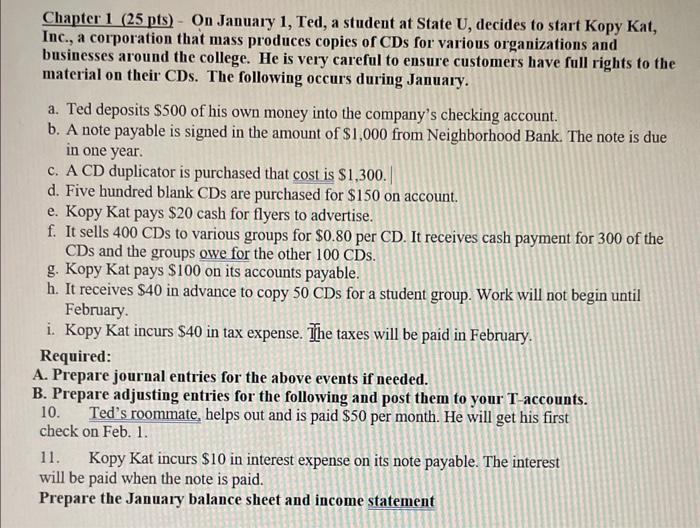

Chapter 1 (25 pts) - On January 1, Ted, a student at State U, decides to start Kopy Kat, Inc., a corporation that mass produces copies of CDs for various organizations and businesses around the college. He is very careful to ensure customers have full rights to the material on their CDs. The following occurs during January. a. Ted deposits $500 of his own money into the company's checking account. b. A note payable is signed in the amount of $1,000 from Neighborhood Bank. The note is due in one year. c. A CD duplicator is purchased that cost is $1,300. d. Five hundred blank CDs are purchased for $150 on account. e. Kopy Kat pays $20 cash for flyers to advertise. f. It sells 400CDs to various groups for $0.80 per CD. It receives cash payment for 300 of the CDs and the groups owe for the other 100 CDs. g. Kopy Kat pays $100 on its accounts payable. h. It receives $40 in advance to copy 50CD for a student group. Work will not begin until February. i. Kopy Kat incurs $40 in tax expense. The taxes will be paid in February. Required: A. Prepare journal entries for the above events if needed. B. Prepare adjusting entries for the following and post them to your T-accounts. 10. Ted's roommate, helps out and is paid $50 per month. He will get his first check on Feb. 1. 11. Kopy Kat incurs $10 in interest expense on its note payable. The interest will be paid when the note is paid. Prepare the January balance sheet and income statement Chapter 1 (25 pts) - On January 1, Ted, a student at State U, decides to start Kopy Kat, Inc., a corporation that mass produces copies of CDs for various organizations and businesses around the college. He is very careful to ensure customers have full rights to the material on their CDs. The following occurs during January. a. Ted deposits $500 of his own money into the company's checking account. b. A note payable is signed in the amount of $1,000 from Neighborhood Bank. The note is due in one year. c. A CD duplicator is purchased that cost is $1,300. d. Five hundred blank CDs are purchased for $150 on account. e. Kopy Kat pays $20 cash for flyers to advertise. f. It sells 400CDs to various groups for $0.80 per CD. It receives cash payment for 300 of the CDs and the groups owe for the other 100 CDs. g. Kopy Kat pays $100 on its accounts payable. h. It receives $40 in advance to copy 50CD for a student group. Work will not begin until February. i. Kopy Kat incurs $40 in tax expense. The taxes will be paid in February. Required: A. Prepare journal entries for the above events if needed. B. Prepare adjusting entries for the following and post them to your T-accounts. 10. Ted's roommate, helps out and is paid $50 per month. He will get his first check on Feb. 1. 11. Kopy Kat incurs $10 in interest expense on its note payable. The interest will be paid when the note is paid. Prepare the January balance sheet and income statement