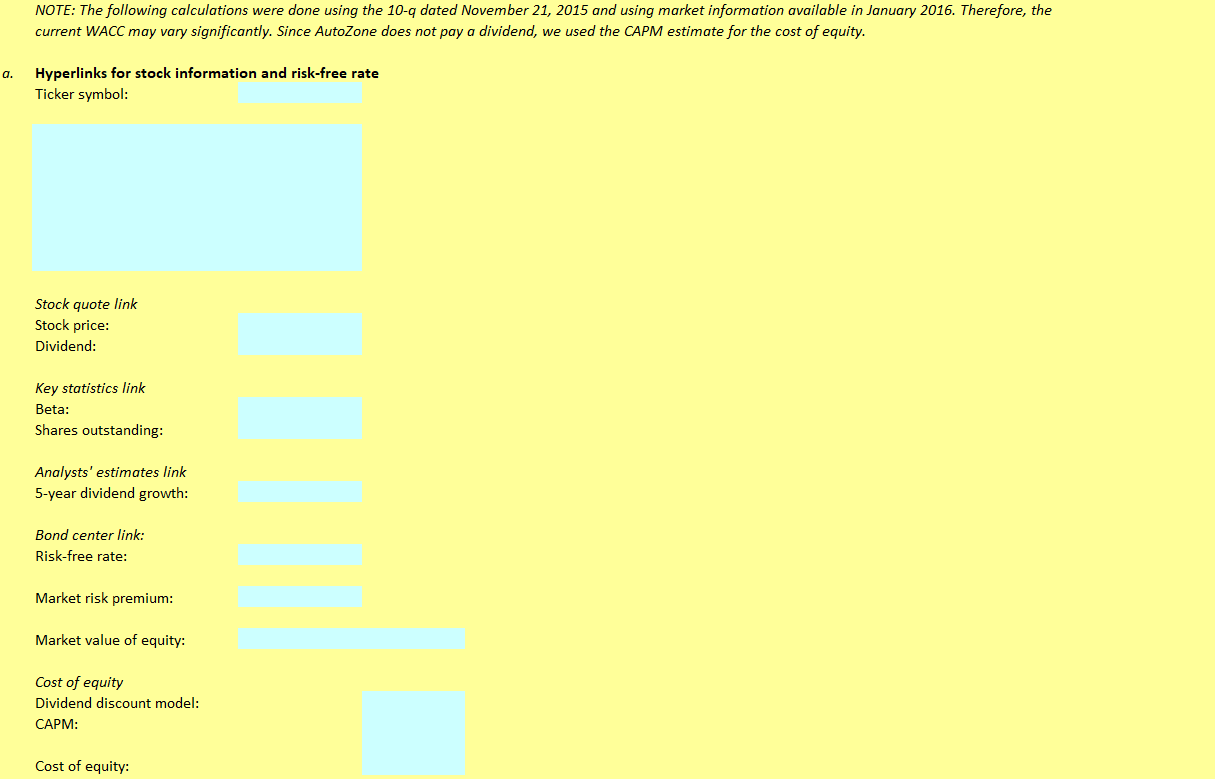

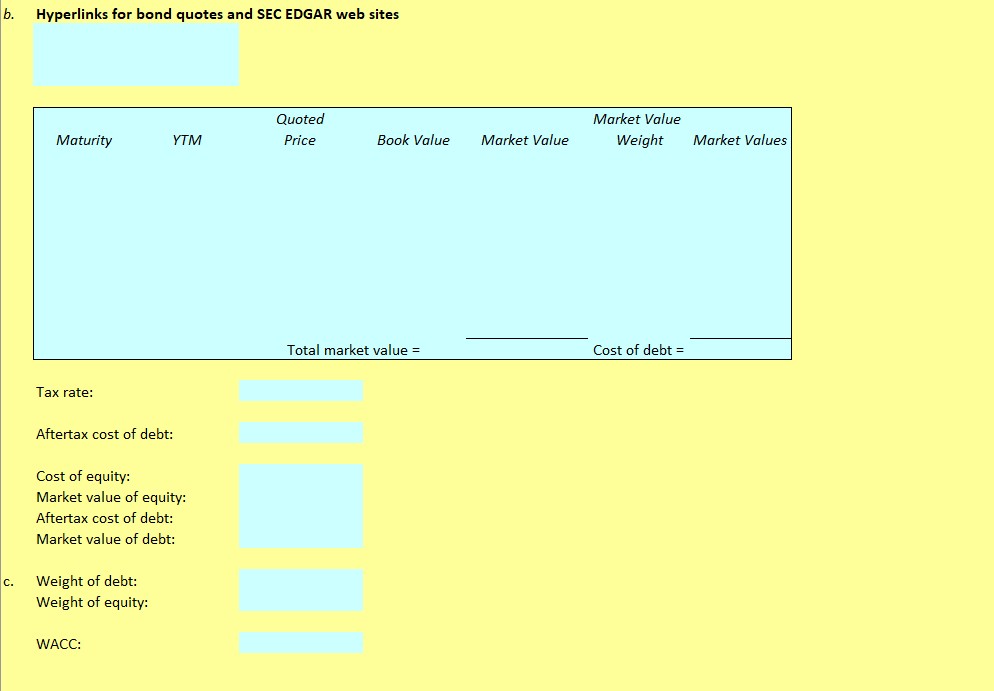

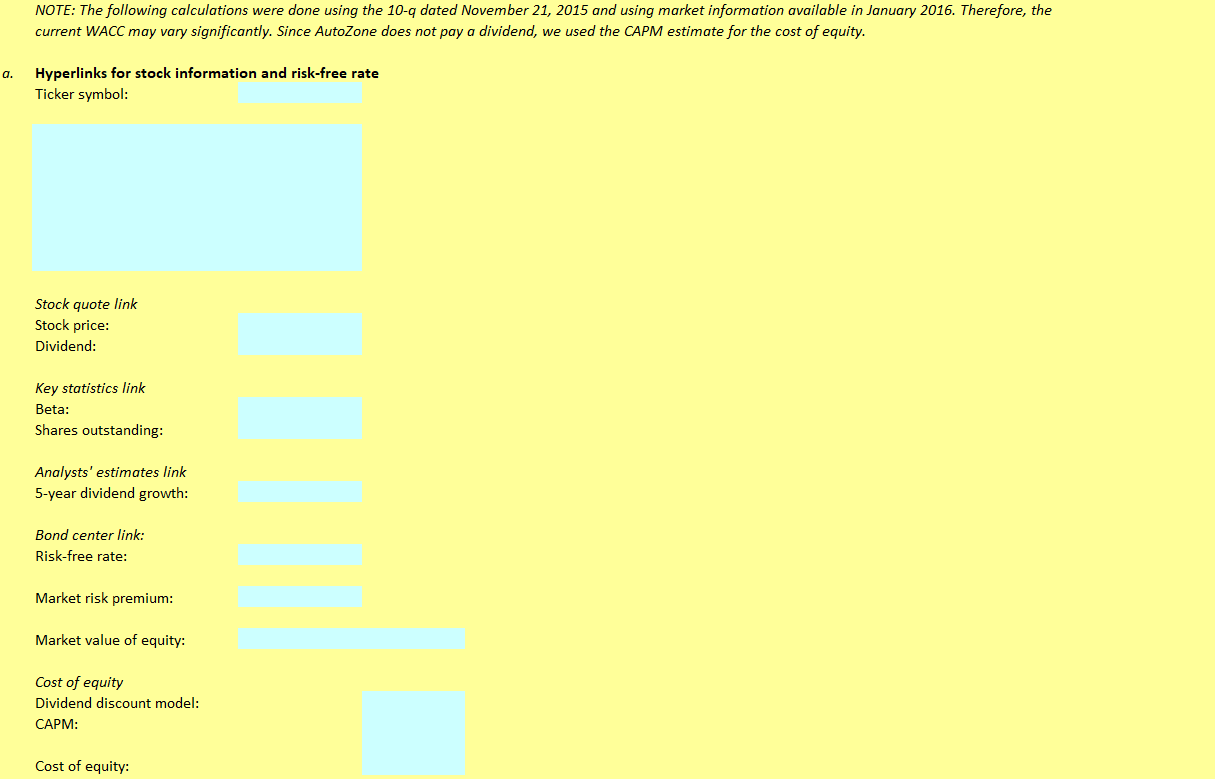

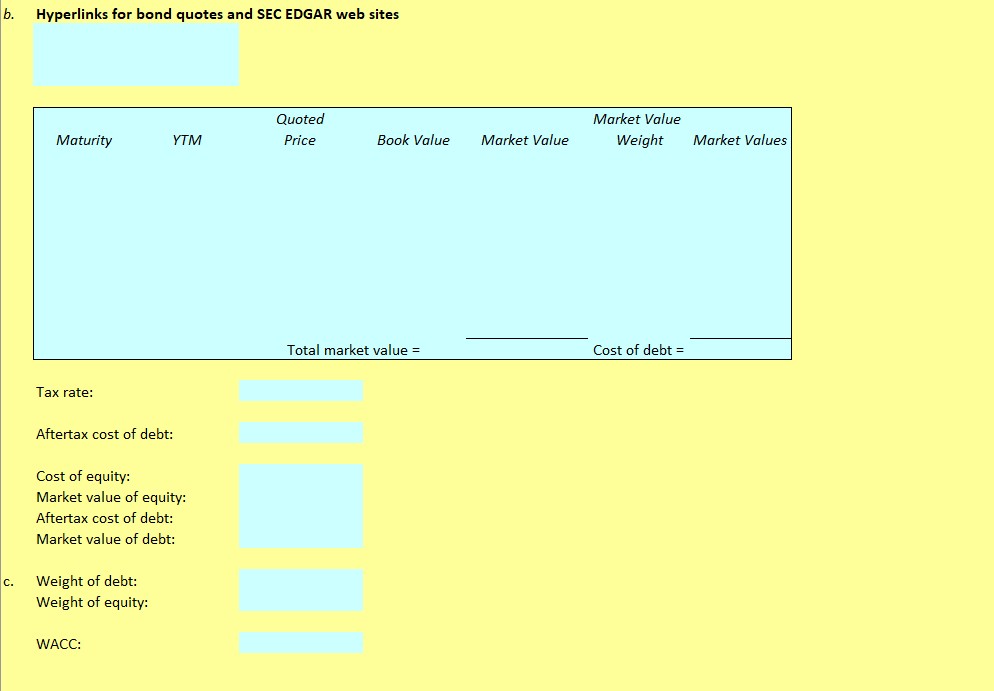

Chapter 12 - Master it! You want to calculate the WACC for auto parts retailer AutoZone (AZO). Complete the following steps to construct a spreadsheet that can be updated. Using an input for the ticker symbol, create hyperlinks to the web pages that you will need to find all of the information necessary to calculate the cost of equity. Use a market risk premium of seven percent when using CAPM. Create hyperlinks to go to the FINRA bond quote website and the SEC EDGAR database and find the information for the company's bonds. Create a table that calculates the cost of debt for the company. Assume the tax rate is 35 percent. c. Finally, calculate the market value weights for debt and equity. What is the WACC for AutoZone? NOTE: The following calculations were done using the 10-a dated November 21, 2015 and using market information available in January 2016. Therefore, the current WACC may vary significantly. Since AutoZone does not pay a dividend, we used the CAPM estimate for the cost of equity. a. Hyperlinks for stock information and risk-free rate Ticker symbol: Stock quote link Stock price: Dividend: Key statistics link Beta: Shares outstanding: Analysts' estimates link 5-year dividend growth: Bond center link: Risk-free rate: Market risk premium: Market value of equity: Cost of equity Dividend discount model: CAPM: Cost of equity: b. Hyperlinks for bond quotes and SEC EDGAR web sites Quoted Price YTM Market Value Weight Maturity Book Value Market Value Market Values Total market value = Cost of debt = Tax rate: Aftertax cost of debt: Cost of equity: Market value of equity: Aftertax cost of debt: Market value of debt: c. Weight of debt: Weight of equity: WACC: Chapter 12 - Master it! You want to calculate the WACC for auto parts retailer AutoZone (AZO). Complete the following steps to construct a spreadsheet that can be updated. Using an input for the ticker symbol, create hyperlinks to the web pages that you will need to find all of the information necessary to calculate the cost of equity. Use a market risk premium of seven percent when using CAPM. Create hyperlinks to go to the FINRA bond quote website and the SEC EDGAR database and find the information for the company's bonds. Create a table that calculates the cost of debt for the company. Assume the tax rate is 35 percent. c. Finally, calculate the market value weights for debt and equity. What is the WACC for AutoZone? NOTE: The following calculations were done using the 10-a dated November 21, 2015 and using market information available in January 2016. Therefore, the current WACC may vary significantly. Since AutoZone does not pay a dividend, we used the CAPM estimate for the cost of equity. a. Hyperlinks for stock information and risk-free rate Ticker symbol: Stock quote link Stock price: Dividend: Key statistics link Beta: Shares outstanding: Analysts' estimates link 5-year dividend growth: Bond center link: Risk-free rate: Market risk premium: Market value of equity: Cost of equity Dividend discount model: CAPM: Cost of equity: b. Hyperlinks for bond quotes and SEC EDGAR web sites Quoted Price YTM Market Value Weight Maturity Book Value Market Value Market Values Total market value = Cost of debt = Tax rate: Aftertax cost of debt: Cost of equity: Market value of equity: Aftertax cost of debt: Market value of debt: c. Weight of debt: Weight of equity: WACC