Answered step by step

Verified Expert Solution

Question

1 Approved Answer

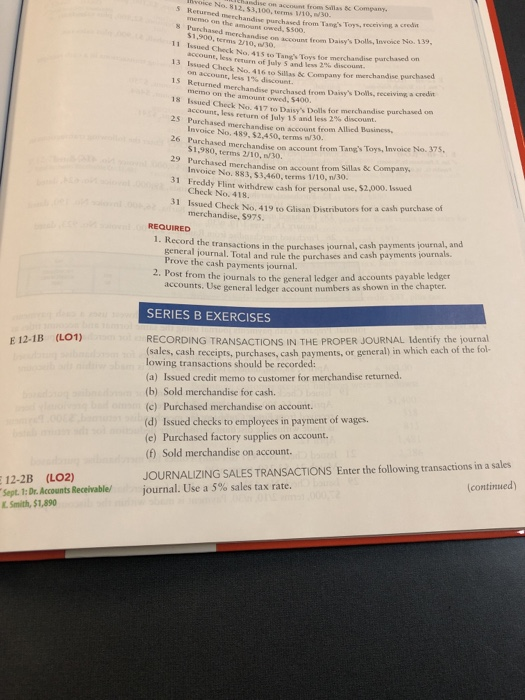

chapter 12 series B exercises PLEASE andise on account from Sillas avice No 12,53,100, terms 1/10, a Company 5 Returned merchandive purchased from Tang's Toys,

chapter 12 series B exercises

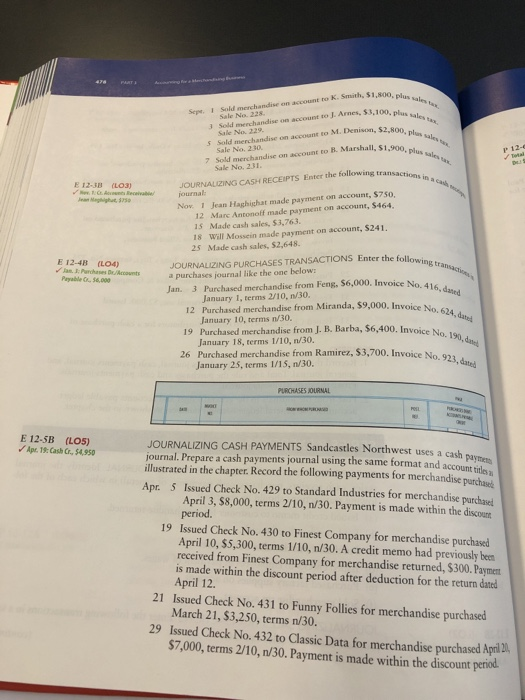

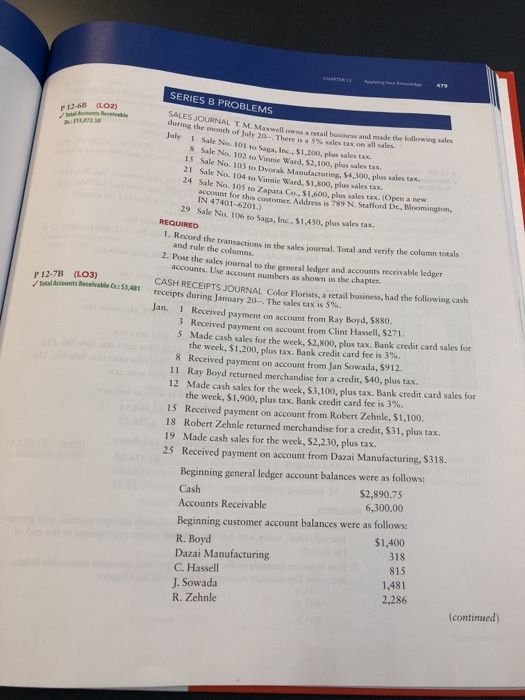

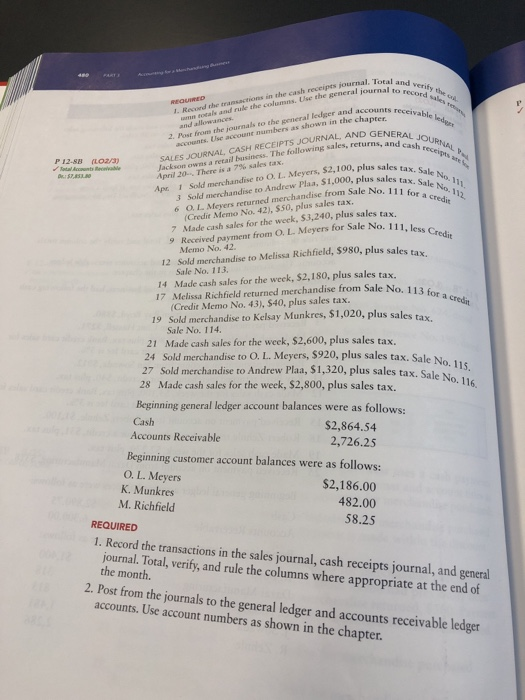

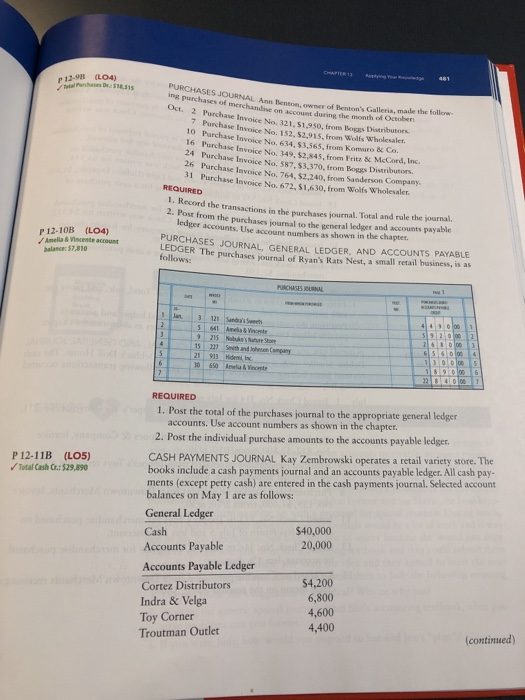

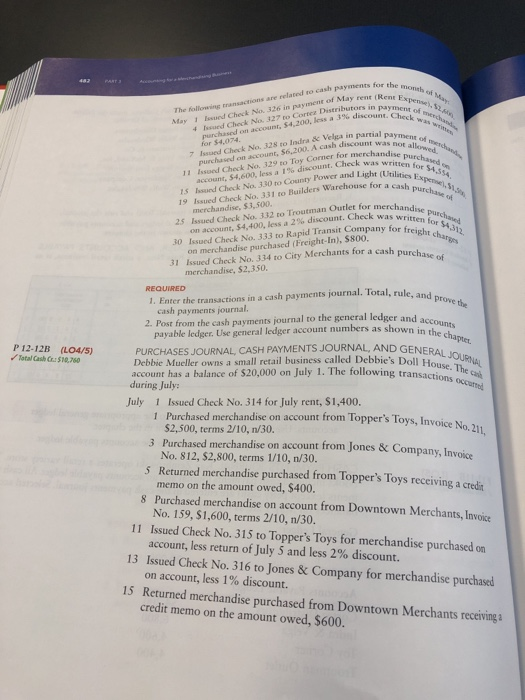

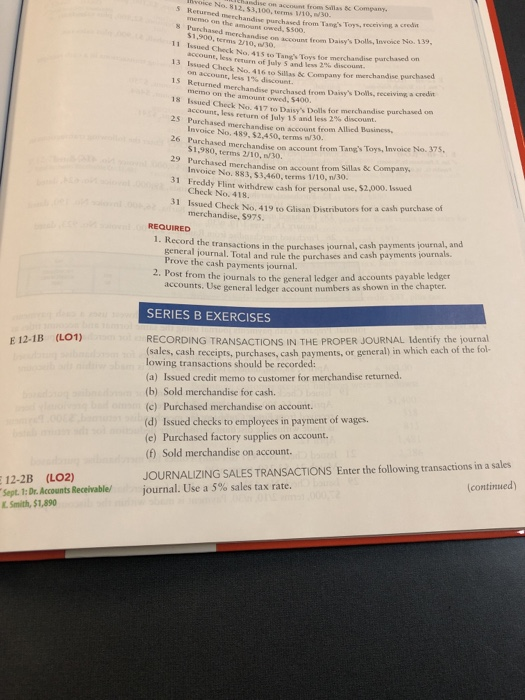

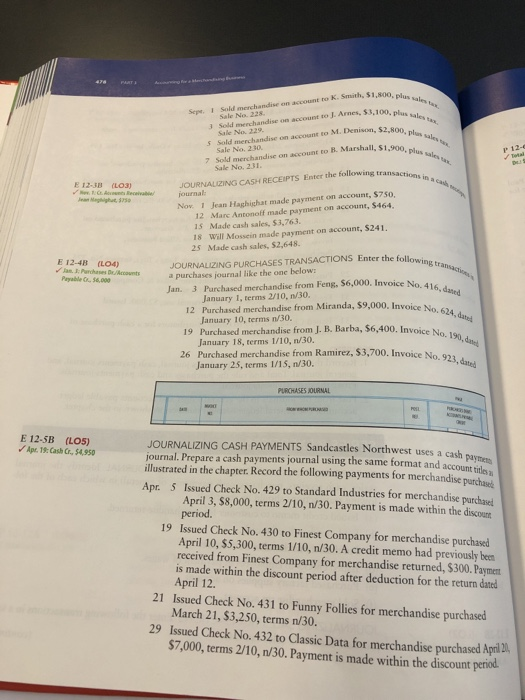

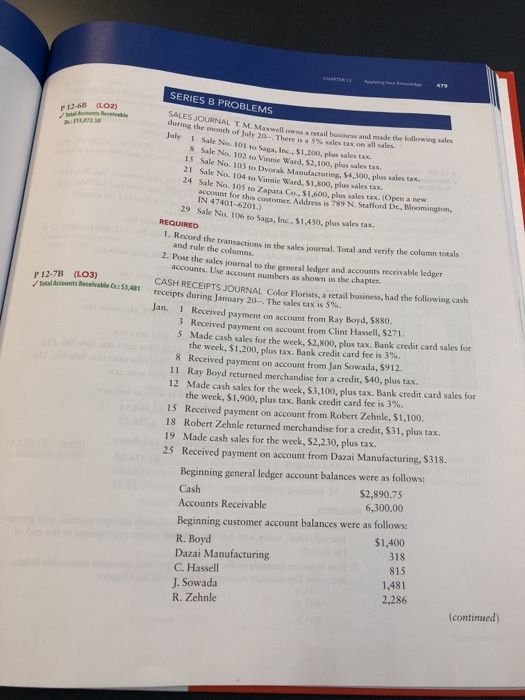

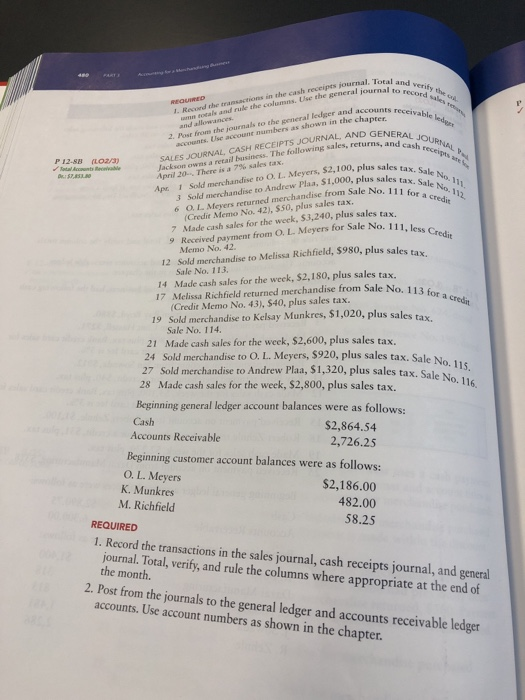

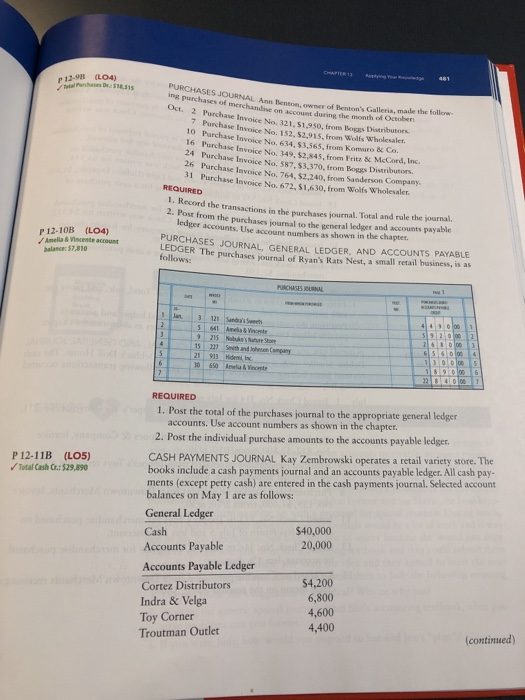

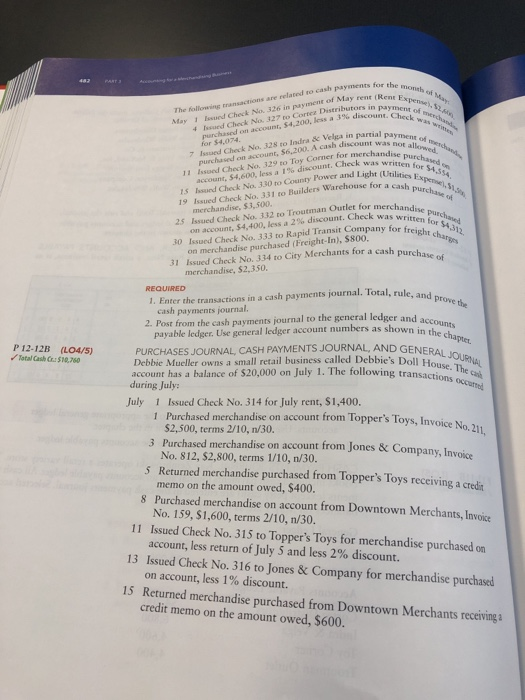

andise on account from Sillas avice No 12,53,100, terms 1/10, a Company 5 Returned merchandive purchased from Tang's Toys, receiving a credit wmemo on the amount owed, $500 s Parchased merchandise on account from Daisy's Dolls, Invoice No. 139, $1,900, terms 2/10, /30. 11 Issued Check No.415 t0 Tang's Toys for merchandise parchased on account, less return of luly 5 and less 2% dincount 13 Issoed Check No. 416 to Sillas & Company for merchandise purchased on account, less 1% discount 15 Returned merchandise parchased from Daisy's Dolls, receiving a credit memo on the amount owed, 5400 18 Issued Check No. 417 to Daisy's Dolls for merchandise purchased on account, less return of tuly 15 and less 2% discount 25 Purchased merchandise on account from Allied Buss Invoice No. 489, $2.450, terms n/30. 26 Purchased merchandise on account from Tang's Toys, Invoice No. 375, $1,980, terms 2/10, n/30. 29 Purchased merchandise on account from Sillas & Company, Invoice No. 883, $3,460, terms 1/10, n/30. 31 Freddy Flint withdrew cash for personal use, 52,000. Issued Check No. 418. 31 Issued Check No. 419 to Glisan Distributors for a cash purchase of merchandise, S975 onoREQUIRED 1. Record the transactions in the punchases journal, cash payments journal, and general journal. Total and rule the purchases and cash payments journals. Prove the cash payments journal. 2. Post from the journals to the general ledger and accounts payable ledger accounts. Use general ledger account numbers as shown in the chapter. SERIES B EXERCISES RECORDING TRANSACTIONS IN THE PROPER JOURNAL ldentify the journal (sales, cash receipts, purchases, cash payments, or general) in which each of the fol- lowing transactions should be recorded: E 12-1B (LO1) (a) Issued credit memo to customer for merchandise returned. (b) Sold merchandise for cash. (c) Purchased merchandise on account. of (d) Issued checks to employees in payment (e) Purchased (f) Sold merchandise on account. l wages. ctory supplies on account. JOURNALIZING SALES TRANSACTIONS Enter the following transactions in a sales (continued) 12-2B (LO2) Sept. 1: Dr. Accounts Receivable/ Smith, $1,890 journal. Use a 5% sales tax rate. 0 0002 as ndng 478 A PART Sepe,1 Soid merchamdise on account to K. Smith, $1,800, plus sales tax, 3 Sold mechandise on eccount ro J Arnes, 53,100, plus sales tas, S Sold merchandise on account to M. Denison, $2,800, plus sales 7 Sold merchandise on account to B. Marshall, $1,900, plus sales tax, Sale No. 228 Sale No. 229. Sale No. 230 P 12-e atal Sale No. 231 JOURNALIZING CASH RECEIPTS Enter the following transactions in a cash E 12-38 CAevt ecivabie Jean Maghight 875 (LO3) Nov 1 Jean Haghighat made payment on account, $750, 12 Marc Antonoff made payment on account, $464, 15 Made cash sales, $3,763 18 Will Mossein made payment on account, $241, 25 Made cash sales, $2,648. journal JOURNALIZING PURCHASES TRANSACTIONS Enter the following, transach E 12-4B Jan 1:Parchases Dr/Accounts Payable C S6.000 (LO4) a purchases journal like the one below 3 Purchased merchandise from Feng, $6,000. Invoice No. 416, dated Jan 12 Purchased merchandise from Miranda, $9,000. Invoice No. 624, dated January 1, terms 2/10, n/30. January 10, terms n/30. 19 Purchased merchandise from J. B. Barba, $6,400. Invoice No. 190, date January 18, terms 1/10, n/30. 26 Purchased merchandise from Ramirez, $3,700. Invoice No. 923, dated January 25, terms 1/15, n/30. PURCHASES JOURNAL ONCPR JOURNALIZING CASH PAYMENTS Sandcastles Northwest uses a cash paymen journal. Prepare a cash payments journal using the same format and account tiles illustrated in the chapter. Record the following payments for merchandise purch Apr. 5 Issued Check No. 429 to Standard Industries for merchandise purdh sied April 3, $8,000, terms 2/10, n/30. Payment is made within the discour period. 19 Issued Check No. 430 to Finest Company for merchandise purchased April 10, $5,300, terms 1/10, n/30. A credit memo had previously been received from Finest Company for merchandise returned, $300. Paymen is made within the discount period after deduction for the return dated April 12 21 Issued Check No. 431 to Funny Follies for merchandise purchased March 21, $3,250, terms n/30. 29 Issued Check No. 432 to Classic Data for merchandise purchased Apil $7,000, terms 2/10, n/30. Payment is made within the discount period. E 12-5B (LO5) Apr. 19: Cash C, $4950 OAPTER12 Appmg R 4791 SERIES B PROBLEMS r 12-68 (L02) Zeal Accounts Receivable STRe72s SALES JOURNAL T.M, Maxwell owns a retail business and made the following sales during the month of July 20--There is a 5% sales tax on all sales. July 1 Sale No. 101 to Saza, Inc., $1.200, plun sales tax. 8 Sale No, 102 to Vinnie Ward. $2,.100, plas sales tax 15 Sale No, 103 to Dyorak Manufacturing, $4,300, plus sales tax 21 Sale No., 104 to Vinnie Ward, S1.80o, plus sales tax 24 Sale No. 105 to Zapata Co., $1,600, plus sales tax. (Open a new account for this customer. Address is 789 N. Stafford Dr, Bloomington, IN 47401-6201.) 29 Sale No. 106 to Saga., Inc. $1,450, plus sales tax REQUIRED 1. Record the transactions in the sales journal. Total and verify the column totals and rule the columns. 2. Post the sales journal to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter P 12-7B (LO3) etal Aecounts Recelvable C: $3,48 CASH RECEIPTS JOURNAL Color Florists, a retail business, had the following cash receipts during January 20-. The sales tax is 5%. Received payment on account from Ray Boyd, $880. Jan. 1 3 Received payment on account from Clint Hassell, S271. 5 Made cash sales for the week, $2,800, plus tax. Bank credit card sales for the week, $1,200, plus tax. Bank credit card fee is 3 % 8 Received payment on account from Jan Sowada, $912. 11 Ray Boyd returned merchandise for a credit, $40, plus tax 12 Made cash sales for the week, $3,100, plus tax. Bank credit card sales for the week, $1,900, plus tax. Bank credit card fee is 3%. 15 Received payment on account from Robert Zehnle, $1,100. 18 Robert Zehnle returned merchandise for a credit, $31, plus tax. 19 Made cash sales for the week, $2,230, plus tax. 25 Received payment on account from Dazai Manufacturing, $318. Beginning general ledger account balances were as follows: $2,890.75 Cash Accounts Receivable u 6,300.00 Beginning customer account balances were as follows: $1,400 R. Boyd Dazai Manufacturing C. Hassell 318 815 1,481 2,286 J. Sowada R. Zehnle (continued) 1. Record the transactions in the cash receipts journal, Total and veridy the me otals and rule the columas, Use the general journal to record sales tea REQUIRED 2. Post from the journals to the general ledger and accounts receivable ledys and allowances SALES JOURNAL, CASH RECEIPTS JOURNAL, AND GENERAL JOURNA Pa accounts. Use account numbers as shown in the chant Jackson owns a retail business. The following sales, returns, and cash receipts are o P 12-88 (L02/3) Tatal Accounts Recevale Apr 1 Sold merchandise to O. L Meyers, $2,100, plus sales tax. Sale No. 111 6 O.L Meyers returned merchandise from Sale No. 111 fot a credit April 20 There is a 7 % sales tax. D$78530 3 Sold merchandise to Andrew Plaa, $1,000, plus sales tax. Sale No.112 (Credit Memo No. 42), $50, plus sales tax. 7 Made cash sales for the week, S3,240, plus sales tax 9 Received payment from O. L. Meyers for Sale No. 111, less Credit Memo No. 42 12 Sold merchandise to Melissa Richfield, $980, plus sales tax. Sale No. 113. 14 Made cash sales for the week, $2,180, plus sales tax. 17 Melissa Richfield returned merchandise from Sale No. 113 for a credn (Credit Memo No. 43), $40, plus sales tax. 19 Sold merchandise to Kelsay Munkres, $1,020, plus sales tax. Sale No. 114. 21 Made cash sales for the week, $2,600, plus sales tax. 24 Sold merchandise to O. L. Meyers, $920, plus sales tax. Sale No. 115. 27 Sold merchandise to Andrew Plaa, $1,320, plus sales tax. Sale No. 116. 28 Made cash sales for the week, $2,800, plus sales tax. Beginning general ledger account balances were as follows: Cash $2,864.54 2,726.25 Accounts Receivable Beginning customer account balances were as follows: O. L. Meyers K. Munkres M. Richfield $2,186.00 482.00 58.25 REQUIRED 1. Record the transactions in the sales journal, cash receipts journal, and general journal. Total, verify, and rule the columns where appropriate at the end of the month. 2. Post from the journals to the general ledger and accounts receivable ledger accounts. Use account numbers as shown in the chapter. CAPTER 12 Applying Your g 481 P 12-98 (L04) tetal Parchases Dr: $18515 PURCHASES JOURNAL Ann Benton, owner of Benton's Galleria, made the follew ing purchases of merchandise on account during the month of October Oct. 2 Parchase Invoice No 321. S1 950, from Boes Distributors 7 Parchase Invoice No 1s o 91 from Wolfs Wholesaler. 10 Purchase Invoice No 634 S3 565. from Komuro 8 Co. 16 Purchase Invoice No. 349, $2,845, from Fritz & McCord, Inc. 24 Purchase Invoice No. 587, 53.370, from Boggs Distributors 26 Purchase Invoice No.764 57.240. from Sanderson Company 31 Purchase Invoice No. 672 $1.630. from Wolfs Wholesaler REQUIRED 1. Record the transactions in the purchases journal. Total and rule the journal. 2. Post from the purchases journal to the general ledger and accounts payable ledger accounts. Use acceount numbers as shown in the chapter 12-10B (LO4 /Amela&Vincente account balance: $7,810 PURCHASES JOURNAL, GENERAL LEDGER, AND ACCOUNTS PAYABLE LEDGER The purchases journal of Ryan's Rats Nest, a small retail business, is as follows: PURCHASES OURNAL w 1lan 3 121 Sandra's Serts 641 Amela&Vincete 215 Nbke's une Store 4 490 lo0 1 2 9 20 00 216 80l00 3 4 Smith and Johen Campany 15 227 21 933 30 Amelia &Vncnte 650 130000 890lo0 22840 l00 7 Hidemi In 6 6 7 REQUIRED 1. Post the total accounts. Use account numbers as shown in the chapter. 2. Post the individual purchase amounts to the accounts payable ledger. the purchases journal to the appropriate general ledger CASH PAYMENTS JOURNAL Kay Zembrowski operates a retail variety store. The books include a cash payments journal and an accounts payable ledger. All cash pay- ments (except petty cash) are entered in the cash payments journal. Selected account balances on May 1 are as follows: P 12-11B (LO5) Total Cash Cr.: $29,890 General Ledger $40,000 20,000 Cash Accounts Payable Accounts Payable Ledger $4,200 Cortez Distributors Indra & Velga Toy Corner Troutman Outlet 6,800 4,600 4,400 (continued) PART Acung eesen on 482 of May May 1 Isund Check No. 326 in payment of May rent (Rent Expenst 2 purchased on account, $4,200, less a 3% discount. Check was wres, The following rransacrions are related to cash payments for the month 4 Issurd Check No. 327 to Cortez Distributors in payment of meechande 7 Issued Check No. 328 to Indra & Velga in partial payment of mesdhan for $4,074. 11 Issued Check No. 329 no Toy Corner for merchandise purchased on account, 54.600, less a 1% discount. Check was written for $4,554. 15 Isued Check No. 330 to County Power and Light (Utilities Expense,S1,5 19 Issued Check No. 331 to Builders Warehouse for a cash purchase of purchased on account, $6,200. A cash discount was not allowed. 25 Issued Check No. 332 to Troutman Outlet for merchandise purchased 30 Issued Check No. 333 to Rapid Transit Company for freight charges merchandise, $3,500 on account, $4,400, less a 2% discount. Check was written tor S4,312 on merchandise purchased (Freight-In), $800, 31 Issued Check No. 334 to City Merchants for a cash purchase of merchandise, $2,350 1. Enter the transactions in a cash payments journal. Total, rule, and prOve the cash payments journal. 2. Post from the cash payments journal to the general ledger and accounts payable ledger. Use general ledger account numbers as shown in the chapter. PURCHASES JOURNAL, CASH PAYMENTS JOURNAL, AND GENERAL JOURNAL Debbie Mucller owns a small retail business called Debbie's Doll House. The ca account has a balance of $20,000 on July 1. The following transactions occutted REQUIRED P 12-12B (LO4/5) Tatal Cash C: $10,760 during July: July 1 Issued Check No. 314 for July rent, $1,400. 1 Purchased merchandise on account from Topper's Toys, Invoice No.211, $2,500, terms 2/10, n/30. 3 Purchased merchandise on account from Jones & Company, Invoice No. 812, $2,800, terms 1/10, n/30. 5 Returned merchandise purchased from Topper's Toys receiving a credia memo on the amount owed, $400. 8 Purchased merchandise on account from Downtown Merchants, Invoire No. 159, $1,600, terms 2/10, n/30. 11 Issued Check No. 315 to Topper's Toys for merchandise purchased on account, less return of July 5 and less 2% discount. 13 Issued Check No. 316 to Jones & Company for merchandise purchased on account, less 1% discount. 15 Returned merchandise purchased from Downtown Merchants receiving a credit memo on the amount owed, $600 PLEASE

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started