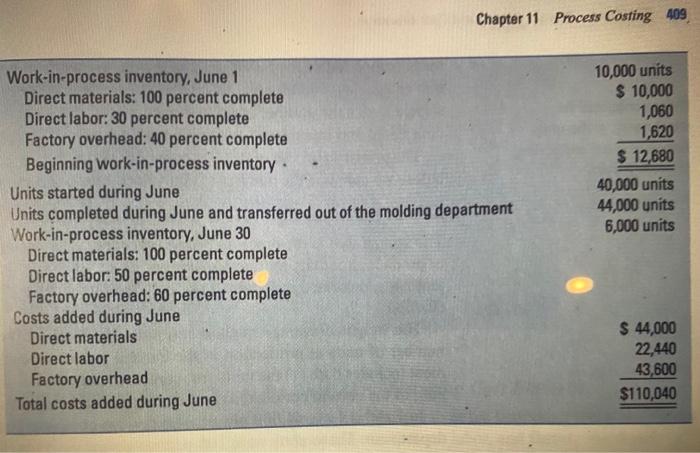

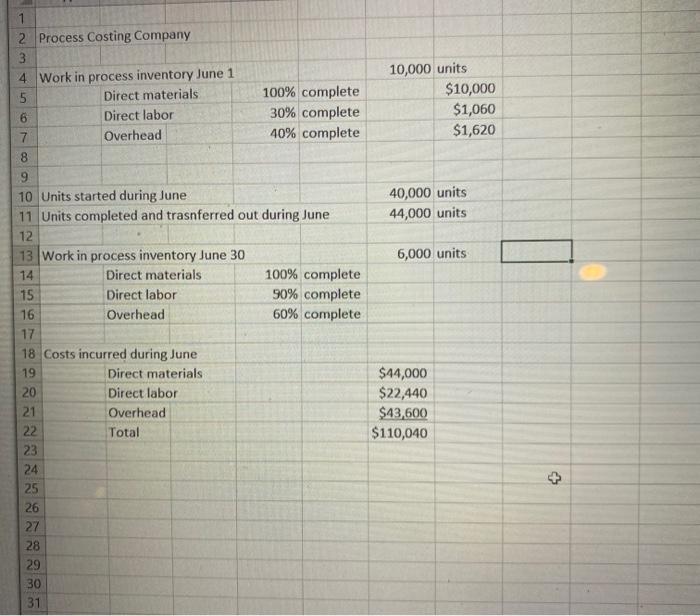

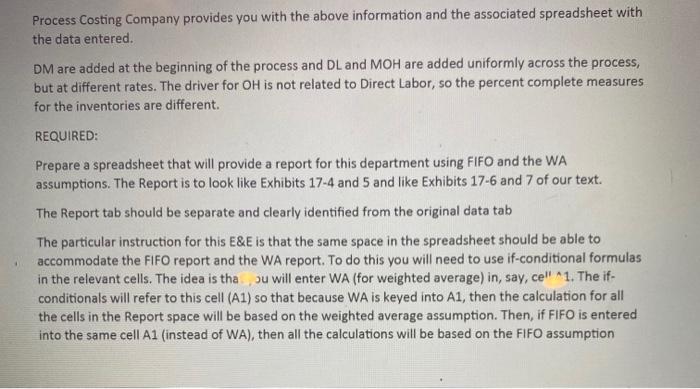

Chapter 11 Process Costing 409 10,000 units $ 10,000 1,060 1,620 $ 12,680 40,000 units 44,000 units 6,000 units Work-in-process inventory, June 1 Direct materials: 100 percent complete Direct labor: 30 percent complete Factory overhead: 40 percent complete Beginning work-in-process inventory Units started during June Units completed during June and transferred out of the molding department Work-in-process inventory, June 30 Direct materials: 100 percent complete Direct labor: 50 percent complete Factory overhead: 60 percent complete Costs added during June Direct materials Direct labor Factory overhead Total costs added during June $ 44,000 22,440 43,600 $110,040 1 2 Process Costing Company 3 4 Work in process inventory June 1 5 Direct materials 6 Direct labor 7 Overhead 8 100% complete 30% complete 40% complete 10,000 units $10,000 $1,060 $1,620 40,000 units 44,000 units 6,000 units 9 10 Units started during June 11 Units completed and trasnferred out during June 12 13 Work in process inventory June 30 14 Direct materials 100% complete 15 Direct labor 90% complete 16 Overhead 60% complete 17 18 Costs incurred during June 19 Direct materials 20 Direct labor 21 Overhead 22 Total 23 24 25 26 27 28 29 30 31 $44,000 $22,440 $43,600 $110,040 + Process Costing Company provides you with the above information and the associated spreadsheet with the data entered. DM are added at the beginning of the process and DL and MOH are added uniformly across the process, but at different rates. The driver for OH is not related to Direct Labor, so the percent complete measures for the inventories are different. REQUIRED: Prepare a spreadsheet that will provide a report for this department using FIFO and the WA assumptions. The Report is to look like Exhibits 17-4 and 5 and like Exhibits 17-6 and 7 of our text. The Report tab should be separate and clearly identified from the original data tab The particular instruction for this E&E is that the same space in the spreadsheet should be able to accommodate the FIFO report and the WA report. To do this you will need to use if-conditional formulas in the relevant cells. The idea is tha ju will enter WA (for weighted average) in, say, cell A1. The if- conditionals will refer to this cell (A1) so that because WA is keyed into A1, then the calculation for all the cells in the Report space will be based on the weighted average assumption. Then, if FIFO is entered into the same cell A1 (instead of WA), then all the calculations will be based on the FIFO assumption because all the if-conditional formulas will refer back to that cell A1. The same report space should report correctly on FIFO if FIFO is requested and on WA if WA is requested