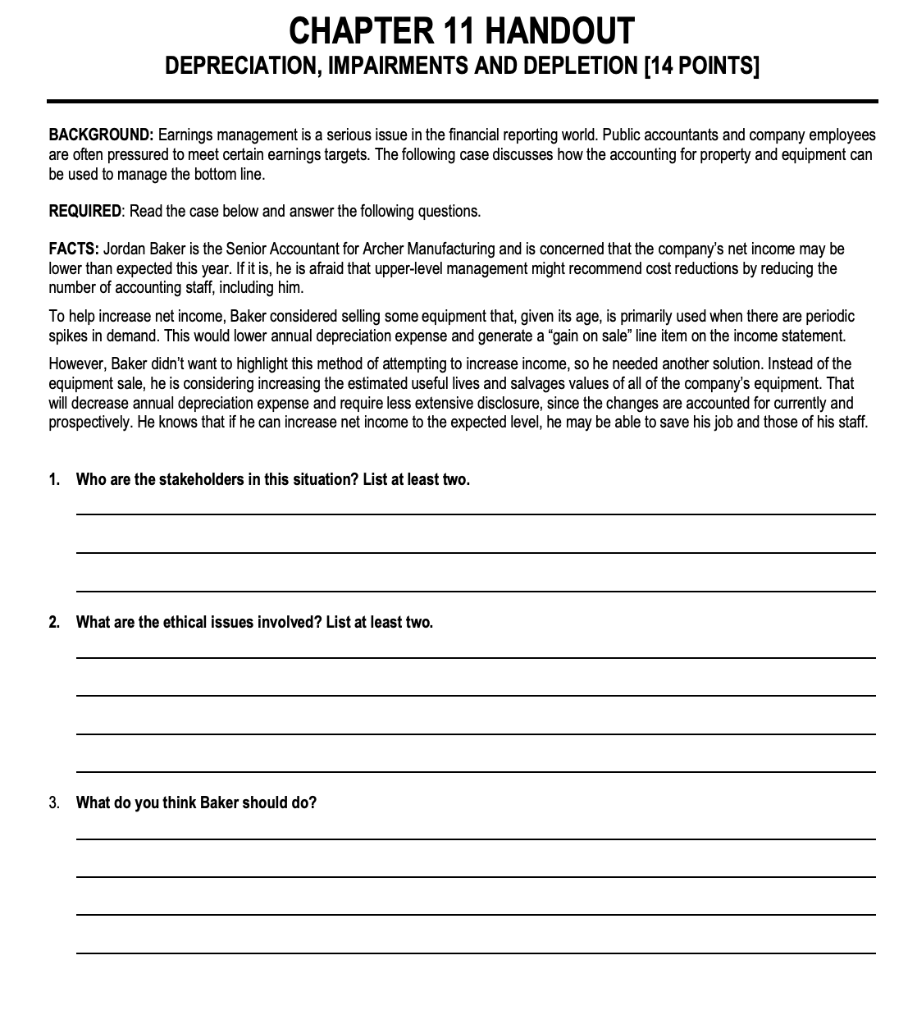

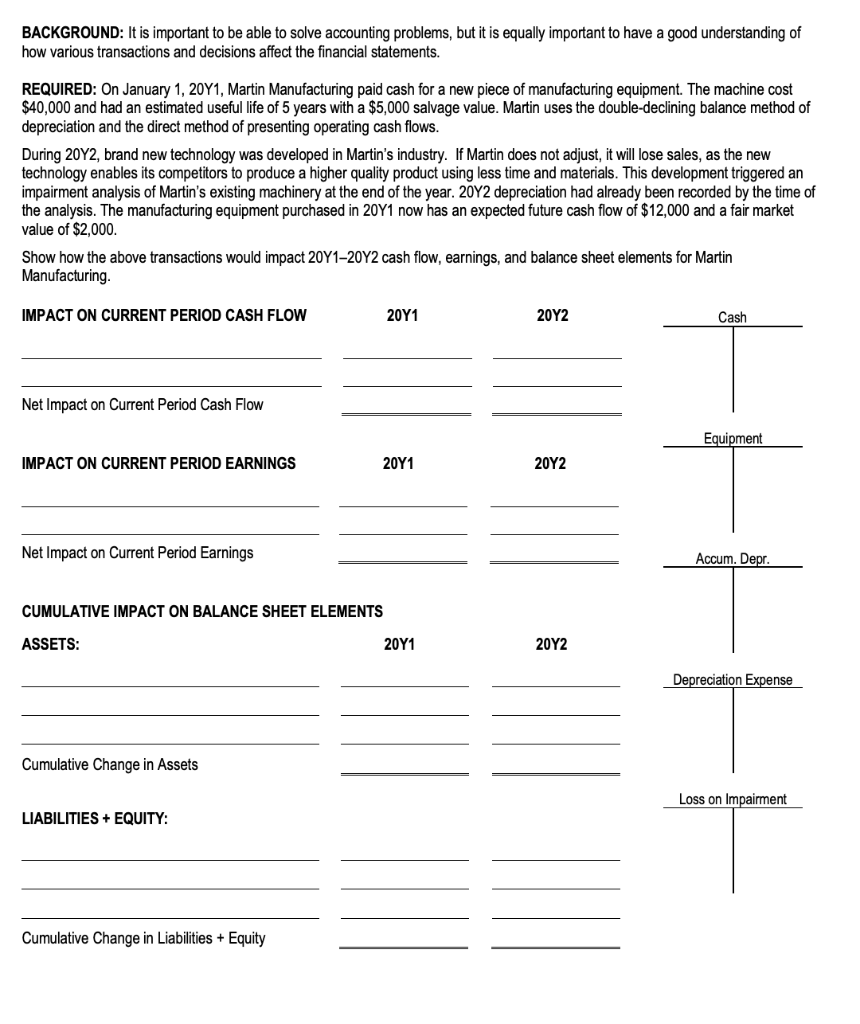

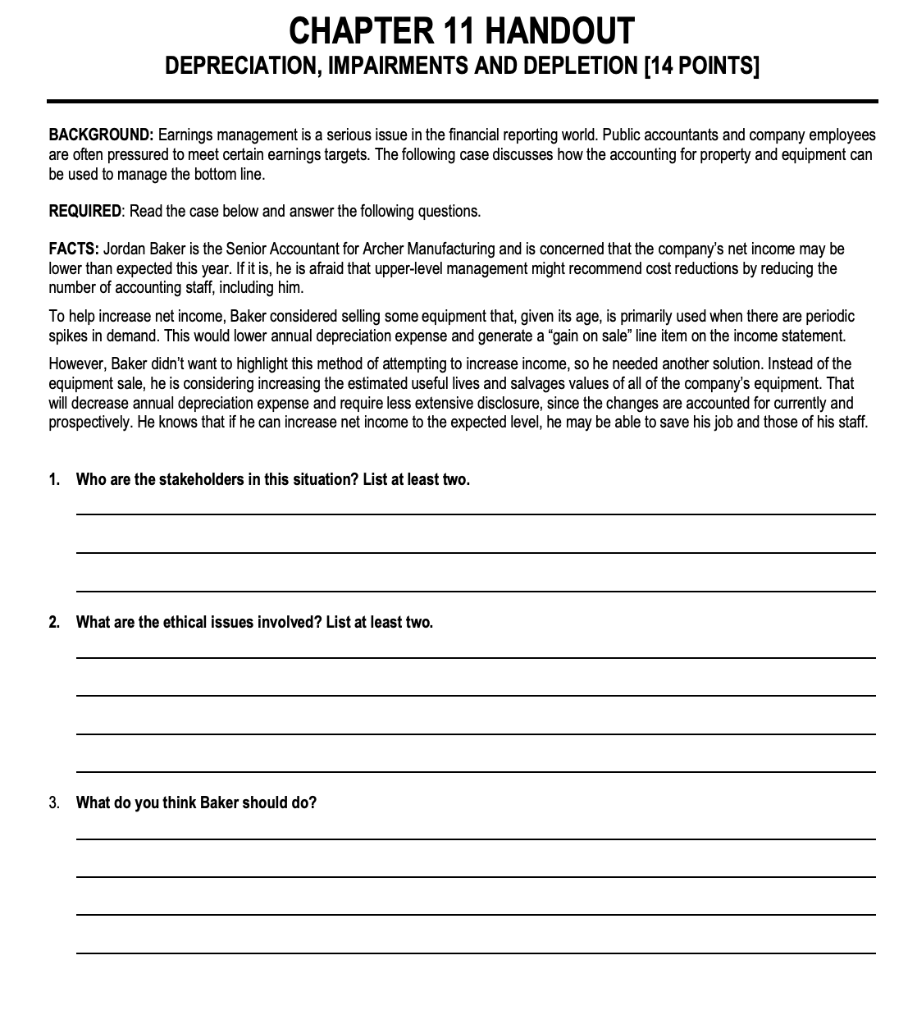

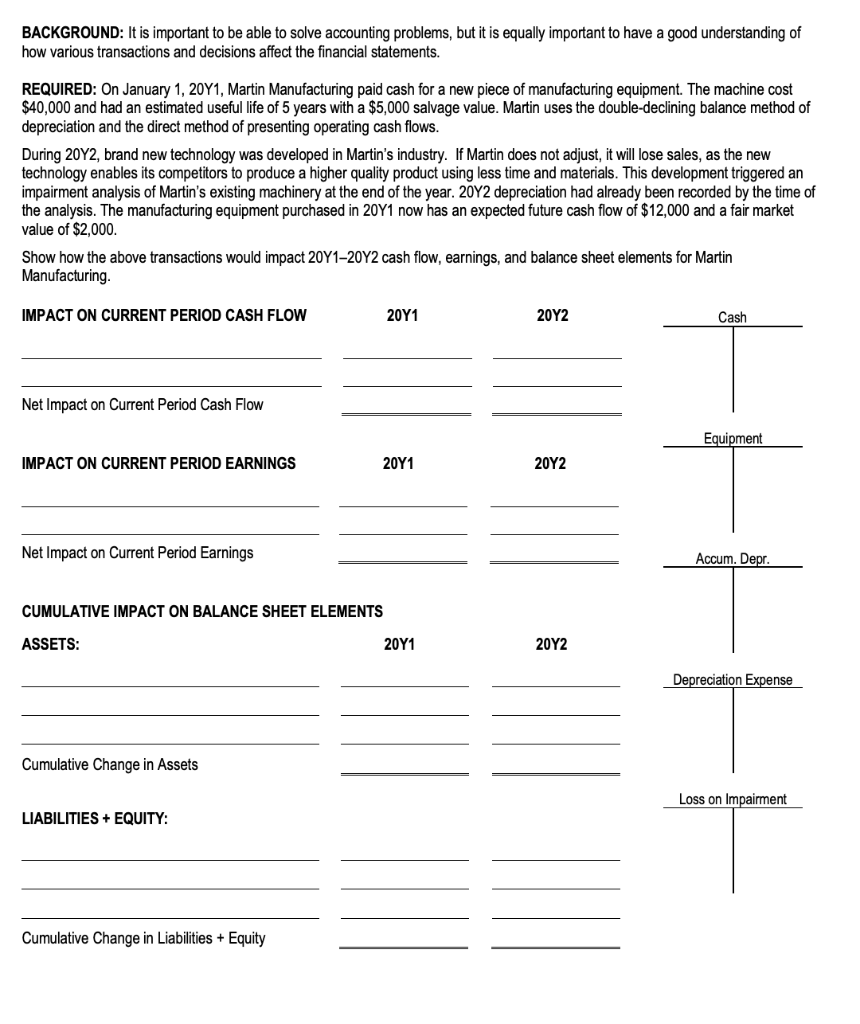

CHAPTER 11 HANDOUT DEPRECIATION, IMPAIRMENTS AND DEPLETION [14 POINTS] BACKGROUND: Earnings management is a serious issue in the financial reporting world. Public accountants and company employees are often pressured to meet certain earnings targets. The following case discusses how the accounting for property and equipment can be used to manage the bottom line. REQUIRED: Read the case below and answer the following questions. FACTS: Jordan Baker is the Senior Accountant for Archer Manufacturing and is concerned that the company's net income may be lower than expected this year. If it is, he is afraid that upper-level management might recommend cost reductions by reducing the number of accounting staff, including him. To help increase net income, Baker considered selling some equipment that, given its age, is primarily used when there are periodic spikes in demand. This would lower annual depreciation expense and generate a "gain on sale" line item on the income statement However, Baker didn't want to highlight this method of attempting to increase income, so he needed another solution. Instead of the equipment sale, he is considering increasing the estimated useful lives and salvages values of all of the company's equipment. That will decrease annual depreciation expense and require less extensive disclosure, since the changes are accounted for currently and prospectively. He knows that if he can increase net income to the expected level, he may be able to save his job and those of his staff. 1. Who are the stakeholders in this situation? List at least two. 2. What are the ethical issues involved? List at least two. 3. What do you think Baker should do? BACKGROUND: It is important to be able to solve accounting problems, but it is equally important to have a good understanding of how various transactions and decisions affect the financial statements. REQUIRED: On January 1, 20Y1, Martin Manufacturing paid cash for a new piece of manufacturing equipment. The machine cost $40,000 and had an estimated useful life of 5 years with a $5,000 salvage value. Martin uses the double-declining balance method of depreciation and the direct method of presenting operating cash flows. During 20Y2, brand new technology was developed in Martin's industry. If Martin does not adjust, it will lose sales, as the new technology enables its competitors to produce a higher quality product using less time and materials. This development triggered an impairment analysis of Martin's existing machinery at the end of the year. 2042 depreciation had already been recorded by the time of the analysis. The manufacturing equipment purchased in 20Y1 now has an expected future cash flow of $12,000 and a fair market value of $2,000. Show how the above transactions would impact 20Y1-20Y2 cash flow, earnings, and balance sheet elements for Martin Manufacturing IMPACT ON CURRENT PERIOD CASH FLOW 20Y1 20Y2 Cash Net Impact on Current Period Cash Flow Equipment IMPACT ON CURRENT PERIOD EARNINGS 20Y1 20Y2 Net Impact on Current Period Earnings Accum. Depr. CUMULATIVE IMPACT ON BALANCE SHEET ELEMENTS ASSETS: 20Y1 20Y2 Depreciation Expense Cumulative Change in Assets Loss on Impairment LIABILITIES + EQUITY: Cumulative Change in Liabilities + Equity