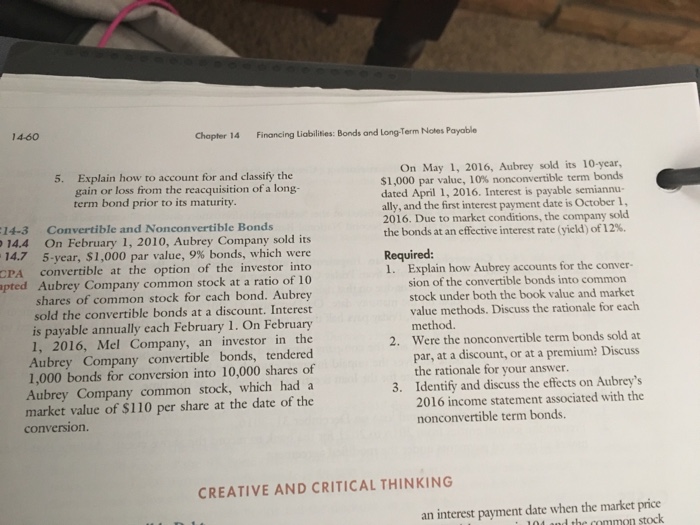

Chapter 14 Financing Liabilities: Bonds and Long Term Notes Payable On May 1, 2016, Aubrey sold its 10-year, 5. Explain how to account for and classify the si,000 par value, 10% nonconvertible term bonds gain or loss from the reacquisition of a long- dated April 1, 2016. Interest is payable semiannu- ally, and the first interest payment date is October 1 term bond prior to its maturity. 2016. Due to market conditions, the company sold 14-3 Convertible and Non convertible Bonds the bonds at an effective interest rate (yield) of 12% 14.4 On February 1, 2010, Aubrey Company sold its 14.7 5-year, $1,000 par value, 9% bonds, which were Required: 1. plain how Aubrey accounts for the conver- CPA convertible at the option of the investor into sion of the convertible bonds into common pted Aubrey Company common stock at a ratio of 10 stock under both the book value and market shares of common stock for each Aubrey value methods. Discuss the rationale for each sold the convertible bonds at a discount. Interest is payable annually each February 1. On February method 2. were the nonconvertible term bonds sold at 1, 2016, Mel Company, an investor in the par, at a discount, or at a premium? Discuss Aubrey Company convertible bonds, tendered the rationale for your answer. ,000 bonds for conversion into 10,000 shares of 3. Identify and discuss the effects on Aubrey's Aubrey Company common stock, which had a 2016 income statement associated with the market value of $110 per share at the date of the nonconvertible term bonds. conversion CREATIVE AND CRITICAL THINKING an interest payment date when the market price common stock. Chapter 14 Financing Liabilities: Bonds and Long Term Notes Payable On May 1, 2016, Aubrey sold its 10-year, 5. Explain how to account for and classify the si,000 par value, 10% nonconvertible term bonds gain or loss from the reacquisition of a long- dated April 1, 2016. Interest is payable semiannu- ally, and the first interest payment date is October 1 term bond prior to its maturity. 2016. Due to market conditions, the company sold 14-3 Convertible and Non convertible Bonds the bonds at an effective interest rate (yield) of 12% 14.4 On February 1, 2010, Aubrey Company sold its 14.7 5-year, $1,000 par value, 9% bonds, which were Required: 1. plain how Aubrey accounts for the conver- CPA convertible at the option of the investor into sion of the convertible bonds into common pted Aubrey Company common stock at a ratio of 10 stock under both the book value and market shares of common stock for each Aubrey value methods. Discuss the rationale for each sold the convertible bonds at a discount. Interest is payable annually each February 1. On February method 2. were the nonconvertible term bonds sold at 1, 2016, Mel Company, an investor in the par, at a discount, or at a premium? Discuss Aubrey Company convertible bonds, tendered the rationale for your answer. ,000 bonds for conversion into 10,000 shares of 3. Identify and discuss the effects on Aubrey's Aubrey Company common stock, which had a 2016 income statement associated with the market value of $110 per share at the date of the nonconvertible term bonds. conversion CREATIVE AND CRITICAL THINKING an interest payment date when the market price common stock