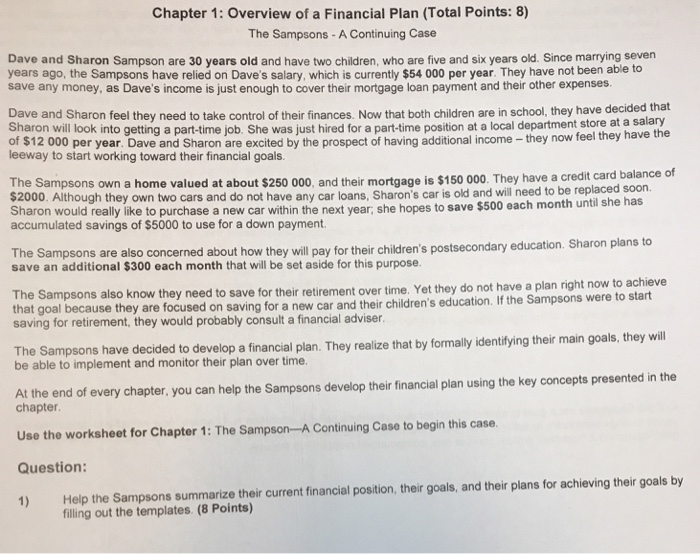

Chapter 1: Overview of a Financial Plan (Total Points: 8) The Sampsons - A Continuing Case Dave and Sharon Sampson are 30 years old and have two children, who are five and six years old. Since marrying seven years ago, the Sampsons have relied on Dave's salary, which is currently $54 000 per year. They have not been able to save any money, as Dave's income is just enough to cover their mortgage loan payment and their other expenses. Dave and Sharon feel they need to take control of their finances. Now that both children are in school, they have de Sharon will look into getting a part-time job. She was just hired for a part-time position at of $12 000 per year. Dave and Sharon are excited by the prospect of having additional income-they now fee eeway to start working toward their financial goals. cided that a local department store at a salary aid by the prospect of having additional income - they now feel they have the The Sampsons own a home valued a $2000. Although they own two cars and do not have any car loans, Sharon would really like to purchase a new car within the next year, she hopes to save $500 each month until s accumulated savings of $5000 to use for a down payment. t about $250 000, and their mortgage is $150 000. They have a credit card balance of Sharon's car is old and will need to be replaced soon. he has The Sampsons are also concerned about how they will pay for their children's postsecondary save an additional $300 each month that will be set aside for this purpose The Sampsons also know they nee that d to save for their retirement over time. Yet they do not have a plan right now to achieve goal because they are focused on saving for an ew car and their children's education. If the Sampsons were to start saving for retirement, they would probably consult a financial adviser be de to mnlenee decided to develop a financial plan. They realize that by foryng their main goals, hey wil be able to implement and monitor their plan over time At the end of every chapter, you can help the Sampsons develop their financial plan using the key concepts presented in the chapter Use the worksheet for Chapter 1: The Sampson-A Continuing Case to begin this case. Question: Help the Sampsons summarize their current financial position, their goals, and their plans for achieving their goals by filling out the templates. (8 Points) 1)