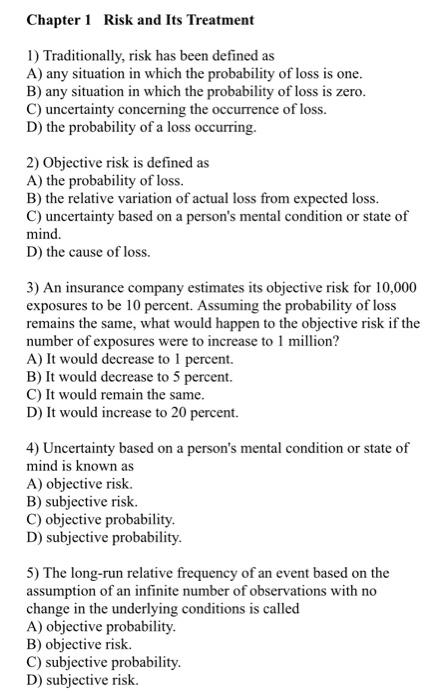

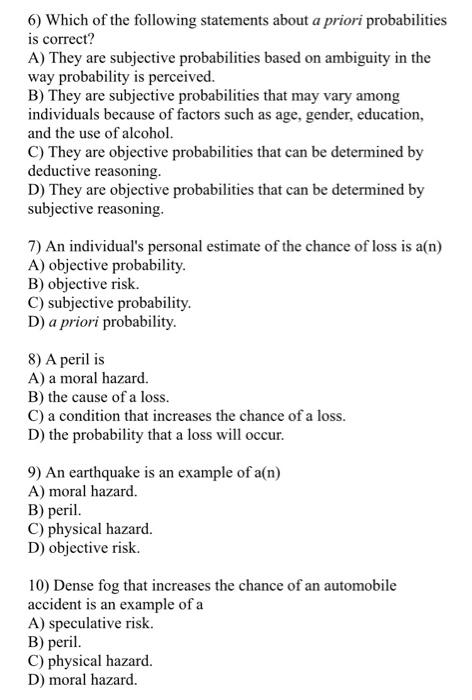

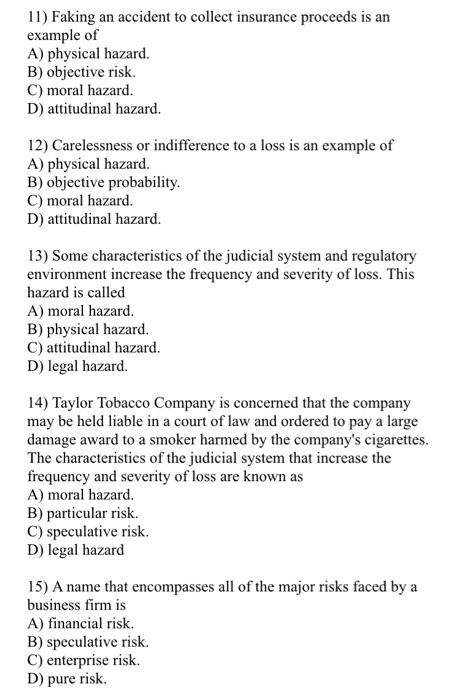

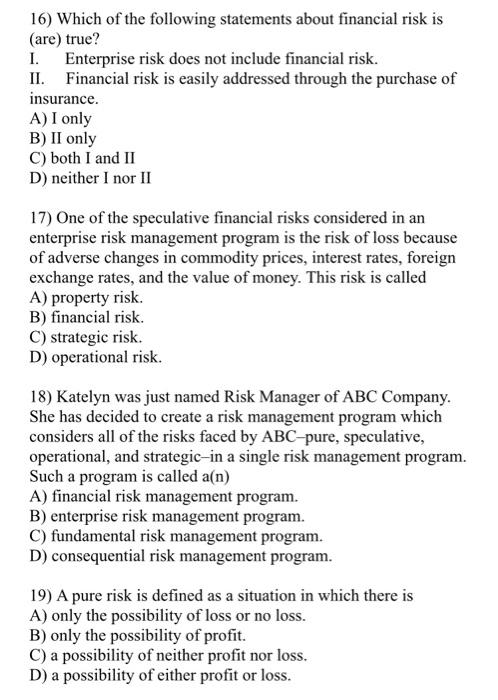

Chapter 1 Risk and Its Treatment 1) Traditionally, risk has been defined as A) any situation in which the probability of loss is one. B) any situation in which the probability of loss is zero. C) uncertainty concerning the occurrence of loss. D) the probability of a loss occurring. 2) Objective risk is defined as A) the probability of loss. B) the relative variation of actual loss from expected loss. C) uncertainty based on a person's mental condition or state of mind. D) the cause of loss. 3) An insurance company estimates its objective risk for 10,000 exposures to be 10 percent. Assuming the probability of loss remains the same, what would happen to the objective risk if the number of exposures were to increase to 1 million? A) It would decrease to 1 percent. B) It would decrease to 5 percent. C) It would remain the same. D) It would increase to 20 percent. 4) Uncertainty based on a person's mental condition or state of mind is known as A) objective risk. B) subjective risk. C) objective probability. D) subjective probability. 5) The long-run relative frequency of an event based on the assumption of an infinite number of observations with no change in the underlying conditions is called A) objective probability. B) objective risk. C) subjective probability. D) subjective risk. 6) Which of the following statements about a priori probabilities is correct? A) They are subjective probabilities based on ambiguity in the way probability is perceived. B) They are subjective probabilities that may vary among individuals because of factors such as age, gender, education, and the use of alcohol. C) They are objective probabilities that can be determined by deductive reasoning. D) They are objective probabilities that can be determined by subjective reasoning. 7) An individual's personal estimate of the chance of loss is a(n) A) objective probability. B) objective risk. C) subjective probability. D) a priori probability. 8) A peril is A) a moral hazard. B) the cause of a loss. C) a condition that increases the chance of a loss. D) the probability that a loss will occur. 9) An earthquake is an example of a(n) A) moral hazard. B) peril. C) physical hazard. D) objective risk. 10) Dense fog that increases the chance of an automobile accident is an example of a A) speculative risk. B) peril. C) physical hazard D) moral hazard. 11) Faking an accident to collect insurance proceeds is an example of A) physical hazard. B) objective risk. C) moral hazard. D) attitudinal hazard. 12) Carelessness or indifference to a loss is an example of A) physical hazard. B) objective probability. C) moral hazard. D) attitudinal hazard. 13) Some characteristics of the judicial system and regulatory environment increase the frequency and severity of loss. This hazard is called A) moral hazard. B) physical hazard. C) attitudinal hazard. D) legal hazard. 14) Taylor Tobacco Company is concerned that the company may be held liable in a court of law and ordered to pay a large damage award to a smoker harmed by the company's cigarettes. The characteristics of the judicial system that increase the frequency and severity of loss are known as A) moral hazard. B) particular risk. C) speculative risk. D) legal hazard 15) A name that encompasses all of the major risks faced by a business firm is A) financial risk. B) speculative risk. C) enterprise risk. D) pure risk. 16) Which of the following statements about financial risk is (are) true? 1. Enterprise risk does not include financial risk. II. Financial risk is easily addressed through the purchase of insurance. A) I only B) II only C) both I and II D) neither I nor II 17) One of the speculative financial risks considered in an enterprise risk management program is the risk of loss because of adverse changes in commodity prices, interest rates, foreign exchange rates, and the value of money. This risk is called A) property risk. B) financial risk. C) strategic risk. D) operational risk. 18) Katelyn was just named Risk Manager of ABC Company. She has decided to create a risk management program which considers all of the risks faced by ABC-pure, speculative, operational, and strategic-in a single risk management program. Such a program is called a(n) A) financial risk management program. B) enterprise risk management program. C) fundamental risk management program. D) consequential risk management program. 19) A pure risk is defined as a situation in which there is A) only the possibility of loss or no loss. B) only the possibility of profit. C) a possibility of neither profit nor loss. D) a possibility of either profit or loss