Question

Chapter 11, Exercise 11-8 in Essentials of Accounting for Governmental & Not-for-Profit Organizations, 12th Edition by Paul A. Copley erroneously uses the amount of $750,000

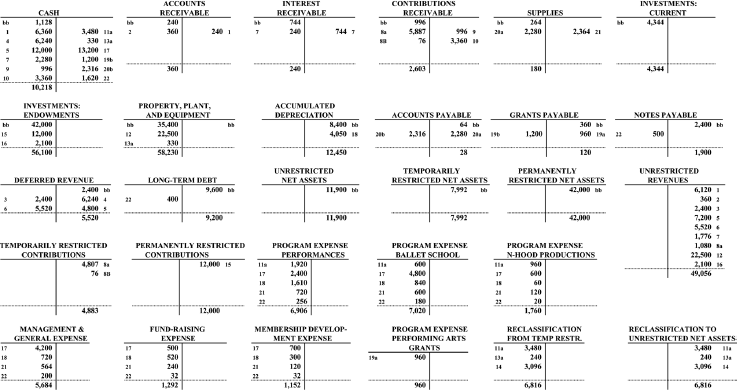

Chapter 11, Exercise 11-8 in Essentials of Accounting for Governmental & Not-for-Profit Organizations, 12th Edition by Paul A. Copley erroneously uses the amount of $750,000 instead of $670,000 in the closing entry credit for Net Assets Temporarily Restricted (p. 362). With the use of the incorrect amount, the closing entries, as shown in the text, do not balance. So how do i get the right balance what other amounts change?

A Statement of Activities using the format presented in Illustration 10-1.

A Statement of Unrestricted Revenues, Expenses, and Other Changes in Unrestricted Net Assets.

A Statement of Changes in Net Assets.

Your paper must:

Include both the completed financial statements and detailed analysis of the data provided.

Explain the process by which you completed the final statements and include any applicable supporting information computations and explanations.

Offer an in-depth analysis of the financial health of Lee College.

1.A Statement of Activities using the format presented in Illustration 10-1. 2.A Statement of Unrestricted Revenues, Expenses, and Other Changes in Unrestricted Net Assets. 3.A Statement of Changes in Net Assets.

1.Include both the completed financial statements and detailed analysis of the data provided. 2.Explain the process by which you completed the final statements and include any applicable supporting information computations and explanations. 3.Offer an in-depth analysis of the financial health of Lee College.

1.Include both the completed financial statements and detailed analysis of the data provided. 2.Explain the process by which you completed the final statements and include any applicable supporting information computations and explanations. 3.Offer an in-depth analysis of the financial health of Lee College.

CASH 6.360 6,240 330 12,000 3,200 2,280 1,200 1st 2316 3360 1,620 10,218 DEFERRED REVENUE CONTRIBUTIONS 4,817 sa 76 a MANAGEMENT & GENERALEXPENSE 4.200 720 200 RECEIVABLE 240 LONG TERM DEBT CONTRIBUTIONS 2,000 15 2.000 FUND-RAISING 520 32 ,292 RECEIVABLE 744 UNRESTRICTED NET ASSETS PERFORMANCES 920 720 256 6906 MEMBERSHIP DEVELOP- MENT EXPENSE RECEIVABLE 996 s 2,603 TEMPORARILY RESTRICTE ET ASSETS BALLET SCHOOL 4,800 PROGRAM ENPENSE SUPPLIES 264 2,280 PERMANENTLY RESTRICTED NET ASSETS N-HOOD PRODUCTIONS 20 FICATION M96 CURRENT 444 UNRESTRICTED REVENUES 6,120 5,520 1.776 22,500 RECLASSIFICATION TO CASH 6.360 6,240 330 12,000 3,200 2,280 1,200 1st 2316 3360 1,620 10,218 DEFERRED REVENUE CONTRIBUTIONS 4,817 sa 76 a MANAGEMENT & GENERALEXPENSE 4.200 720 200 RECEIVABLE 240 LONG TERM DEBT CONTRIBUTIONS 2,000 15 2.000 FUND-RAISING 520 32 ,292 RECEIVABLE 744 UNRESTRICTED NET ASSETS PERFORMANCES 920 720 256 6906 MEMBERSHIP DEVELOP- MENT EXPENSE RECEIVABLE 996 s 2,603 TEMPORARILY RESTRICTE ET ASSETS BALLET SCHOOL 4,800 PROGRAM ENPENSE SUPPLIES 264 2,280 PERMANENTLY RESTRICTED NET ASSETS N-HOOD PRODUCTIONS 20 FICATION M96 CURRENT 444 UNRESTRICTED REVENUES 6,120 5,520 1.776 22,500 RECLASSIFICATION TO

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started