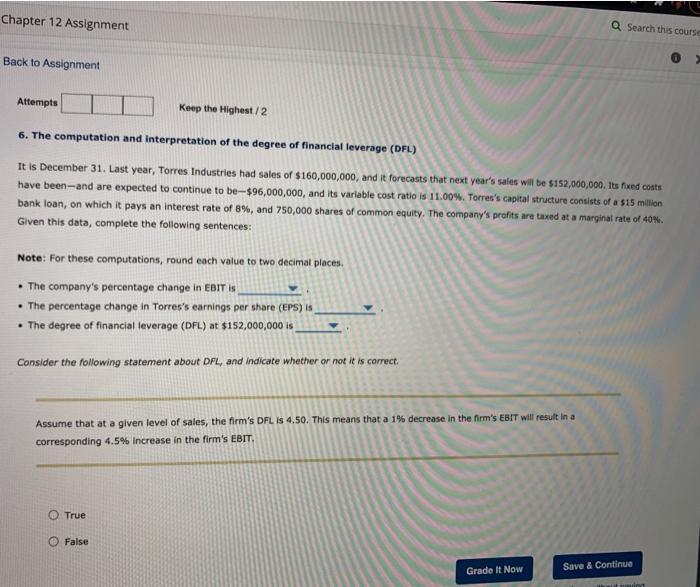

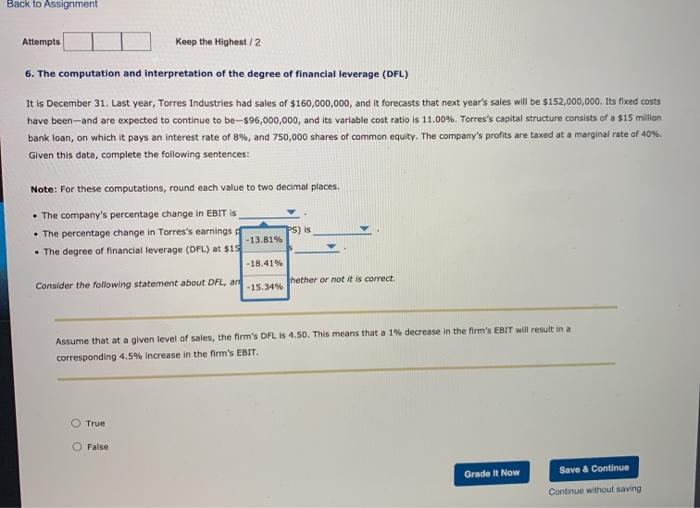

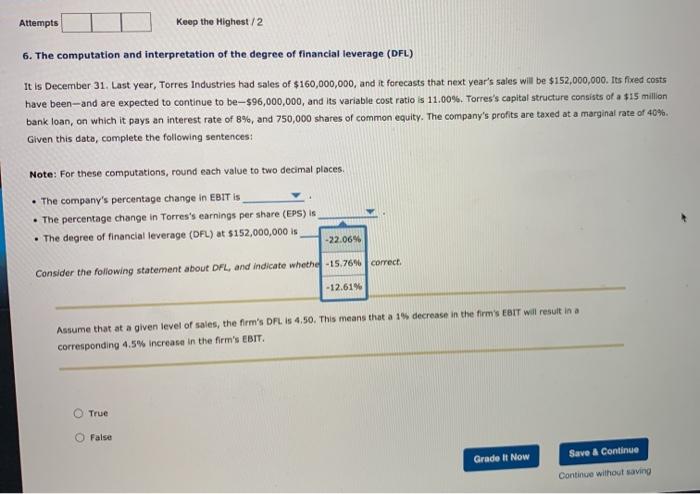

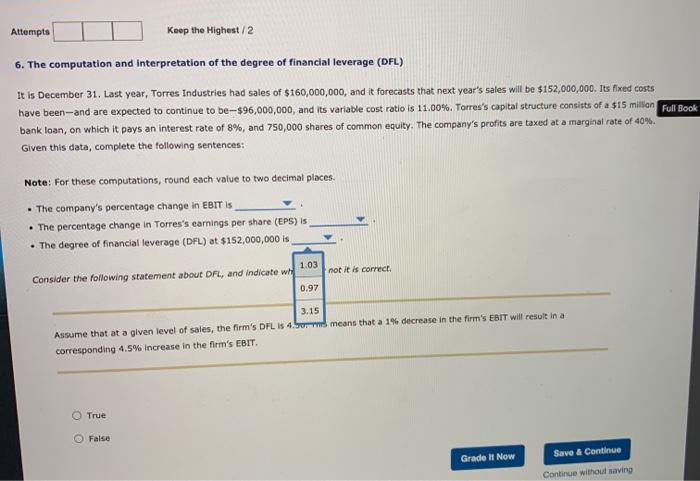

Chapter 12 Assignment Q Search this course Back to Assignment Attempts Keep the Highest/2 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Its fixed costs have been-and are expected to continue to be-$96,000,000, and its variable cost ratio is 11.00%. Torres's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 8%, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences: Note: For these computations, round each value to two decimal places The company's percentage change in EBIT IS The percentage change in Torres's earnings per share (EPS) is . The degree of financial leverage (DFL) at $152,000,000 is Consider the following statement about DFL, and indicate whether or not it is correct. Assume that at a given level of sales, the firm's DFL is 4,50. This means that a 1% decrease in the firm's EBIT will result in a corresponding 4.5% increase in the firm's EBIT. True False Grade It Now Save & Continue Back to Assignment Attempts Keep the Highest / 2 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Its fixed costs have been-and are expected to continue to be-$96,000,000, and its variable cost ratio is 11,00%. Torres's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 8%, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40% Given this data, complete the following sentences: Note: For these computations, round each value to two decimal places. The company's percentage change in EBIT is The percentage change in Torres's earnings of OS) is -13.81% . The degree of financial leverage (OFL) at $15 -18.41% Consider the following statement about DFL, an Thether or not it is correct. - 15.34% Assume that at a given level of sales, the firm's DFL is 4.50. This means that a 1% decrease in the firm's EBIT will result in a corresponding 4.5% Increase in the firm's EBIT. True False Grade It Now Save & Continue Continue without saving Attempts Keep the Highest/2 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Its fixed costs have been-and are expected to continue to be-$96,000,000, and its variable cost ratio is 11.00%. Torres's capital structure consists of a $15 million bank loan, on which it pays an interest rate of 8%, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40%. Given this data, complete the following sentences: Note: For these computations, round each value to two decimal places. The company's percentage change in EBIT is The percentage change in Torres's earnings per share (EPS) is The degree of financial leverage (DFL) at $152,000,000 is -22.06% Consider the following statement about DFL, and indicate whethe-15.76% correct . -12.61% Assume that at a given level of sales, the firm's DFL is 4,50. This means that a 15 decrease in the firm's eart will result in a corresponding 4.5% increase in the firm's EBIT. True False Grade It Now Save & Continue Continue without saving Attempts Keep the Highest / 2 6. The computation and interpretation of the degree of financial leverage (DFL) It is December 31. Last year, Torres Industries had sales of $160,000,000, and it forecasts that next year's sales will be $152,000,000. Its fixed costs have been-and are expected to continue to be-$96,000,000, and its variable cost ratio is 11.00%. Torres's capital structure consists of a $15 milion Full Book bank loan, on which it pays an interest rate of 8%, and 750,000 shares of common equity. The company's profits are taxed at a marginal rate of 40%. Given this data, complete the following sentences: Note: For these computations, round each value to two decimal places. The company's percentage change in EBIT is The percentage change in Torres's earnings per share (EPS) is The degree of financial leverage (DFL) at $152,000,000 is 1.03 not it is correct Consider the following statement about DF, and indicate wind 0.97 3.15 Assume that at a given level of sales, the firm's DFL is 4.Surmd means that a 1% decrease in the firm's EBIT will result in a corresponding 4.5% increase in the firm's EBIT True False Save & Continue Grade It Now Continue without saving