Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 1 Homework Assume on August 1, 2022, an investor company owns 32% of the common stock of an investee and can exercise significant

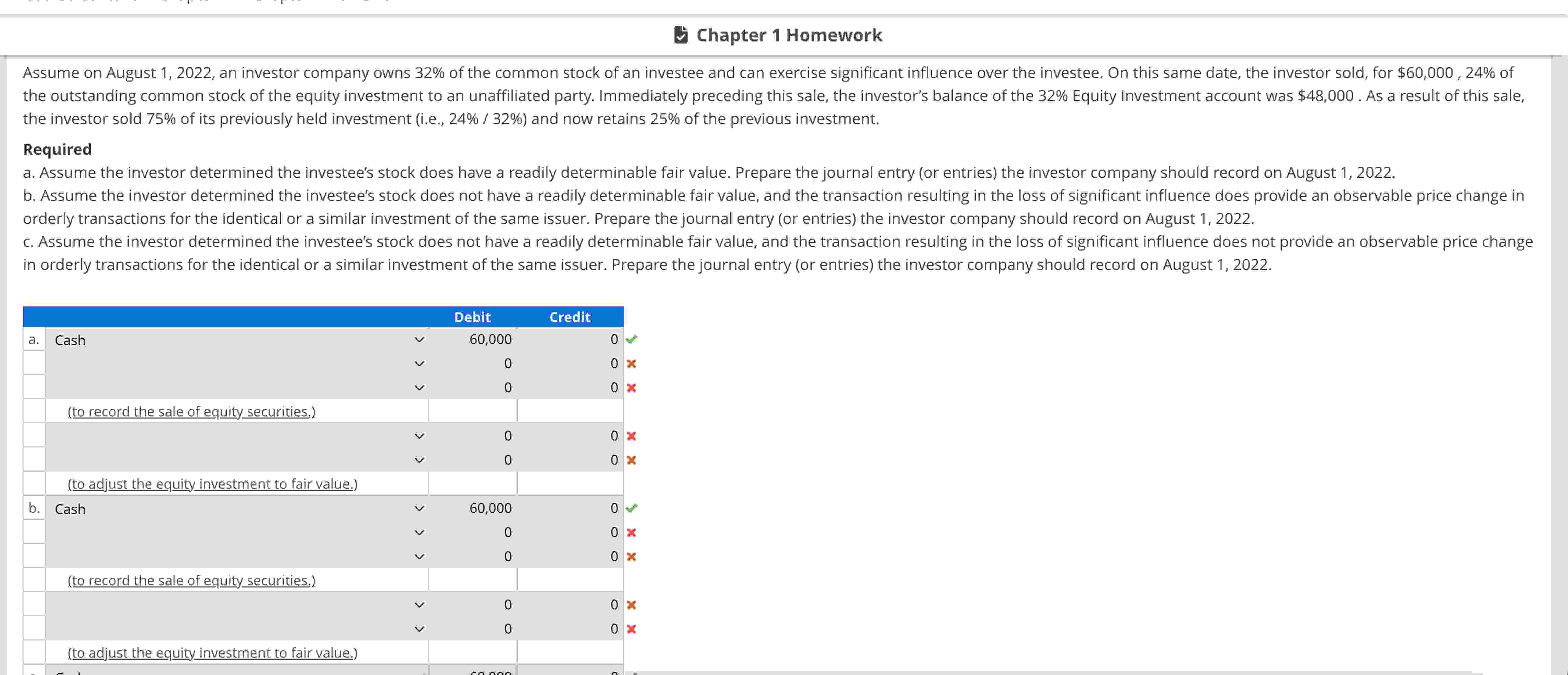

Chapter 1 Homework Assume on August 1, 2022, an investor company owns 32% of the common stock of an investee and can exercise significant influence over the investee. On this same date, the investor sold, for $60,000, 24% of the outstanding common stock of the equity investment to an unaffiliated party. Immediately preceding this sale, the investor's balance of the 32% Equity Investment account was $48,000. As a result of this sale, the investor sold 75% of its previously held investment (i.e., 24% / 32%) and now retains 25% of the previous investment. Required a. Assume the investor determined the investee's stock does have a readily determinable fair value. Prepare the journal entry (or entries) the investor company should record on August 1, 2022, b. Assume the investor determined the investee's stock does not have a readily determinable fair value, and the transaction resulting in the loss of significant influence does provide an observable price change in orderly transactions for the identical or a similar investment of the same issuer. Prepare the journal entry (or entries) the investor company should record on August 1, 2022. c. Assume the investor determined the investee's stock does not have a readily determinable fair value, and the transaction resulting in the loss of significant influence does not provide an observable price change in orderly transactions for the identical or a similar investment of the same issuer. Prepare the journal entry (or entries) the investor company should record on August 1, 2022. a. Cash (to record the sale of equity securities.) (to adjust the equity investment to fair value.) b. Cash (to record the sale of equity securities.) (to adjust the equity investment to fair value.) > > > > > > > > > > Debit 60,000 Credit 0 0 0 0 0x 0 0 0 0 60,000 0 0 0x 0 0 0 0 0 0x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started