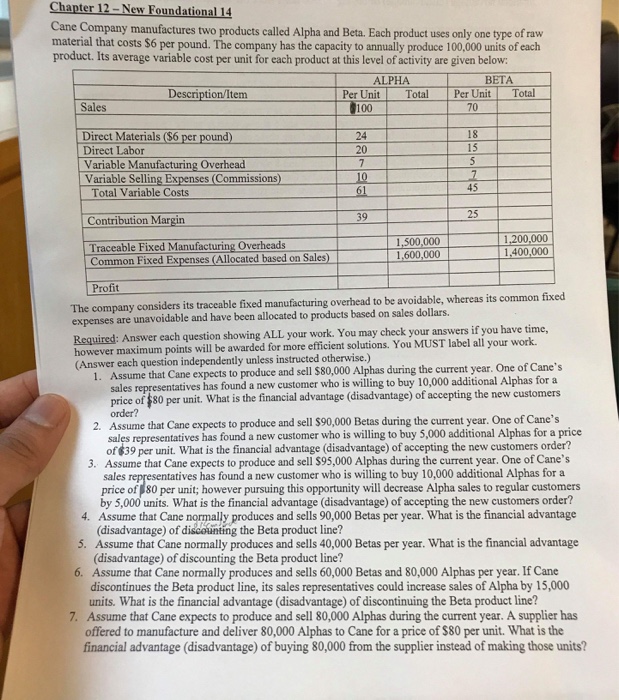

Chapter 12-New Foundational 14 Cane Company manufactures two products called Alpha and Beta. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 100,000 units of each product. Its average variable cost per unit for each product at this level of activity are given below: ALPHA 100 24 BETA Description/Item Per Unit Total Per Unit Total Sales 70 Direct Materials (S6 per pound) Direct Labor Variable Manufacturing Overhead 18 15 20 ariable Selling Expenses (Commissions) Total Variable Costs Contribution Margin Common Fixed Expenses (Allocated based on Sales) 39 25 1,200,000 1,400,000 Overheads 1,600,000 Profit The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are unavoidable and have been allocated to products based on sales dollars. Required: however m (Answer each question independently unless instructed otherwise.) Answer each question showing ALL your work. You may check your answers if you have time, aximum points will be awarded for more efficient solutions. You MUST label all your work. . Assume that Cae expects to produce and sell $80,000 Alphas during the current year. One of Cane's sales representatives has found a new customer who is willing to buy 10,000 additional Alphas fora 2. Assume that Cane expects to produce and sell $90,000 Betas during the current year. One of Cane's 3. Assume that Cane expects to produce and sell $95,000 Alphas during the current year. One of Cane's price of $80 per unit. What is the financial advantage (disadvantage) of accepting the new customers order? sales representatives has found a new customer who is willing to buy 5,000 additional Alphas for a price of $39 per unit. What is the financial advantage (disadvantage) of accepting the new customers order? entatives has found a new customer who is willing to buy 10,000 additional Alphas for a sales price of 80 per unit; however pursuing this opportunity will decrease Alpha sales to regular customers by 5,000 units. What is the financial advantage (disadvantage) of accepting the new customers order? 4. Assume that Cane normally produces and sells 90,000 Betas per year. What is the financial advantage (disadvantage) of discounting the Beta product line? Assume that Cane normally produces and sells 40,000 Betas per year. What is the financial advantage (disadvantage) of discounting the Beta product line? Assume that Cane normally produces and sells 60,000 Betas and 80,000 Alphas per year. If Cane discontinues the Beta product line, its sales representatives could increase sales of Alpha by 15,000 units. What is the financial advantage (disadvantage) of discontinuing the Beta product line? 7. Assume that Cane expects to produce and sell 80,000 Alphas during the current year. A supplier has offered to manufacture and deliver 80,000 Alphas to Cane for a price of $80 per unit. What is the financial advantage (disadvantage) of buying 80,000 from the supplier instead of making those units