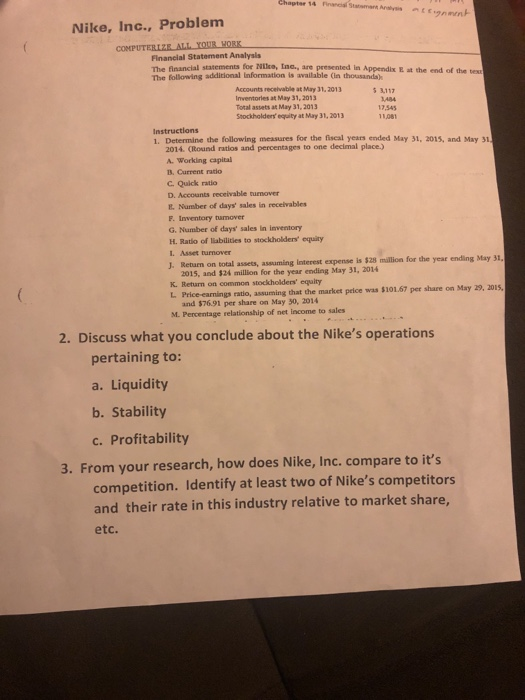

Chapter 14 Financial Statamann Arlysis at Nike, Inc., Problem Financial Statement Analysis The leancial statements for Nilce, Ine, are presented in Appendix E at the end of The following additonal Information is available (in thousanda) Accounts recelvable at May 31, 2013 Inventories at May 31, 2013 Total assets at May 31, 2013 Stockholders' equity at May 31, 2013 17,545 11081 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31 2014. (Round ratios and percentages to one decimal place.) A. Working capital B. Current ratio C,Quick ratio D. Accounts receivable tunover E. Number of days' sales in receivables F. Inventory tamover G. Number of days' sales in inventory H. Ratio of liabilities to stockholders' equity I. Asset turnover J. Return on total assets, assuming Interest expense is $28 million for the year ending May 31 2015, and $24 million for the year ending May 31, 2014 K. Return on common stockholders' equity L Price-earmings ratio, assuming that the market peice was $101.67 per share on May 29, 2015 and $76.91 per share on May 30, 2014 M. Percentage relationship of net income to sales 2. Discuss what you conclude about the Nike's operations pertaining to: a. Liquidity b. Stability c. Profitability 3. From your research, how does Nike, Inc. compare to it's competition. Identify at least two of Nike's competitors and their rate in this industry relative to market share, etc. Chapter 14 Financial Statamann Arlysis at Nike, Inc., Problem Financial Statement Analysis The leancial statements for Nilce, Ine, are presented in Appendix E at the end of The following additonal Information is available (in thousanda) Accounts recelvable at May 31, 2013 Inventories at May 31, 2013 Total assets at May 31, 2013 Stockholders' equity at May 31, 2013 17,545 11081 Instructions 1. Determine the following measures for the fiscal years ended May 31, 2015, and May 31 2014. (Round ratios and percentages to one decimal place.) A. Working capital B. Current ratio C,Quick ratio D. Accounts receivable tunover E. Number of days' sales in receivables F. Inventory tamover G. Number of days' sales in inventory H. Ratio of liabilities to stockholders' equity I. Asset turnover J. Return on total assets, assuming Interest expense is $28 million for the year ending May 31 2015, and $24 million for the year ending May 31, 2014 K. Return on common stockholders' equity L Price-earmings ratio, assuming that the market peice was $101.67 per share on May 29, 2015 and $76.91 per share on May 30, 2014 M. Percentage relationship of net income to sales 2. Discuss what you conclude about the Nike's operations pertaining to: a. Liquidity b. Stability c. Profitability 3. From your research, how does Nike, Inc. compare to it's competition. Identify at least two of Nike's competitors and their rate in this industry relative to market share, etc