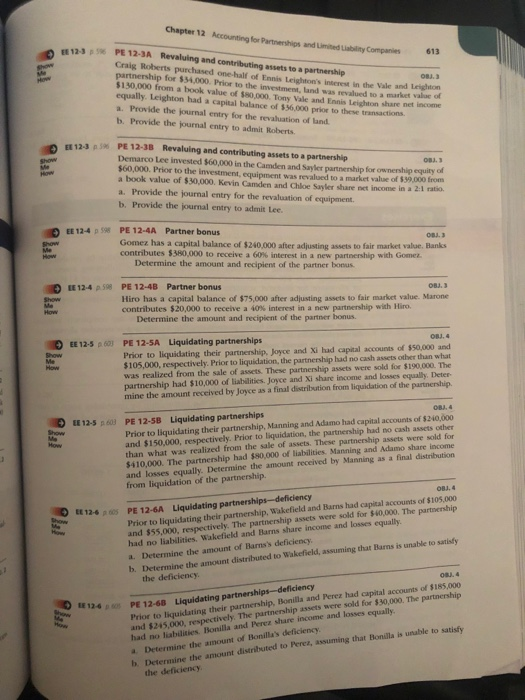

Chapter 12 Accounting for Partnerships and Limited Liablity Companies Revaluing and contributing assets to a partnership "'2-3p5% PE 12-3A 613 Craig Roberts purchased one-half of Ennis Leighton's interest in the Vale and Leighion partnership for $34,000. Prior to the investment, land was revalued to a market value $130,000 from a book value of $80,000. Tony Vale and Ennis Leighton s equally. Leighton had a capital balance of $56,000 prior to these transactions a. Provide the journal entry for the revaluation of land. b. Provide the journal entry to admit Roberts osa, 3 hare net income EI 12-3 p 198 PE 12-3B Demarco Lee invested $60,000 in the Camden and Sayler partnership for ownership equity of Revaluing and contributing assets to a partnership $60,000. Prior to the investment, equipment was revalued to a market value of $39,000 trom a book value of $30,000. Kevin Camden and Chloe Sayler share net income in a 2:1 ratio a. Provide the journal entry for the revaluation of equipment. b. Provide the journal entry to admit Lee. , 3 EE 12-4 p 598 PE 12-4A Partner bonus Gomez has a capital balance of $240,000 after adjusting assets to fair market value. Banks contributes S380.000 to receive a 60% interest in anew partnership with Gomez ou, 3 Determine the amount and recipient of the partner bonus IE12-4 p 58 PE 12-48 Partner bonus Hiro has a capital balance of $75,000 after adjusting assets to fair market value. Marone contributes $20,000 to receive a 40% interest in a new partnership with Hiro. Determine the amount and recipient of the partner iD PE 12-5A Prior to liquidating their partnership, Joyce and Xi had capital accounts of $50,000 and $105,000, respectively. Prior to liquidation, the partnership had no cash assets other than what was realized from the sale of assets. These partnership assets were sold for $190,000. The partnership had $10,000 of liabilities. Joyce and Xi share income and losses equally. Deter mine the amount received by Joyce as a final distribution from liquidation of the partnership. EE 12-562, Liquidating partnerships OR. 4 0B1.4 EE12-563 PE 12-5B Liquidating partnerships Prior to liquidating their partnership, Manning and Adamo had capital accounts of $240,000 and s150000 respoctively Pr r to lieuidation, the paurtnershig had no cash awscts other Howw than what was realized from the sale of assets. These partnership assets were sold for and losses equally. Determine the amount received by Manning as a final distribution from liquidation of the partnership. had $80,000 of liabilities. Manning and Adamo share income PE 12-6A Liquidating partnerships-deficiency Prior to liquidating their partnership, Wakefield and Barns had capital accounts of $105.000 and $55,000, respectively. The partnership assets were sold for $40,000. The partnership had no liabilities. Wakefield and Barns share income and losses equally 124 a. Determine the amount of Barns's deficiency b. Determine the amount distributed to Wakefield, assuming that Barns is unable to satisfy the deficiency. Prior to liquidating their partnership, Bonilla and Perez had capital accounts of $185,000 and $245,000, respectively. The partnership assets were sold for $30,000. The partnership had no liabilities. Bonilla and Perez share income and losses equally 124,PE 12-68 Liquidating partnerships-delidency a Determine the amount of Bonilla's deficiency b. Determine the amount distributed to Perez, assuming that Bonilla is unable to satisfy the deficiency Chapter 12 Accounting for Partnerships and Limited Liablity Companies Revaluing and contributing assets to a partnership "'2-3p5% PE 12-3A 613 Craig Roberts purchased one-half of Ennis Leighton's interest in the Vale and Leighion partnership for $34,000. Prior to the investment, land was revalued to a market value $130,000 from a book value of $80,000. Tony Vale and Ennis Leighton s equally. Leighton had a capital balance of $56,000 prior to these transactions a. Provide the journal entry for the revaluation of land. b. Provide the journal entry to admit Roberts osa, 3 hare net income EI 12-3 p 198 PE 12-3B Demarco Lee invested $60,000 in the Camden and Sayler partnership for ownership equity of Revaluing and contributing assets to a partnership $60,000. Prior to the investment, equipment was revalued to a market value of $39,000 trom a book value of $30,000. Kevin Camden and Chloe Sayler share net income in a 2:1 ratio a. Provide the journal entry for the revaluation of equipment. b. Provide the journal entry to admit Lee. , 3 EE 12-4 p 598 PE 12-4A Partner bonus Gomez has a capital balance of $240,000 after adjusting assets to fair market value. Banks contributes S380.000 to receive a 60% interest in anew partnership with Gomez ou, 3 Determine the amount and recipient of the partner bonus IE12-4 p 58 PE 12-48 Partner bonus Hiro has a capital balance of $75,000 after adjusting assets to fair market value. Marone contributes $20,000 to receive a 40% interest in a new partnership with Hiro. Determine the amount and recipient of the partner iD PE 12-5A Prior to liquidating their partnership, Joyce and Xi had capital accounts of $50,000 and $105,000, respectively. Prior to liquidation, the partnership had no cash assets other than what was realized from the sale of assets. These partnership assets were sold for $190,000. The partnership had $10,000 of liabilities. Joyce and Xi share income and losses equally. Deter mine the amount received by Joyce as a final distribution from liquidation of the partnership. EE 12-562, Liquidating partnerships OR. 4 0B1.4 EE12-563 PE 12-5B Liquidating partnerships Prior to liquidating their partnership, Manning and Adamo had capital accounts of $240,000 and s150000 respoctively Pr r to lieuidation, the paurtnershig had no cash awscts other Howw than what was realized from the sale of assets. These partnership assets were sold for and losses equally. Determine the amount received by Manning as a final distribution from liquidation of the partnership. had $80,000 of liabilities. Manning and Adamo share income PE 12-6A Liquidating partnerships-deficiency Prior to liquidating their partnership, Wakefield and Barns had capital accounts of $105.000 and $55,000, respectively. The partnership assets were sold for $40,000. The partnership had no liabilities. Wakefield and Barns share income and losses equally 124 a. Determine the amount of Barns's deficiency b. Determine the amount distributed to Wakefield, assuming that Barns is unable to satisfy the deficiency. Prior to liquidating their partnership, Bonilla and Perez had capital accounts of $185,000 and $245,000, respectively. The partnership assets were sold for $30,000. The partnership had no liabilities. Bonilla and Perez share income and losses equally 124,PE 12-68 Liquidating partnerships-delidency a Determine the amount of Bonilla's deficiency b. Determine the amount distributed to Perez, assuming that Bonilla is unable to satisfy the deficiency