Question

Chapter 13: Corporations: Organization, Stock Transactions, and Dividends Company: Activision Blizzard Using the annual report of the corporation that you have been researching these weeks,

Chapter 13: Corporations: Organization, Stock Transactions, and Dividends

Company: Activision Blizzard

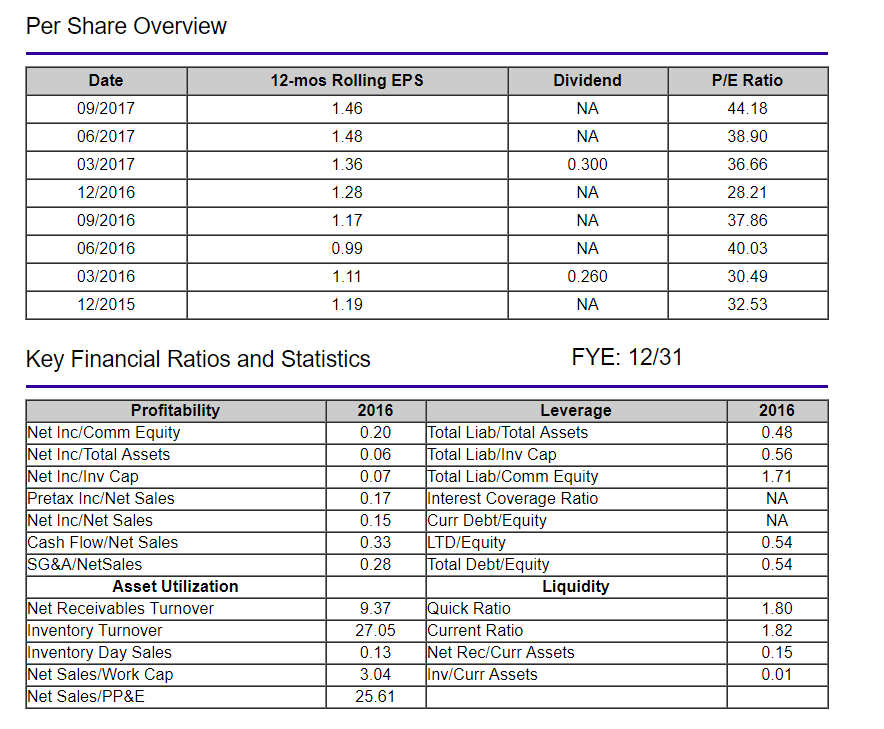

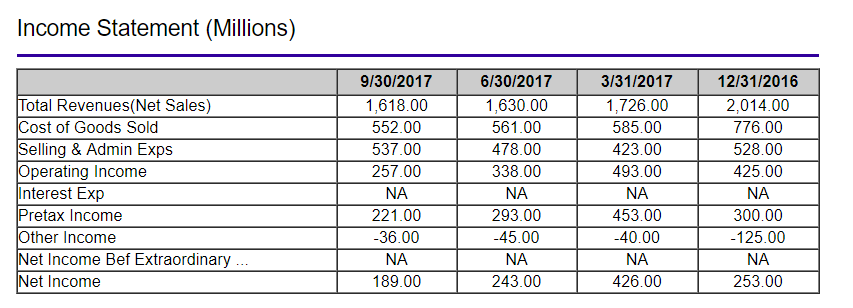

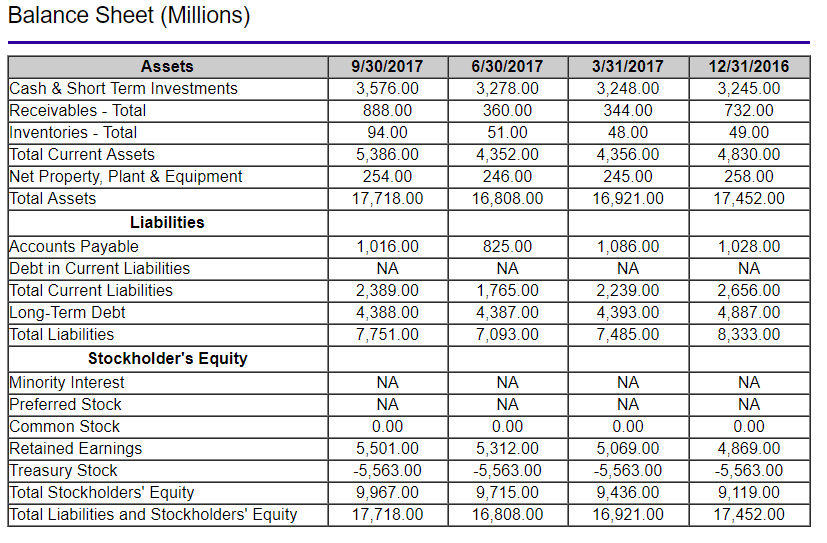

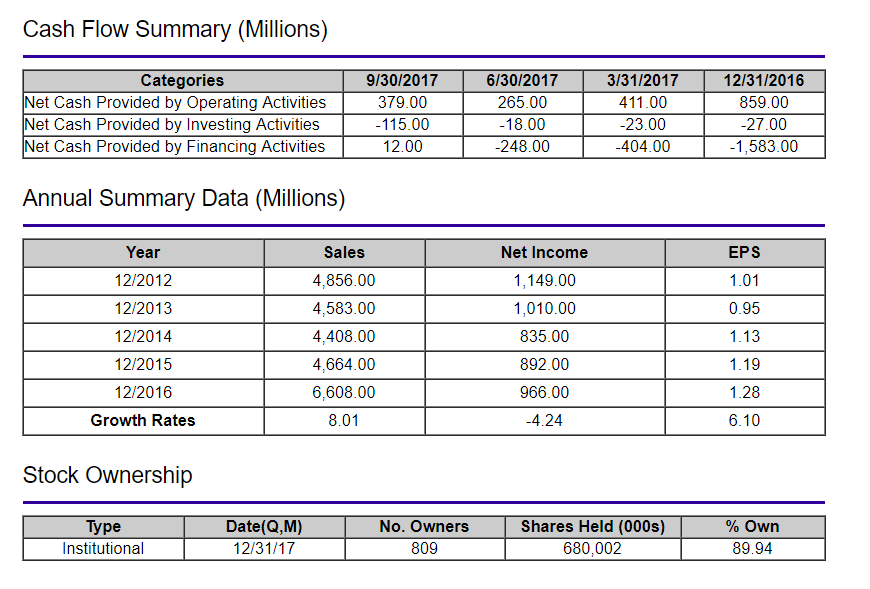

Using the annual report of the corporation that you have been researching these weeks, take a look at that corporation's Statement of Stockholders' Equity. Tell us about the common stock that it issued including its outstanding shares. Also, take a look at a website, such as Yahoo Finance and find information about the corporation's price per share and whether or not it issues a dividend. Your corporation could have probably raised a lot of money by issuing long-term debt instead of issuing stock. What are some advantages of issuing common stock instead of issuing long-term debt? What are some disadvantages?

Please remember that references are required for your initial post. This week, please be sure to reference Chapter 13 of your e-text and use APA style. Also include the link to the financial statements. Also, include the link to Yahoo Finance as a reference.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started