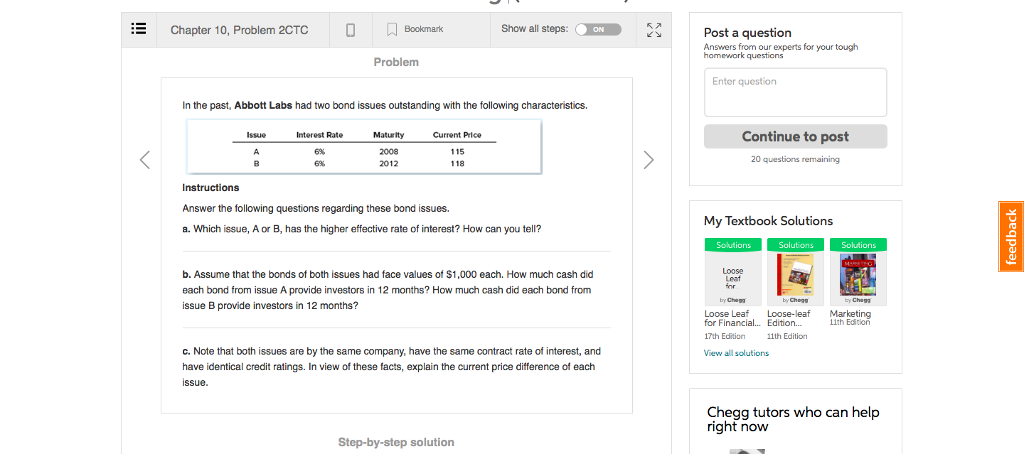

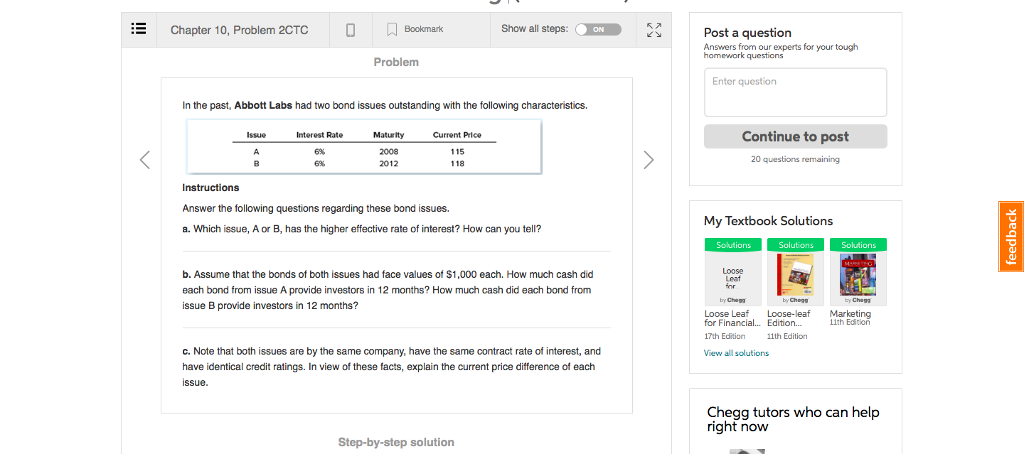

Chapter 10, Problem 2CTC Bookmark Show all steps: ON Post a question Answers from our experts for your tough Problem Enter question In the past, Abbott Labs had two bond issues outstanding with the folloing characteristics. Continue to post Issue Interest Rate 6% 6% Maturity 2008 2012 Current Price 115 118 Instructions Answer the following questions regarding these bond issues. a. Which issue, A or B, has the higher effective rate of interest? How can you tell? My Textbook Solutions Solutions Solutions Loose b. Assume that the bonds of both issues had face values of $1,000 each. How much cash did each bond from issue A provide investors in 12 months? How much cash did each bond from issue B provide investors in 12 months? by Chepa Loose Leaf Loose-leaf Marketing for Financial... Edition... 1th Edition 17th Edition 1th Edition View all solutions c. Note that both issues are by the same company, have the same contract rate of interest, and have identical credit ratings. In view of these facts, explain the current price difference of each ssue. Chegg tutors who can help right now Step-by-step solution Chapter 10, Problem 2CTC Bookmark Show all steps: ON Post a question Answers from our experts for your tough Problem Enter question In the past, Abbott Labs had two bond issues outstanding with the folloing characteristics. Continue to post Issue Interest Rate 6% 6% Maturity 2008 2012 Current Price 115 118 Instructions Answer the following questions regarding these bond issues. a. Which issue, A or B, has the higher effective rate of interest? How can you tell? My Textbook Solutions Solutions Solutions Loose b. Assume that the bonds of both issues had face values of $1,000 each. How much cash did each bond from issue A provide investors in 12 months? How much cash did each bond from issue B provide investors in 12 months? by Chepa Loose Leaf Loose-leaf Marketing for Financial... Edition... 1th Edition 17th Edition 1th Edition View all solutions c. Note that both issues are by the same company, have the same contract rate of interest, and have identical credit ratings. In view of these facts, explain the current price difference of each ssue. Chegg tutors who can help right now Step-by-step solution