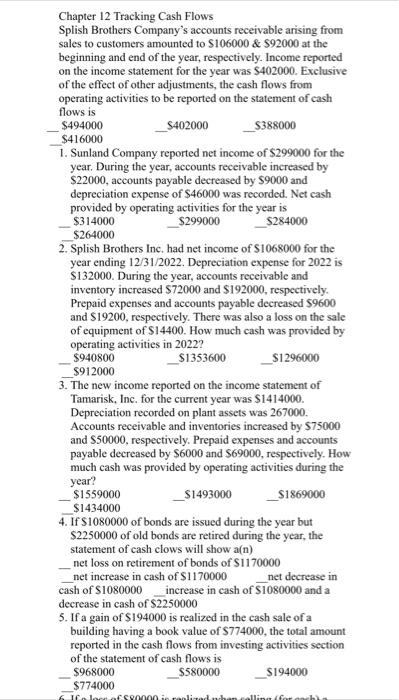

Chapter 12 Tracking Cash Flows Splish Brothers Company's accounts receivable arising from sales to customers amounted to $106000 \& $92000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $402000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is $494000 $402000 $388000 $416000 1. Sunland Company reported net income of $299000 for the year. During the year, accounts receivable increased by $22000, accounts payable decreased by $9000 and depreciation expense of $46000 was recorded. Net cash provided by operating activities for the year is $314000 $299000 $284000 $264000 2. Splish Brothers Inc. had net income of $1068000 for the year ending 12/31/2022. Depreciation expense for 2022 is $132000. During the year, accounts receivable and inventory increased $72000 and $192000, respectively. Prepaid expenses and accounts payable decreased $9600 and \$19200, respectively. There was also a loss on the sale of equipment of $14400. How much cash was provided by operating activities in 2022 ? $940800 $1353600 $1296000 $912000 3. The new income reported on the income statement of Tamarisk, Inc. for the current year was $1414000. Depreciation recorded on plant assets was 267000 . Accounts receivable and inventories increased by $75000 and $50000, respectively. Prepaid expenses and accounts payable decreased by $6000 and $69000, respectively. How much cash was provided by operating activities during the year? $1559000 $1493000 $1869000 $1434000 4. If $1080000 of bonds are issued during the year but $2250000 of old bonds are retired during the year, the statement of cash clows will show a(n) net loss on retirement of bonds of $1170000 net increase in cash of $1170000 net decrease in cash of $1080000 increase in cash of $1080000 and a decrease in cash of $2250000 5. If a gain of $194000 is realized in the cash sale of a building having a book value of $774000, the total amount reported in the cash flows from investing activities section of the statement of cash flows is $968000 $580000 $194000 $774000