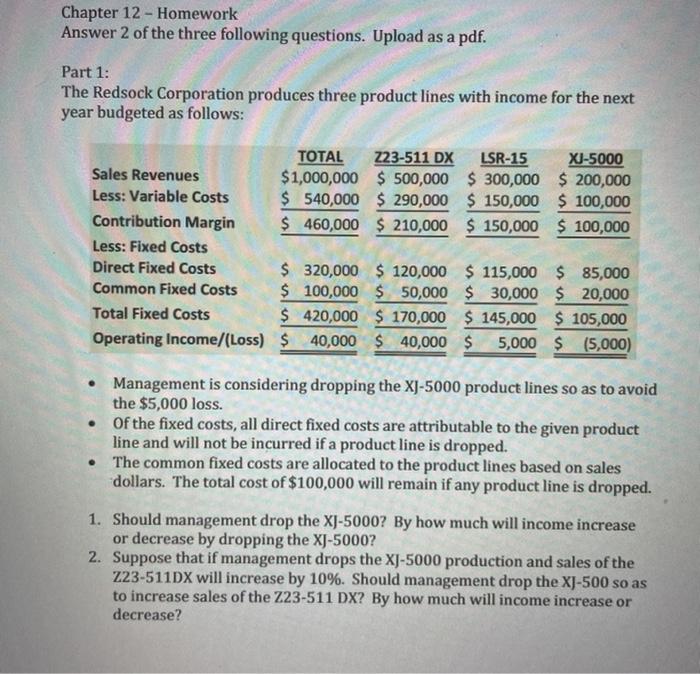

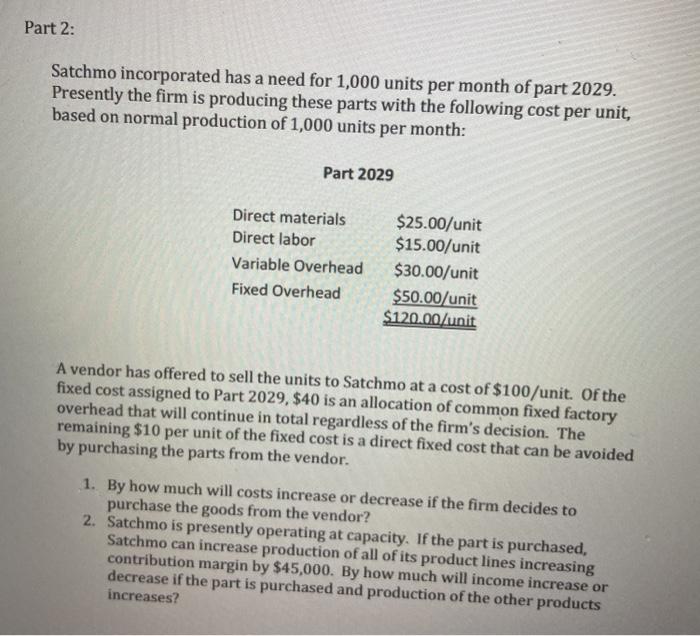

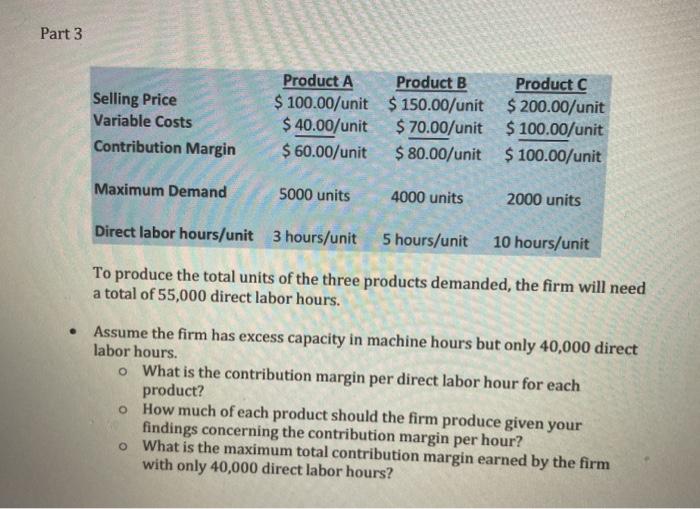

Chapter 12 - Homework Answer 2 of the three following questions. Upload as a pdf. Part 1: The Redsock Corporation produces three product lines with income for the next year budgeted as follows: TOTAL Z23-511 DX LSR-15 XJ-5000 Sales Revenues $1,000,000 $ 500,000 $ 300,000 $ 200,000 Less: Variable Costs $ 540,000 $ 290,000 $150,000 $100,000 Contribution Margin $ 460,000 $ 210,000 $ 150,000 $100,000 Less: Fixed Costs Direct Fixed Costs $ 320,000 $ 120,000 $ 115,000 $ 85,000 Common Fixed Costs $ 100,000 $50,000 $ 30,000 $ 20,000 Total Fixed Costs $ 420,000 $ 170,000 $ 145,000 $ 105,000 Operating Income/(Loss) $ 40,000 $40,000 $ 5,000 $ (5,000) Management is considering dropping the XJ-5000 product lines so as to avoid the $5,000 loss. of the fixed costs, all direct fixed costs are attributable to the given product line and will not be incurred if a product line is dropped. The common fixed costs are allocated to the product lines based on sales dollars. The total cost of $100,000 will remain if any product line is dropped. 1. Should management drop the XJ-5000? By how much will income increase or decrease by dropping the XJ-5000? 2. Suppose that if management drops the XJ-5000 production and sales of the Z23-511DX will increase by 10%. Should management drop the XJ-500 so as to increase sales of the Z23-511 DX? By how much will income increase or decrease? Part 2: Satchmo incorporated has a need for 1,000 units per month of part 2029. Presently the firm is producing these parts with the following cost per unit, based on normal production of 1,000 units per month: Part 2029 Direct materials Direct labor Variable Overhead Fixed Overhead $25.00/unit $15.00/unit $30.00/unit $50.00/unit $120.00/unit A vendor has offered to sell the units to Satchmo at a cost of $100/unit. Of the fixed cost assigned to Part 2029, $40 is an allocation of common fixed factory overhead that will continue in total regardless of the firm's decision. The remaining $10 per unit of the fixed cost is a direct fixed cost that can be avoided by purchasing the parts from the vendor. 1. By how much will costs increase or decrease if the firm decides to purchase the goods from the vendor? 2. Satchmo is presently operating at capacity. If the part is purchased, Satchmo can increase production of all of its product lines increasing contribution margin by $45,000. By how much will income increase or decrease if the part is purchased and production of the other products increases? Part 3 Selling Price Variable Costs Contribution Margin Product A Product B Product C $ 100.00/unit $ 150.00/unit $ 200.00/unit $ 40.00/unit $ 70.00/unit $ 100.00/unit $ 60.00/unit $ 80.00/unit $ 100.00/unit Maximum Demand 5000 units 4000 units 2000 units Direct labor hours/unit 3 hours/unit 5 hours/unit 10 hours/unit To produce the total units of the three products demanded, the firm will need a total of 55,000 direct labor hours. Assume the firm has excess capacity in machine hours but only 40,000 direct labor hours. o What is the contribution margin per direct labor hour for each product? o How much of each product should the firm produce given your findings concerning the contribution margin per hour? o What is the maximum total contribution margin earned by the firm with only 40,000 direct labor hours