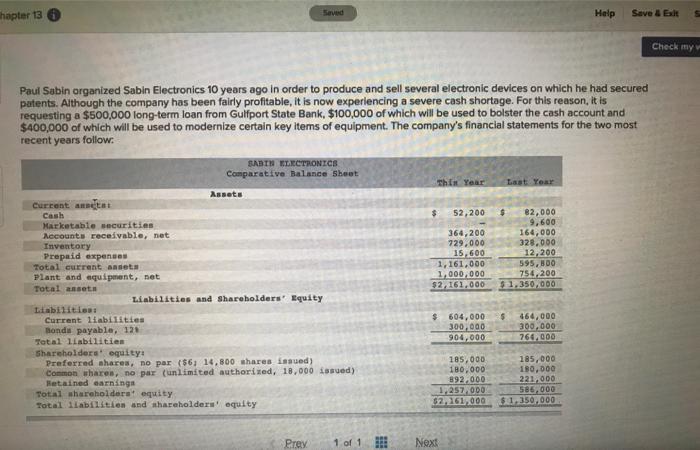

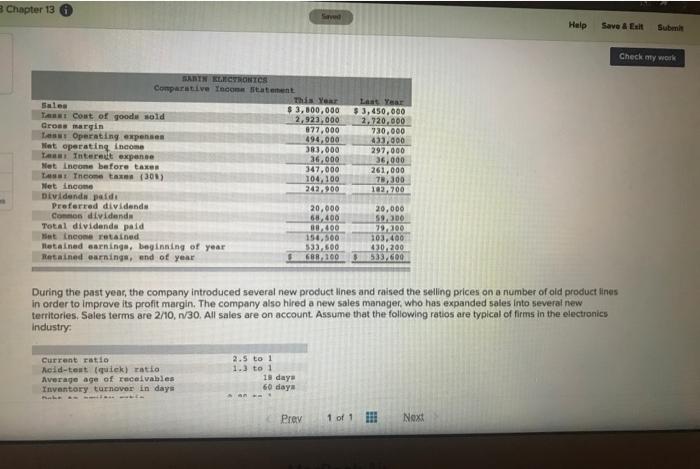

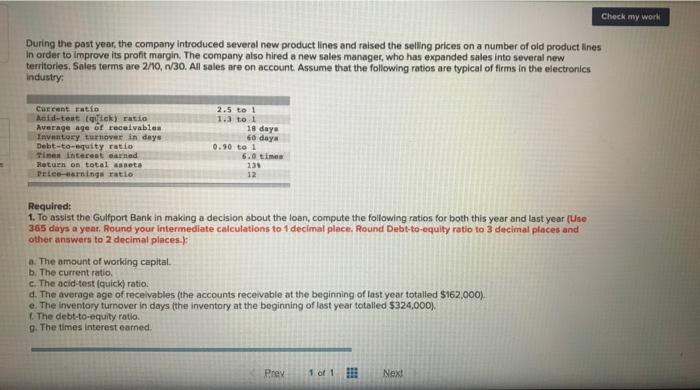

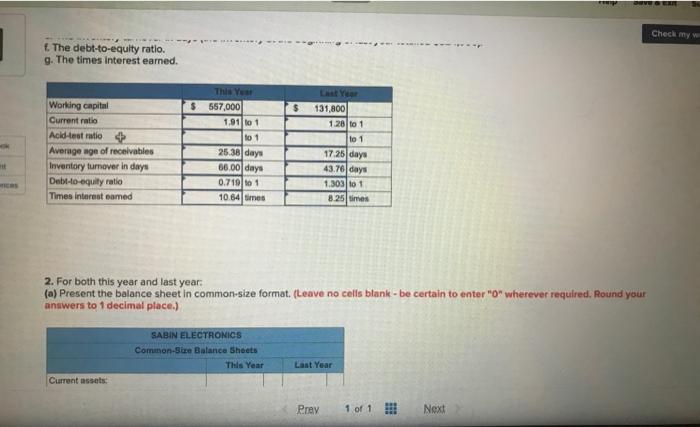

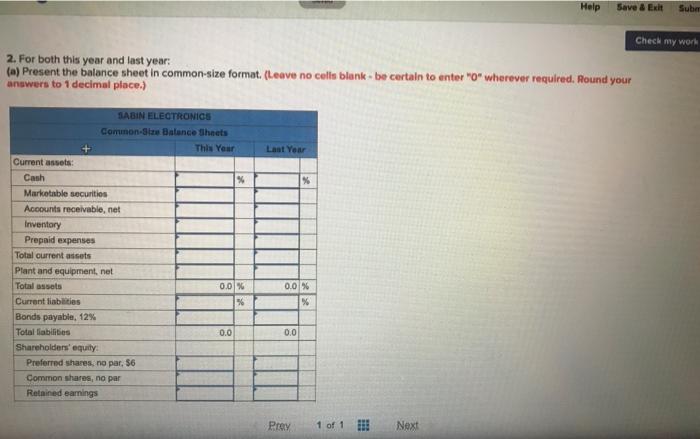

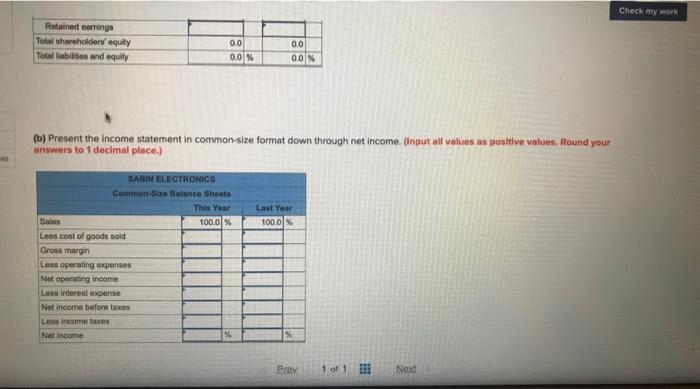

Chapter 13 Help Save & E Check my Paul Sabin organized Sabin Electronics 10 years ago in order to produce and sell several electronic devices on which he had secured patents. Although the company has been fairly profitable, it is now experiencing a severe cash shortage. For this reason, it is requesting a $500,000 long-term loan from Gulfport State Bank, $100,000 of which will be used to bolster the cash account and $400,000 of which will be used to modernize certain key items of equipment. The company's financial statements for the two most recent years follow. SABTU ELECTRONICS Comparative Balance Sheet This Year Last Year $ 52,200 364,200 729.000 15,600 1,161,000 1,000,000 $2,161.000 $ 82,000 9,600 164,000 328.000 12,200 595,00 754,200 1.350.000 Asseto Current annat Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current annet Plant and equipment, net Total anset Liabilities and shareholders' Equity Liabilities: Current liabilities Ronda payable, 123 Total liabilities Shareholders' equity: Preferred shares, no par (56; 14,800 shares issued) Common whares, no par unlimited authorixed, 18,000 issued) Retained earnings Total shareholders equity Total liabilities and shareholders equity 5 604,000 300,000 904,000 464,000 300,000 764,000 185,000 180.000 892,000 1,257,000 52,161,000 185,000 180,000 221,000 586,000 $1,350,000 Prey 1 of 1 !!! Next Chapter 13 Sad Help Save & Exit Sube Check my work SARIN KLECTRONICS Comparative Taconstatement This Year Sales $ 3,000,000 TARRI Cout of good old 2,923,000 Gross margin 877.000 Les Operating expenses 494,000 Mat operating income 383,000 Interest expense 26.000 Net neon before taxes 347.000 Less Income taxes (301) 104,100 Net Income 242.900 Dividend pada Preferred dividende 20.000 Common dividende 68,400 Total dividends paid 0,400 at incon retained 150,500 Metained earnings, beginning of year 533.500 Retained earnings, end of year GBR, 100 Last Year $3,450,000 2,720,000 730,000 433,000 297,000 36,000 261,000 78,300 102,700 20.000 5200 79.100 103,400 430.200 533,600 During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines in order to improve its profit margin. The company also hired a new sales manager who has expanded sales into several new territories. Sales terms are 2/10, 1/30. All sales are on account Assume that the following ratios are typical of firms in the electronics Industry: Current ratio Acid-test (quick) ratio Average age of receivables Inventory turnover in days -- 2.5 to 1 1.3 to 1 19 day 60 day -- Prey 1 of 1 Next Check my world During the past year, the company introduced several new product lines and raised the selling prices on a number of old product lines In order to improve its profit margin. The company also hired a new sales manager, who has expanded sales into several new territories. Sales terms are 2/10, 1/30. All sales are on account. Assume that the following ratios are typical of firms in the electronics Industry: Current ratio Raid-teat tiek) ratio Average age of receivables Inventory turnover in days Debt-to-equity ratio Tine interest and Return on total saseta Drie-rings ratio 2.5 to 1 1.3 to 1 18 days 60 days 0.90 to 1 6.0 times 131 12 Required: 1. To assist the Gulfport Bank in making a decision about the loan, compute the following ratios for both this year and last year (Use 365 days a year. Round your intermediate calculations to 1 decimal place. Round Debt-to-equity ratio to 3 decimal places and other answers to 2 decimal places . The amount of working capital. b. The current ratio, c. The acid-test (quick) ratio. 4. The average age of receivables (the accounts receivable at the beginning of last year totalled $162,000). e. The inventory turnover in days (the inventory at the beginning of last year totalled $324,000). The debt-to-equity ratio The times interest earned. Prey 1 of 1 !!! Next GER Check my The debt-to-equity ratio. g. The times interest earned, $ $ Last Year 131,800 1.28101 to 1 Working capital Current ratio Aoid test ratio 4 Average age of receivables Inventory tumover in days Debt-to-equity ratio Times interest eamed This Year 557,000 1.91 101 to 1 25.38 days 66.00 days 0.710101 10.84 times 17.25 days 43.76 days 1.303101 8.25 times 2. For both this year and last year: (a) Present the balance sheet in common-size format. (Leave no cells blanke - be certain to enter "O" wherever required. Round your answers to 1 decimal place.) SABIN ELECTRONICS Comunan-Size Balance Sheets This Year Last Year Current assets Prey 1 of 1 Next Help Save & Exh Suba Check my work 2. For both this year and last year: (a) Present the balance sheet in common-size format. (Leave no cells blank - be certain to enter "o" wherever required. Round your answers to 1 decimal place.) Lant Your SABIN ELECTRONICS Common S Balance Sheets This Your Current assets Cash % Marketable securities Accounts receivable, net Inventory Prepaid expenses Total current assets Plant and equipment, net Total assets 0.0 % Current liabilities % Bonds payable, 12% Total liabilities 0.0 Shareholders' equity Preferred shares, no par. 56 Common shares, no par Retained earnings 0.0 % % 0.0 Pray 1 of 1 Next Check my work Retained earnings Total shareholders' equity Total abilities and equity 0.0 0.0% 0,0 0.0 % (b) Present the income statement in common-size format down through net income. (Input all values as positive values, Round your answers to 1 decimal place.) Last Year 100.0 % BABIN ELECTRONICS Cammon Stellalance Sheets This Year Sales 100.0 % Less cost of goods sold Gross margin Loss operating expenses Net operating income Less Interest expense Net income before taxes Less income taxe Net Income Prev 1 of 1 Nex