Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 10 of Financial Accounting Club Town, Inc., ended 2016 with 6 million shares of $1 par common stock issued and outstanding. Beginning additional paid-in

Chapter 10 of Financial Accounting

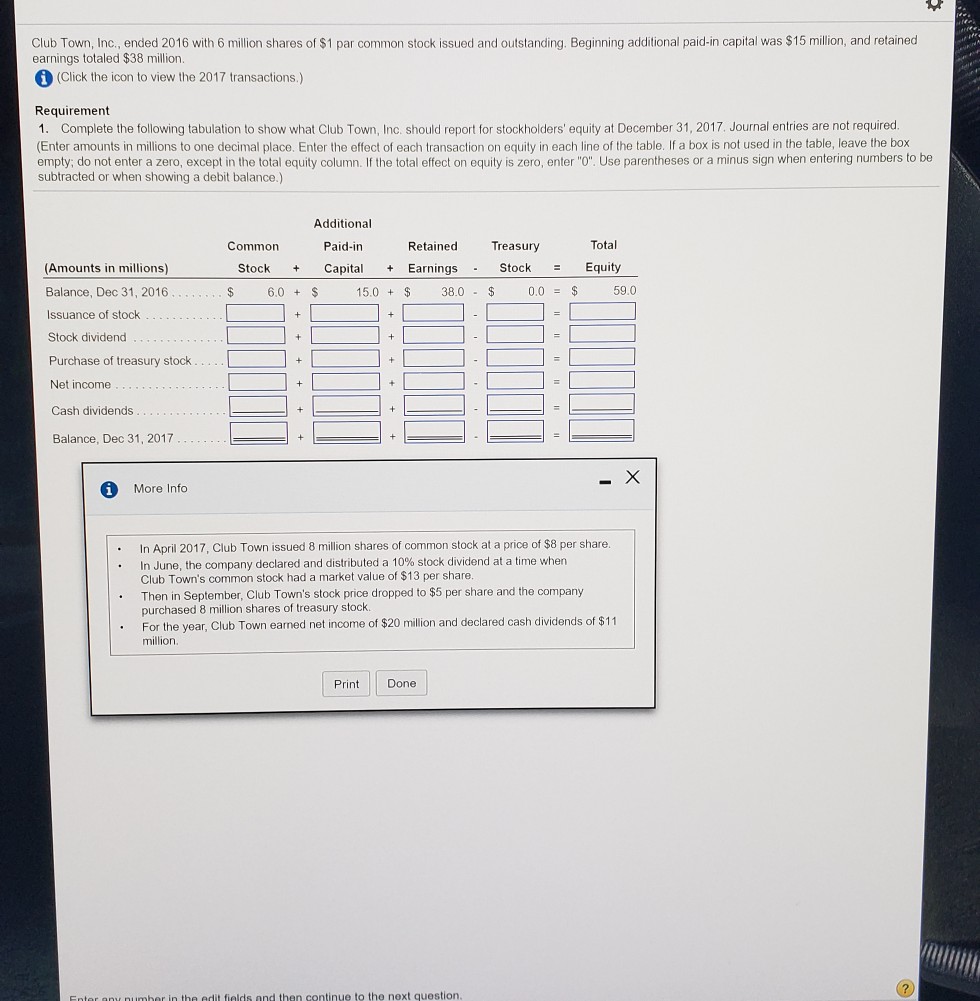

Club Town, Inc., ended 2016 with 6 million shares of $1 par common stock issued and outstanding. Beginning additional paid-in capital was $15 million, and retained earnings totaled $38 million (Click the icon to view the 2017 transactions.) Requirement 1. Complete the following tabulation to show what Club Town, Inc. should report for stockholders' equity at December 31, 2017. Journal entries are not required (Enter amounts in millions to one decimal place. Enter the effect of each transaction on equity in each line of the table. If a box is not used in the table, leave the box empty; do not enter a zero, except in the total equity column. If the total effect on equity is zero, enter "O". Use parentheses or a minus sign when entering numbers to be subtracted or when showing a debit balance.) Additional Common PaidRtained Treasury Total Stock Equity (Amounts in millions) Balance, Dec 31, 2016 Issuance of stock Stock dividend Purchase of treasury stock Net income Cash dividends Balance, Dec 31, 2017 Stock CapitalEarnings 6.015.0$ 38.0 $ 0.0 59.0 More Info In April 2017, Club Town issued 8 million shares of common stock at a price of $8 per share. . In June, the company declared and distributed a 10% stock dividend at a time when Club Town's common stock had a market value of $13 per share Then in September, Club Town's stock price dropped to $5 per share and the company purchased 8 million shares of treasury stock For the year, Club Town earned net income of $20 million and declared cash dividends of $11 million Print Done mber in the edit fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started