remaining book value of the steel containers at the time when they will be sold by the wine maker?

tableSelect Select$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started