Answered step by step

Verified Expert Solution

Question

1 Approved Answer

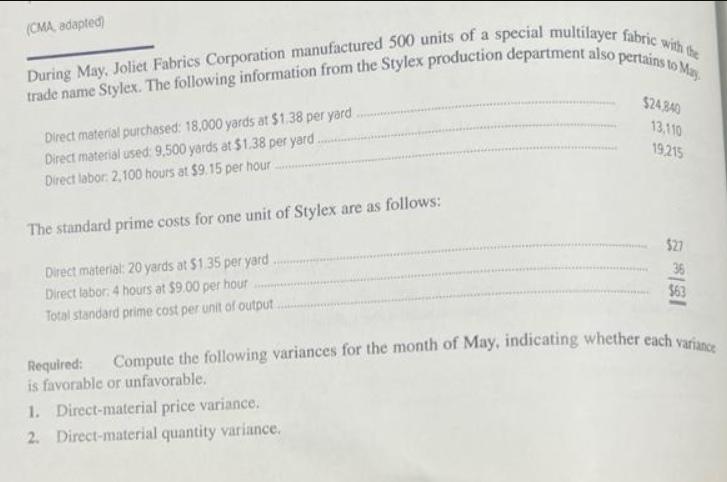

(CMA adapted) trade name Stylex. The following information from the Stylex production department also pertains to May During May, Joliet Fabrics Corporation manufactured 500

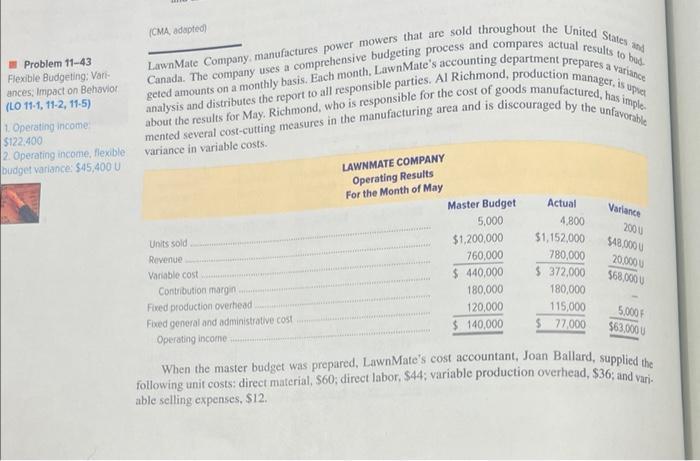

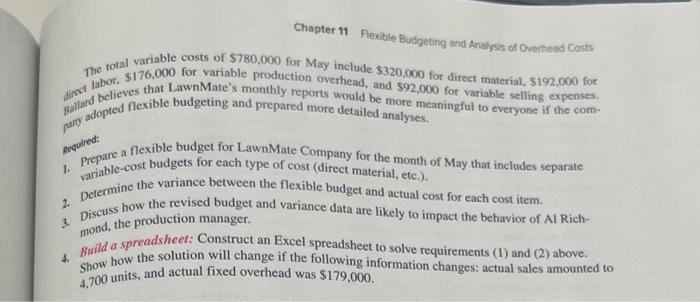

(CMA adapted) trade name Stylex. The following information from the Stylex production department also pertains to May During May, Joliet Fabrics Corporation manufactured 500 units of a special multilayer fabric with the Direct material purchased: 18,000 yards at $1.38 per yard Direct material used: 9,500 yards at $1.38 per yard Direct labor: 2,100 hours at $9.15 per hour. The standard prime costs for one unit of Stylex are as follows: Direct material: 20 yards at $1.35 per yard. Direct labor: 4 hours at $9.00 per hour Total standard prime cost per unit of output.. $24.840 13,110 19,215 $27 36 $63 Required: Compute the following variances for the month of May, indicating whether each variance is favorable or unfavorable. 1. Direct-material price variance. 2. Direct-material quantity variance. 3. Direct-material purchase price variance. 4. Direct-labor rate variance. 5. Direct-labor efficiency variance. Problem 11-43 Flexible Budgeting: Vari- ances; Impact on Behavior (LO 11-1, 11-2, 11-5) 1. Operating income $122.400 2. Operating income, flexible budget variance: $45,400 U (CMA adapted) Canada. The company uses a comprehensive budgeting process and compares actual results to bod LawnMate Company, manufactures power mowers that are sold throughout the United States and geted amounts on a monthly basis. Each month, LawnMate's accounting department prepares a variance analysis and distributes the report to all responsible parties. Al Richmond, production manager, is upset about the results for May, Richmond, who is responsible for the cost of goods manufactured, has imple mented several cost-cutting measures in the manufacturing area and is discouraged by the unfavorable variance in variable costs. Units sold Revenue Variable cost Contribution margin Fixed production overhead Fixed general and administrative cost Operating income LAWNMATE COMPANY Operating Results For the Month of May Master Budget 5,000 $1,200,000 760,000 $ 440,000 180,000 120,000 $ 140,000 Actual 4,800 $1,152,000 780,000 $ 372,000 180,000 115,000 77,000 Variance 200 U $48,000 U 20,000 U $68,000 U 5,000 F $63,000 U When the master budget was prepared, LawnMate's cost accountant, Joan Ballard, supplied the following unit costs: direct material, $60; direct labor, $44; variable production overhead, $36; and vari able selling expenses, $12. Chapter 11 Flexible Budgeting and Analysis of Overhead Costs The total variable costs of $780,000 for May include $320,000 for direct material, $192,000 for direct labor, $176,000 for variable production overhead, and $92,000 for variable selling expenses. Ballard believes that LawnMate's monthly reports would be more meaningful to everyone if the com- pany adopted flexible budgeting and prepared more detailed analyses. Required: 1. Prepare a flexible budget for LawnMate Company for the month of May that includes separate variable-cost budgets for each type of cost (direct material, etc.). 2. Determine the variance between the flexible budget and actual cost for each cost item. 3. Discuss how the revised budget and variance data are likely to impact the behavior of Al Rich- mond, the production manager. 4. Build a spreadsheet: Construct an Excel spreadsheet to solve requirements (1) and (2) above. Show how the solution will change if the following information changes: actual sales amounted to 4,700 units, and actual fixed overhead was $179,000.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Problem 1035 Directmaterial price variance The standard price for direct material is 135 per yard and the actual price is 138 per yard Therefore the directmaterial price variance is unfavorable and is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started