Chapter 13- 9 and 10

Please provide solution and explanation for my guidance thank you so much :) It will help me a lot :)

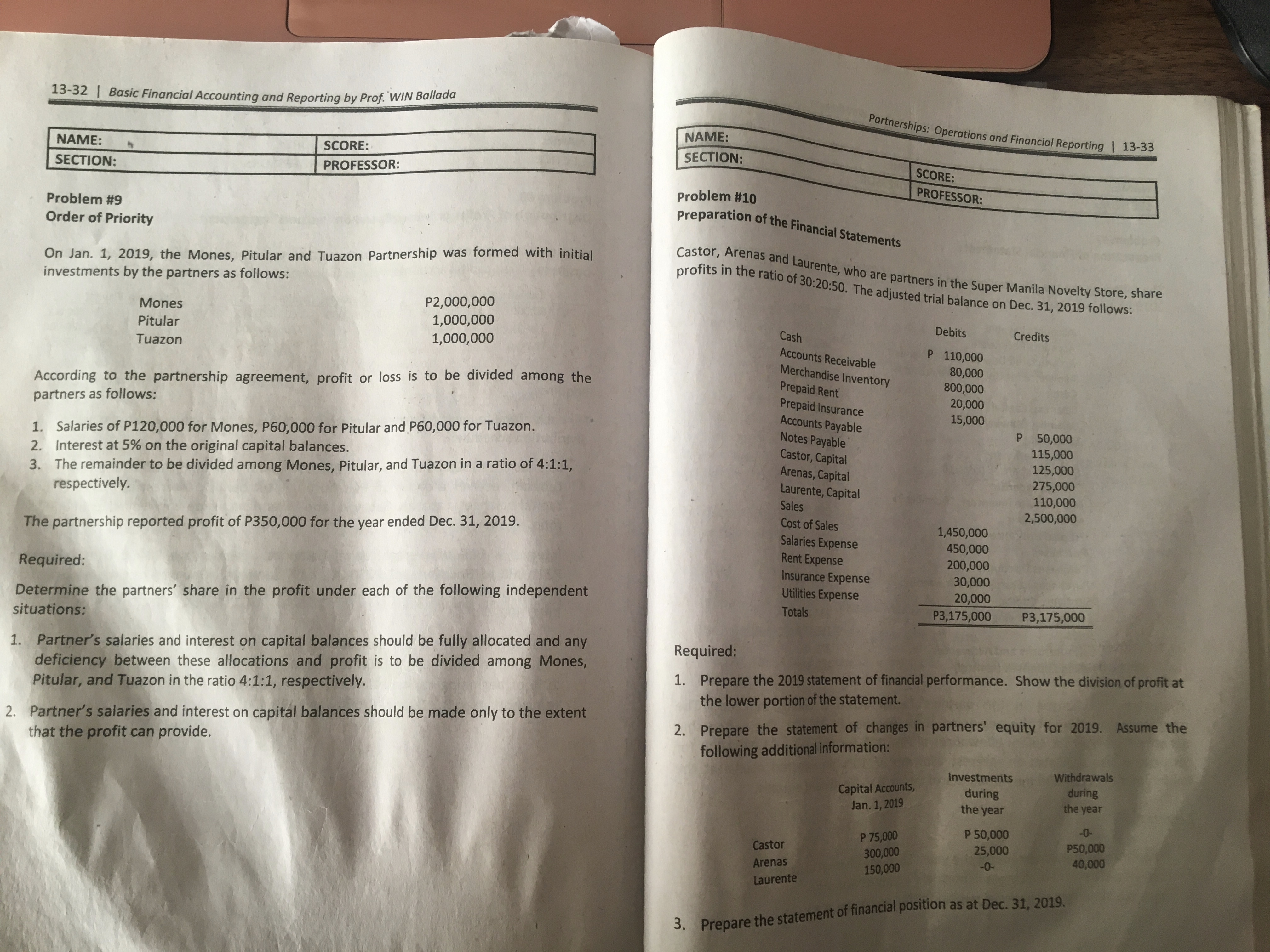

13-32 | Basic Financial Accounting and Reporting by Prof. WIN Ballada NAME: Partnerships: Operations and Financial Reporting | 13-33 NAME: SCORE: SECTION: SECTION: PROFESSOR: SCORE : Problem #10 PROFESSOR: Problem #9 Order of Priority preparation of the Financial Statements On Jan. 1, 2019, the Mones, Pitular and Tuazon Partnership was formed with initial investments by the partners as follows: Castor, Arenas and Laurente, who are partners in the Super Manila Novelty Store, share profits in the ratio of 30:20:50. The adjusted trial balance on Dec. 31, 2019 follows: Mones P2,000,000 Pitular 1,000,000 Cash Debits Credits Tuazon 1,000,000 Accounts Receivable P 110,000 Merchandise Inventory 80,000 According to the partnership agreement, profit or loss is to be divided among the Prepaid Rent 800,000 partners as follows: Prepaid Insurance 20,000 Accounts Payable 15,000 1. Salaries of P120,000 for Mones, P60,000 for Pitular and P60,000 for Tuazon. Notes Payable 50,000 Interest at 5% on the original capital balances. Castor, Capital 115,000 The remainder to be divided among Mones, Pitular, and Tuazon in a ratio of 4:1:1, Arenas, Capital 125,000 3 . 275,000 respectively. Laurente, Capital 110,000 Sales 2,500,000 The partnership reported profit of P350,000 for the year ended Dec. 31, 2019. Cost of Sales 1,450,000 Salaries Expense 450,000 Rent Expense 200,000 Required: Insurance Expense 30,000 Determine the partners' share in the profit under each of the following independent Utilities Expense 20,00 Totals P3,175,000 P3,175,000 situations: 1. Partner's salaries and interest on capital balances should be fully allocated and any Required: deficiency between these allocations and profit is to be divided among Mones, 1. Prepare the 2019 statement of financial performance. Show the division of profit at Pitular, and Tuazon in the ratio 4:1:1, respectively. the lower portion of the statement. 2. Partner's salaries and interest on capital balances should be made only to the extent 2. Prepare the statement of changes in partners' equity for 2019. Assume the that the profit can provide. following additional information: Investments Withdrawals Capital Accounts, during during Jan. 1, 2019 the year the year P 75,000 P 50,000 -0- Castor 300,000 25,000 P50,000 Arenas 150,000 -0- 40,000 Laurente 3. Prepare the statement of financial position as at Dec. 31, 2019