Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Chapter 12 Exercise Which one of the following would not be considered a disadvantage of the partnership form of organization? a. Limited life b. Unlimited

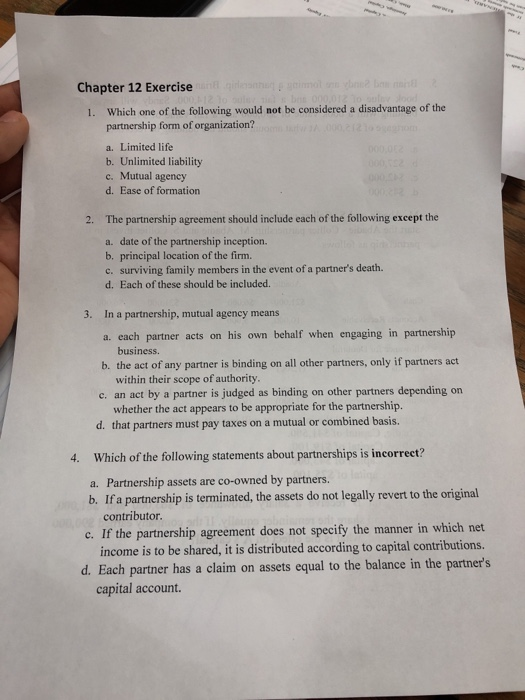

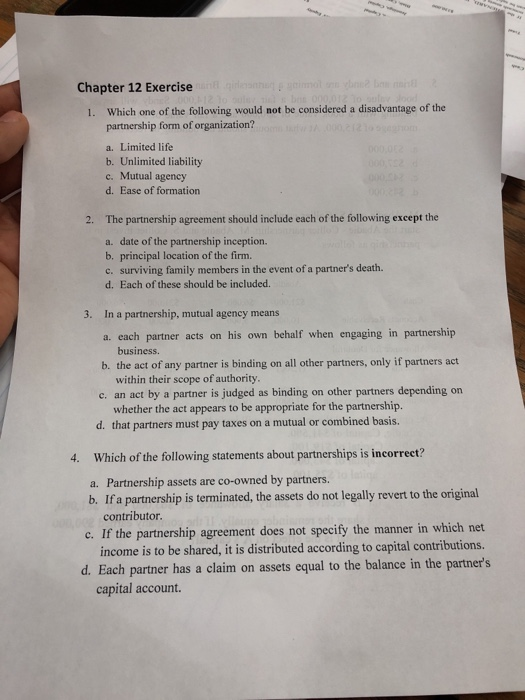

Chapter 12 Exercise Which one of the following would not be considered a disadvantage of the partnership form of organization? a. Limited life b. Unlimited liability c. Mutual agency d. Ease of formation 1. 2. The partnership agreement should include each of the following except the a. date of the partnership inception. b. principal location of the firm. c. surviving family members in the event of a partner's death. d. Each of these should be included. In a partnership, mutual agency means a. each partner acts on his own behalf when engaging in partnership 3. business. b. the act of any partner is binding on all other partners, only if partners act within their scope of authority. c. an act by a partner is judged as binding on other partners depending on whether the act appears to be appropriate for the partnership. that partners must pay taxes on a mutual or combined basis. Which of the following statements about partnerships is incorrect? a. Partnership assets are co-owned by partners. 4. b. If a partnership is terminated, the assets do not legally revert to the original contributor. c. If the partnership agreement does not specify the manner in which net income is to be shared, it is distributed according to capital contributions Each partner has a claim on assets equal to the balance in the partners capital account d

Chapter 12 Exercise Which one of the following would not be considered a disadvantage of the partnership form of organization? a. Limited life b. Unlimited liability c. Mutual agency d. Ease of formation 1. 2. The partnership agreement should include each of the following except the a. date of the partnership inception. b. principal location of the firm. c. surviving family members in the event of a partner's death. d. Each of these should be included. In a partnership, mutual agency means a. each partner acts on his own behalf when engaging in partnership 3. business. b. the act of any partner is binding on all other partners, only if partners act within their scope of authority. c. an act by a partner is judged as binding on other partners depending on whether the act appears to be appropriate for the partnership. that partners must pay taxes on a mutual or combined basis. Which of the following statements about partnerships is incorrect? a. Partnership assets are co-owned by partners. 4. b. If a partnership is terminated, the assets do not legally revert to the original contributor. c. If the partnership agreement does not specify the manner in which net income is to be shared, it is distributed according to capital contributions Each partner has a claim on assets equal to the balance in the partners capital account d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started