Question

Chapter 12 Engine Repairs Ltd. Review of COMPANY, RECEIVABLES, PAYABLES, INVENTORY & SERVICES modules and Reconciliation & Deposits. Introduction Engine Repairs Ltd. is a service

Chapter 12 Engine Repairs Ltd.

Review of COMPANY, RECEIVABLES, PAYABLES, INVENTORY & SERVICES modules and Reconciliation & Deposits.

Introduction

Engine Repairs Ltd. is a service company that repairs and maintains small engines (lawn movers, garden tillers, small tractors, etc.).

The manual accounting records were converted to Sage 50 Accounting using the following modules at May 31, 2023.

GENERAL RECEIVABLES PAYABLES INVENTORY & SERVICES

You have assumed the position of Bank Reconciliation clerk as of June 30. The previous clerk did not record any bank activity for June 2023.

Download and Open the Company File

1. Refer to Exercise 1-1b, to unzip the Case_4_Engine.exe file. 2. Open the Case_4_Engine file and accept the May 31, 2023 date.

Note: Engine Repairs Ltd. does not print invoices or cheques. Sales terms, if any, are identified with Cash Receipts information.

Entering transactions and Reconciliation

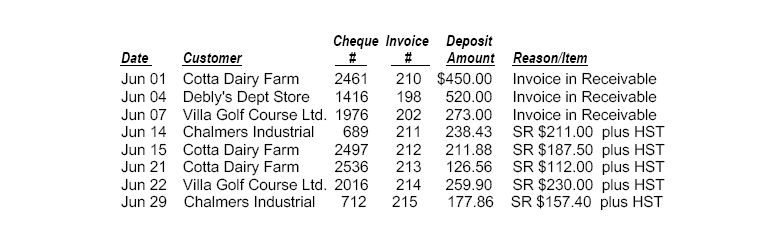

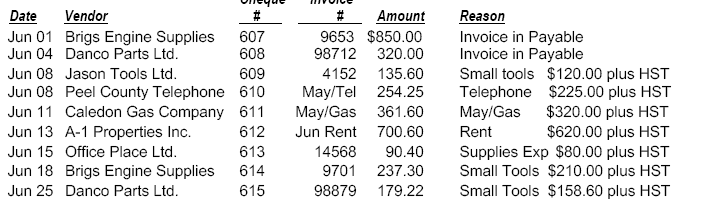

The owner of Engine Repairs Ltd. has asked you to: 3. Set up the linking accounts for the Reconciliation & Deposits Journal for May 31 to June 30. 4. Record the manual Cash Receipts Journal (containing bank account entries) as indicated next.

5. Record the manual Cash Disbursements Journal (containing bank account entries) as indicated next.

6. Advance the date to June 30 and complete the June 30th bank reconciliation. Prepare and post journal entries as required. Relevant information is presented below.

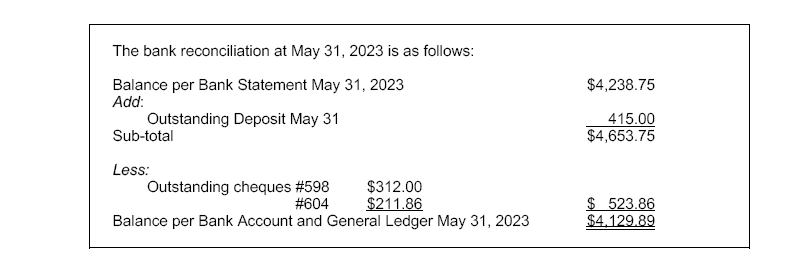

- a) May 31 bank reconciliation.

- b) June 30 bank statement as follows:

- c) Additional Information provided.

- The bank does not charge the firm for processing a customer's NSF cheque.

- The June 29 Loan Payment/Interest deduction is for the Bank Loan Payable account. Interest of $38.00 is included in the $300.00 payment. Note: Dont forget to create a journal entry for the loan principal portion.

To complete the Bank Reconciliation at June 30, the 3 outstanding items (1 deposit and 2 cheques) need to be Inserted as Outstanding items, as shown next.

The bank reconciliation at May 31,2023 is as follows: Balance per Bank Statement May 31, 2023 Add: Outstanding Deposit May 31 Sub-total $4,238.75 Less: $4,653.75415.00 Outstanding cheques \#598 $312.00 #604$211.86 Balance per Bank Account and General Ledger May 31, 2023 $523.86$4.129.89 The bank reconciliation at May 31,2023 is as follows: Balance per Bank Statement May 31, 2023 Add: Outstanding Deposit May 31 Sub-total $4,238.75 Less: $4,653.75415.00 Outstanding cheques \#598 $312.00 #604$211.86 Balance per Bank Account and General Ledger May 31, 2023 $523.86$4.129.89Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started