The following questions are adapted from a variety of sources including questions developed by the AICPA Board

Question:

The following questions are adapted from a variety of sources including questions developed by the AICPA Board of Examiners and those used in the Kaplan CPA Review Course to study accounting changes and errors processing while preparing for the CPA examination. Determine the response that best completes the statements or questions.

1. JME Corporation bills its customers when services are rendered and recognizes revenue at the same time. This event causes an

a. Increase in assets.

b. Increase in net income.

c. Increase in retained earnings.

d. All of the above.

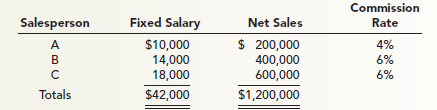

2. Fay Corp. pays its outside salespersons fixed monthly salaries as well as commissions on net sales. Sales commissions are paid in the month following the month of sale, while the fixed salaries are expensed but considered advances against commissions. However, if salespersons’ fixed salaries exceed their sales commissions earned for a month, such excess is not returned to the company. Pertinent data for the month of March for the three salespersons are as follows:

What amount should Fay accrue as a debit to sales commission’s expense and a credit to sales commissions payable at March 31?

a. $26,000

b. $28,000

c. $68,000

d. $70,000

3. Compared to the accrual basis of accounting, the cash basis of accounting produces a lower amount of income by the net decrease during the accounting period of

Accounts Receivable .Accrued Liabilities

a. Yes .No

b. No. Yes

c. Yes. Yes

d. No. No

4. On April 1 Ivy Corp. began operating a service company with an initial cash investment by shareholders of $1,000,000. The company provided $3,200,000 of services in April and received full payment in May. Ivy also incurred expenses of $1,500,000 in April that were paid in June. During May, Ivy paid its shareholders cash dividends of $500,000. What was the company’s income before income taxes for the two months ended May 31 under the following methods of accounting?

Cash Basis . Accrual Basis

a. $3,200,000 .$1,700,000

b. $2,700,000 .$1,200,000

c. $1,700,000 .$1,700,000

d. $3,200,000 .$1,200,000

5. Under East Co.’s accounting system, all insurance premiums paid are debited to prepaid insurance. During the year, East records monthly estimated charges to insurance expense with credits to prepaid insurance. Additional information for the year ended December 31 is as follows:

Prepaid insurance at January 1 $105,000

Insurance expense recognized during the year 437,500

Prepaid insurance at December 31 122,500

What was the total amount of cash paid by East for insurance premiums during the year?

a. $332,500

b. $420,000

c. $437,500

d. $455,000

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Intermediate accounting

ISBN: 978-0077647094

7th edition

Authors: J. David Spiceland, James Sepe, Mark Nelson