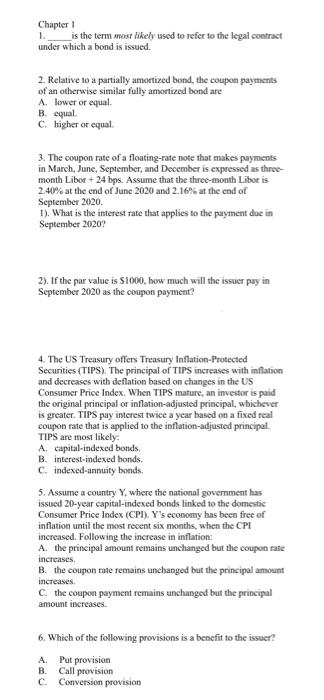

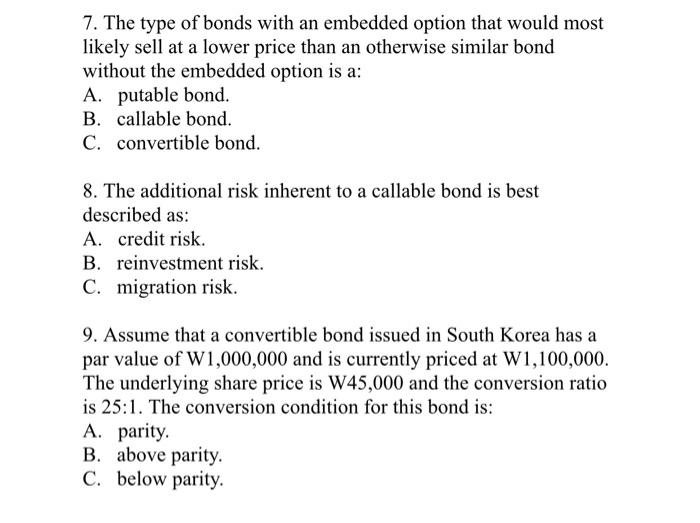

Chapter 1 1 is the term most likely used to refer to the legal contract under which a bond is issued 2. Relative to a partially amortized bond, the coupon payments of an otherwise similar fully amortized bond are A. lower or equal B. equal C. higher or equal 3. The coupon rate of a floating-rate note that makes payments in March, June, September, and Deocmber is expressed as three- month Libor + 24 bps. Assume that the three-month Libor is 2.40% at the end of June 2020 and 2.16% at the end of September 2020 1). What is the interest rate that applies to the payment due in September 2020? 2). If the par value is $1000, how much will the issuer pay in September 2020 as the coupon payment? 4. The US Treasury offers Treasury Inflation Protected Securities (TIPS). The principal of TIPS increases with inflation and decreases with deflation based on changes in the US Consumer Price Index. When TIPS mature, an investor is paid the original principal or inflation-adjusted principal, whichever is greater. TIPS pay interest twice a year based on a fixed real coupon rate that is applied to the inflation-adjusted principal TIPS are most likely A, capital-indexed bonds. B. Interest-indexed bonds. C. indexed-annuity bonds. 5. Assume a country Y, where the national government has issued 20-year capital-indexed bonds linked to the domestic Consumer Price Index (CPI). Y's economy has been free of inflation until the most recent six months, when the CPI increased. Following the increase in inflation: A. the principal amount remains unchanged but the coupon rate increases. B. the coupon rate remains unchanged but the principal amount increases C. the coupon payment remains unchanged but the principal amount increases. 6. Which of the following provisions is a benefit to the issuer? Put provision Call provision C. Conversion provision A B. 7. The type of bonds with an embedded option that would most likely sell at a lower price than an otherwise similar bond without the embedded option is a: A. putable bond. B. callable bond. C. convertible bond. 8. The additional risk inherent to a callable bond is best described as: A. credit risk. B. reinvestment risk. C. migration risk. 9. Assume that a convertible bond issued in South Korea has a par value of W1,000,000 and is currently priced at W1,100,000. The underlying share price is W45,000 and the conversion ratio is 25:1. The conversion condition for this bond is: A. parity. B. above parity. C. below parity