Answered step by step

Verified Expert Solution

Question

1 Approved Answer

CHAPTER 10, QUESTION 1: *NEED C, D & E ONLY* CHAPTER 13 Q 1 CHAPTER 13 Q 2: CHAPTER 14 Q 2: CHAPTER 14 Q

CHAPTER 10, QUESTION 1: *NEED C, D & E ONLY*

CHAPTER 13 Q 1

CHAPTER 13 Q 2: CHAPTER 14 Q 2:

CHAPTER 14 Q 2:

CHAPTER 14 Q 5:

CHAPTER 16 Q 2:

CHAPTER 16 Q 2:

Typed up responses preferred

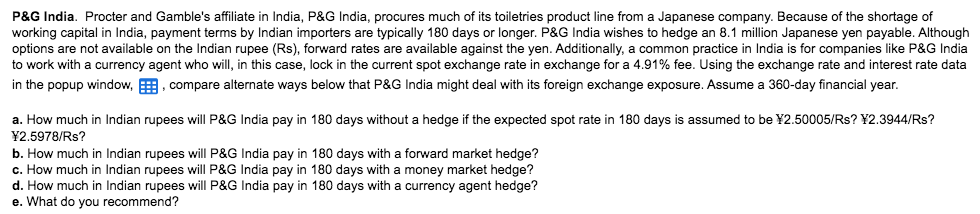

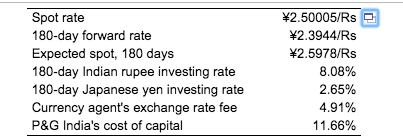

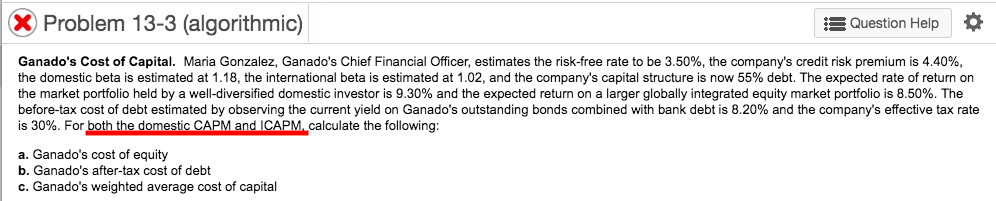

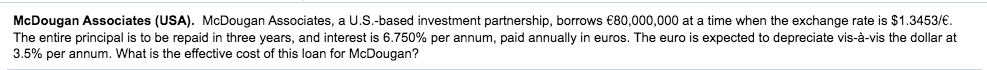

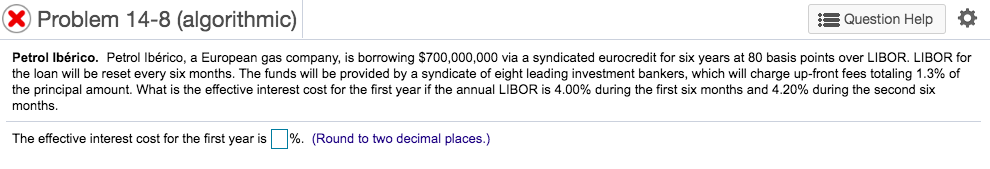

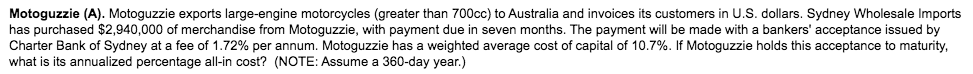

P&G India. Procter and Gamble's affiliate in India, P&G India, procures much of its toiletries product line from a Japanese company. Because of the shortage of working capital in India, payment terms by Indian importers are typically 180 days or longer. P&G India wishes to hedge an 8.1 million Japanese yen payable. Although options are not available on the Indian rupee (Rs), forward rates are available against the yen. Additionally, a common practice in India is for companies like P&G India to work with a currency agent who will, in this case, lock in the current spot exchange rate in exchange for a 4.91% fee. Using the exchange rate and interest rate data in the popup window, , compare alternate ways below that P&G India might deal with its foreign exchange exposure. Assume a 360-day financial year. a. How much in Indian rupees will P&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be Y2.50005/Rs? Y2.3944/Rs? Y2.5978/Rs? b. How much in Indian rupees will P&G India pay in 180 days with a forward market hedge? c. How much in Indian rupees will P&G India pay in 180 days with a money market hedge? d. How much in Indian rupees will P&G India pay in 180 days with a currency agent hedge? e. What do you recommend? Spot rate 180-day forward rate Expected spot, 180 days 180-day Indian rupee investing rate 180-day Japanese yen investing rate Currency agent's exchange rate fee P&G India's cost of capital 2.50005/Rs 2.3944/Rs 2.5978/Rs 8.08% 2.65% 4.91% 11.66% X Problem 13-3 (algorithmic) Question Help Ganado's Cost of Capital. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.50%, the company's credit risk premium is 4.40%, the domestic beta is estimated at 1.18, the international beta is estimated at 1.02, and the company's capital structure is now 55% debt. The expected rate of return on the market portfolio held by a well-diversified domestic investor is 9.30% and the expected return on a larger globally integrated equity market portfolio is 8.50%. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.20% and the company's effective tax rate is 30%. For both the domestic CAPM and ICAPM. calculate the following: a. Ganado's cost of equity b. Ganado's after-tax cost of debt c. Ganado's weighted average cost of capital Problem 13-4 (algorithmic) Question Help Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 4.00%, the company's credit risk premium is 4.00%, the domestic beta is estimated at 1.06, the international beta is estimated at 0.74, and the company's capital structure is now 65% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.80% and the company's effective tax rate is 42% Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. a. 8.10% b. 7.10% c. 5.10% d. 4.10% McDougan Associates (USA). McDougan Associates, a U.S.-based investment partnership, borrows 80,000,000 at a time when the exchange rate is $1.3453/. The entire principal is to be repaid in three years, and interest is 6.750% per annum, paid annually in euros. The euro is expected to depreciate vis--vis the dollar at 3.5% per annum. What is the effective cost of this loan for McDougan? X Problem 14-8 (algorithmic) A Question Help O Petrol Ibrico. Petrol Ibrico, a European gas company, is borrowing $700,000,000 via a syndicated eurocredit for six years at 80 basis points over LIBOR. LIBOR for the loan will be reset every six months. The funds will be provided by a syndicate of eight leading investment bankers, which will charge up-front fees totaling 1.3% of the principal amount. What is the effective interest cost for the first year if the annual LIBOR is 4.00% during the first six months and 4.20% during the second six months. The effective interest cost for the first year is % (Round to two decimal places.) Motoguzzie (A). Motoguzzie exports large-engine motorcycles (greater than 700cc) to Australia and invoices its customers in U.S. dollars. Sydney Wholesale Imports has purchased $2,940,000 of merchandise from Motoguzzie, with payment due in seven months. The payment will be made with a bankers' acceptance issued by Charter Bank of Sydney at a fee of 1.72% per annum. Motoguzzie has a weighted average cost of capital of 10.7%. If Motoguzzie holds this acceptance to maturity, what is its annualized percentage all-in cost? (NOTE: Assume a 360-day year.) P&G India. Procter and Gamble's affiliate in India, P&G India, procures much of its toiletries product line from a Japanese company. Because of the shortage of working capital in India, payment terms by Indian importers are typically 180 days or longer. P&G India wishes to hedge an 8.1 million Japanese yen payable. Although options are not available on the Indian rupee (Rs), forward rates are available against the yen. Additionally, a common practice in India is for companies like P&G India to work with a currency agent who will, in this case, lock in the current spot exchange rate in exchange for a 4.91% fee. Using the exchange rate and interest rate data in the popup window, , compare alternate ways below that P&G India might deal with its foreign exchange exposure. Assume a 360-day financial year. a. How much in Indian rupees will P&G India pay in 180 days without a hedge if the expected spot rate in 180 days is assumed to be Y2.50005/Rs? Y2.3944/Rs? Y2.5978/Rs? b. How much in Indian rupees will P&G India pay in 180 days with a forward market hedge? c. How much in Indian rupees will P&G India pay in 180 days with a money market hedge? d. How much in Indian rupees will P&G India pay in 180 days with a currency agent hedge? e. What do you recommend? Spot rate 180-day forward rate Expected spot, 180 days 180-day Indian rupee investing rate 180-day Japanese yen investing rate Currency agent's exchange rate fee P&G India's cost of capital 2.50005/Rs 2.3944/Rs 2.5978/Rs 8.08% 2.65% 4.91% 11.66% X Problem 13-3 (algorithmic) Question Help Ganado's Cost of Capital. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 3.50%, the company's credit risk premium is 4.40%, the domestic beta is estimated at 1.18, the international beta is estimated at 1.02, and the company's capital structure is now 55% debt. The expected rate of return on the market portfolio held by a well-diversified domestic investor is 9.30% and the expected return on a larger globally integrated equity market portfolio is 8.50%. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 8.20% and the company's effective tax rate is 30%. For both the domestic CAPM and ICAPM. calculate the following: a. Ganado's cost of equity b. Ganado's after-tax cost of debt c. Ganado's weighted average cost of capital Problem 13-4 (algorithmic) Question Help Ganado and Equity Risk Premiums. Maria Gonzalez, Ganado's Chief Financial Officer, estimates the risk-free rate to be 4.00%, the company's credit risk premium is 4.00%, the domestic beta is estimated at 1.06, the international beta is estimated at 0.74, and the company's capital structure is now 65% debt. The before-tax cost of debt estimated by observing the current yield on Ganado's outstanding bonds combined with bank debt is 7.80% and the company's effective tax rate is 42% Calculate both the CAPM and ICAPM weighted average costs of capital for the following equity risk premium estimates. a. 8.10% b. 7.10% c. 5.10% d. 4.10% McDougan Associates (USA). McDougan Associates, a U.S.-based investment partnership, borrows 80,000,000 at a time when the exchange rate is $1.3453/. The entire principal is to be repaid in three years, and interest is 6.750% per annum, paid annually in euros. The euro is expected to depreciate vis--vis the dollar at 3.5% per annum. What is the effective cost of this loan for McDougan? X Problem 14-8 (algorithmic) A Question Help O Petrol Ibrico. Petrol Ibrico, a European gas company, is borrowing $700,000,000 via a syndicated eurocredit for six years at 80 basis points over LIBOR. LIBOR for the loan will be reset every six months. The funds will be provided by a syndicate of eight leading investment bankers, which will charge up-front fees totaling 1.3% of the principal amount. What is the effective interest cost for the first year if the annual LIBOR is 4.00% during the first six months and 4.20% during the second six months. The effective interest cost for the first year is % (Round to two decimal places.) Motoguzzie (A). Motoguzzie exports large-engine motorcycles (greater than 700cc) to Australia and invoices its customers in U.S. dollars. Sydney Wholesale Imports has purchased $2,940,000 of merchandise from Motoguzzie, with payment due in seven months. The payment will be made with a bankers' acceptance issued by Charter Bank of Sydney at a fee of 1.72% per annum. Motoguzzie has a weighted average cost of capital of 10.7%. If Motoguzzie holds this acceptance to maturity, what is its annualized percentage all-in cost? (NOTE: Assume a 360-day year.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started