Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Assume two firms (A and B) producing a commodity. Firm A produces a highly quality version of the commodity (Good), which meets

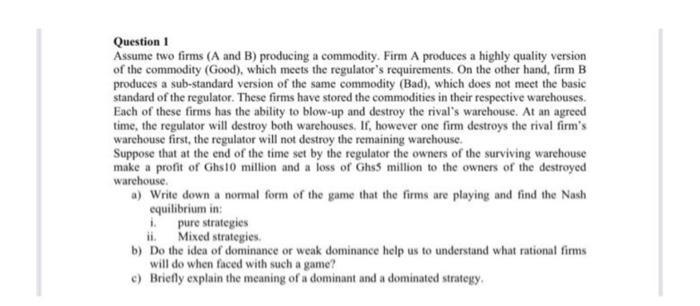

Question 1 Assume two firms (A and B) producing a commodity. Firm A produces a highly quality version of the commodity (Good), which meets the regulator's requirements. On the other hand, firm B produces a sub-standard version of the same commodity (Bad), which does not meet the basic standard of the regulator. These firms have stored the commodities in their respective warehouses. Each of these firms has the ability to blow-up and destroy the rival's warehouse. At an agreed time, the regulator will destroy both warehouses. If, however one firm destroys the rival firm's warehouse first, the regulator will not destroy the remaining warehouse. Suppose that at the end of the time set by the regulator the owners of the surviving warehouse make a profit of Ghs10 million and a loss of Ghs5 million to the owners of the destroyed warehouse. a) Write down a normal form of the game that the firms are playing and find the Nash equilibrium in: 1. ii. b) Do the idea of dominance or weak dominance help us to understand what rational firms will do when faced with such a game? c) Briefly explain the meaning of a dominant and a dominated strategy. pure strategies Mixed strategies.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started